Find a low-fee investing strategy

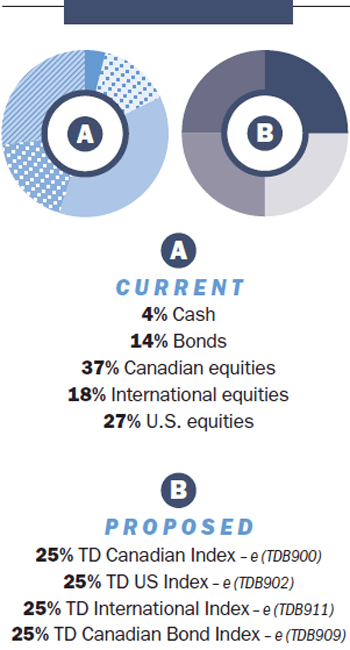

Bryn and Ruby want to simplify their portfolio.

Advertisement

Bryn and Ruby want to simplify their portfolio.

The Solution

The SolutionShare this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email