Want to make money in real estate? Real money. Like $13-million in profit kinda money? Don’t bother with rental properties and put away the hammer because sweat equity won’t cut it. Instead, you’ll want to team up with a home-reno celebrity or a successful real estate tycoon and go into the real estate seminar racket.

While, I’ve written about the dubious nature of real estate training workshops in the past, I thought a refresher was due. Why? Because of the sheer volume of seminars that are being offered across this country and because a Vancouver lawyer is finally poking holes in the validity of the claims made by these seminar promoters.

Lawyer Ron Usher spent the last five years examining and fact-checking claims made by At Will Events—a Canadian-based marketing and event planning firm that offers free seminars on how to invest and make money in the U.S. real estate market, among other topics.

What Usher found through his investigation was not surprising. The sample cases and testimonials offered by seminar coordinators and participants are, on the whole, simply not factual. For example, a six-plex may be profiled as an example of a great buy that appreciated quickly due to landlord capital investments. Problem is: that six-plex was not purchased as a result of the seminar promoter and their educational training—it was purchased by a real estate investor who had done their homework. The rationale for using these proffered examples is that they are illustrations—examples of what seminar attendees could achieve, but shouldn’t expect.

Sadly, what is surprising is how often would-be investors pay for this so-called knowledge. The pitch is quite formulaic and the potential profit margin for these promoters is shocking.

Based on my own observations, the formula for these “free two-hour seminars” includes the following:

#1. Celebrity endorsement

Just about every big real estate event—seminars held in large conference halls, over multiple days, offering freebies (such as MP3 players), and travel across the province or country—will use a brand-name celebrity to promote their event.

This year I’ve seen event endorsements from: Mike Holmes (HGTV), Than Merrill (A&E), Scott McGillivray (HGTV), Chad Chiniquy (Flip & Build Wealth System), and Robert Kiyosaki (Rich Dad), to name only a few.

But the endorsements aren’t limited to celebrities. Lawyers from both Canada and the United States, real estate agents and brokers, even self-proclaimed real estate tycoons have all jumped on the seminar train, with advertisements for these events posted in newspapers, in online forums and chat-rooms, and even sent by direct mail to mailing lists (that’s how I got my two free tickets to the spring seminar I attended).

#2. Celebrity involvement

In the early stages of a new seminar series or investment program, the celebrity may actually show up and provide either a key-note speech or a motivational talk to the seminar attendees.

Over time, though, the celebrity’s level of involvement will dwindle, until only their name is used—either on a poster, in ads promoting the event, or through motivational videos.

Most of the time these celebrities aren’t even endorsing the seminar or investment program, but the theoretical use of real estate as an investment. While some celebrities do become stakeholders in these “learn to invest” seminars/workshops/educational groups, the vast majority are paid just to endorse the product.

“I attended a real estate seminar sponsored by Property Wars star, Doug Hopkins,” explains one reader. “Turns out it was just his face on the poster along with two video clips. Truly disappointing.”

True secrets of real estate seminars »

#3. Offer you the dream

If you do happen to attend one of these free two-hour events, the agenda will go something like this:

→ Introduce your host. A bit of background. I used to be a chump, now I’m wealthy.

→ I took my family on this lovely vacation, wouldn’t you like to?

→ Some statistics on real estate (usually U.S. stats that are vague and general)

→ Simplified investing plans and results (often with quotes from famous investors, such as Warren Buffet)

→ Some admonishment for how foolish you are not to grab this opportunity

→ A push for you to commit to their three-day training program (all you need to learn about real estate investing, until you get there and they sell you on the next, bigger training package)

→ The discounted push. (At the event I attended, the three-day event was regularly priced at $5,600, but act now and we only had to pay $1,737. At other seminars I’ve seen as little as $1,900 and as much as $7,000.)

Granted, there was a slow trickle of attendees that left between the 45 minute and 120 minute mark of this seminar, but the vast majority of attendees sat in the chairs…waiting.

#4. Upsell. And upsell again

But here’s the real rub: These free two-hour real estate seminars aren’t actually seminars. They are thinly disguised sales pitches—and the pitch isn’t actually making money in property, but the dream of making money in property.

They rarely offer any real information about how to make money in real estate investing. There are no lawyers explaining the difference between commercial and residential units; there are no mortgage brokers on hand to teach attendees about the rules and regulations about investment property financing; there’s not even a real estate agent to discuss the intricacies of the local market, never mind details about specific types of housing or ideal neighbourhoods. (Find a seminar or group that offers this type of information, and you may actually learn how to make money in real estate.)

So, if you end up listening to a speaker that keeps reinforcing your desire to make money in real estate but doesn’t actually share some the nuts and bolts about real estate investing, then buyer beware: Your seminar is about selling the dream, not sharing the knowledge.

The truth? These seminars are all about the upsell. And it works.

Academics, motivational speakers, and salespeople in every industry know that in order to make a sale you need to convert a potential customer into a paying client. That process is one part art and one part science and it’s known as conversion. And it all boils down to numbers. For cold-calling, sales agents are told to expect a 1% conversion—for every 100 people spoken to, one will agree to your pitch. In face-to-face real estate seminars, there’s a general rule of thumb that 30% to 40% of your audience will buy into that three-day seminar training. That’s 3 out of 10 people. So pack a room full of hundreds of people, spread the seminar presentation out over a few days, and the numbers start to add up.

#4. Guarantees

So, why would intelligent, hard-working people fall for these get-rich-through-real-estate-training schemes? Often it’s because we get lulled into a false sense of confidence with just a glimmer of hope—and many times it’s the perks and promises, offered like a carrot on a stick, that sway us from being rational to acting irrationally.

For example, many seminars will offer money-back guarantees, but getting your money back can be quite an arduous ordeal. (Read one reader’s ordeal here.) For those that do manage to get their money refunded, the promoters will then use this as proof of their “satisfaction” guarantee, which only further entices still more people to buy in.

#5. Access to easy loan money

The other method now being used to entice people into buying into these seminars is the promise of easy loans. With tightened mortgage rules and stiffer lending practices, many would-be investors can’t get funding through traditional routes (such as banks or mono-lenders). But the line used is that restricted access to cash shouldn’t prevent you from realizing big profits in real estate investment. Enter the funding package.

Funding package money is reportedly available within 24-hours of paying to attend the three-day educational event. But read the fine-print. One reader that paid almost $2,000 for a three-day event learned later that “the promise of up to $500,000 in loaned funds to help fund your real estate investment were only available for ‘seasoned’ investors.” It’s hard to be a seasoned investor if you’re signing up to learn to invest.

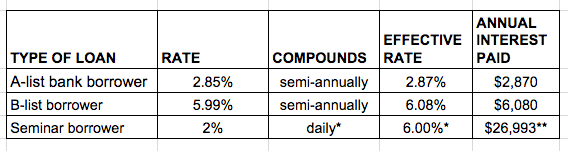

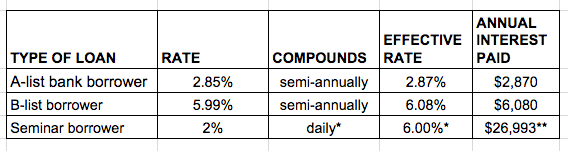

But there’s more. Even if you are approved for this funding, you’ll need to keep an eye on the nominal and effective interest rates of this loan. Don’t and you could be on the hook for tens of thousands in interest payments.

For instance, the cost of the three-month loan offered at the seminar I attended was 2% to 3% per month. This was the nominal rate—the posted rate used to attract borrowers. But these funding packages have interest that compounds daily. So, the effective interest rate is different. The effective rate is the interest rate that factors in the power of compounding.

To understand the difference let’s take, for example, a 6% mortgage rate that compounds semi-annually (as most mortgages do in Canada). On a $1,000 loan you’d pay $30 in interest in the first six months ($1,000 x 0.03), and $30.90 of interest in the next six months ($1030 x 0.30). After one year you’d owe $60.90 of interest on that $1,000 loan—making the effective interest rate 6.09%.

Mathematically speaking, the difference between the nominal rate and the effective rate increases with the number of compounding periods within a specified time period.

According to the seminar I attended, the effective interest rate on their three-month loan is 6% to 9%. This effective rate climbs again if you don’t pay back your loan within those three months. To understand how dramatic this is, let’s examine take a look at a $100,000 loan:

*My math is fuzzy but I took the seminar promoters at their word and used the 6% effective rate they had quoted to the seminar attendees.

**The initial three-month interest rate on an effective rate of 6% that compounds daily is $1,764. I had to get a bit creative, and this number is not accurate, but it gives you an idea of how ridiculously expensive this seminar loan can be.

Where’s the real money?

But here’s the rub: the real money is not in loaning money or investing in real estate. The real money is made when these seminar-promoters convince would-be property investors to pay for the advice and guidance they offer.

Again, let’s use the event I attended as an example. It was only one of 15 free two-hour seminars in Ontario. At a very conservative estimate that means 5,250 people attended these seminars. At a 30% conversion rate that means 1,575 paid for the three-day event, which means the seminar promoters would’ve taken in $2,735,775. That’s almost $3-million in gross earnings.

It doesn’t stop there. “The $1,997 three-day course I attended was definitely just an upsell for the $20,000 to $70,000 advanced class,” explains one seminar attendee. So, if 1,575 people attended this advanced course and 30% of those attendees were convinced to spend another $20,000 on additional training, the seminar promoters would have earned another $10,000,000 in seminar sales. So, for this 15 seminar series a conservative estimate of the total gross earnings would be just shy of $13-million. And that’s just one seminar series in one province in one year.

So, that’s how to make money in real estate.

Read more from Romana King at Home Owner on Facebook »