How to retire at 55 on $55,000 a year

Paula and Pierre's dream retirement rests solely on their investment returns

Advertisement

Paula and Pierre's dream retirement rests solely on their investment returns

Paula Lorimer and husband Pierre Sopel save $30,000 annually. They hope to retire at age 55 with a net annual income of $55,000.

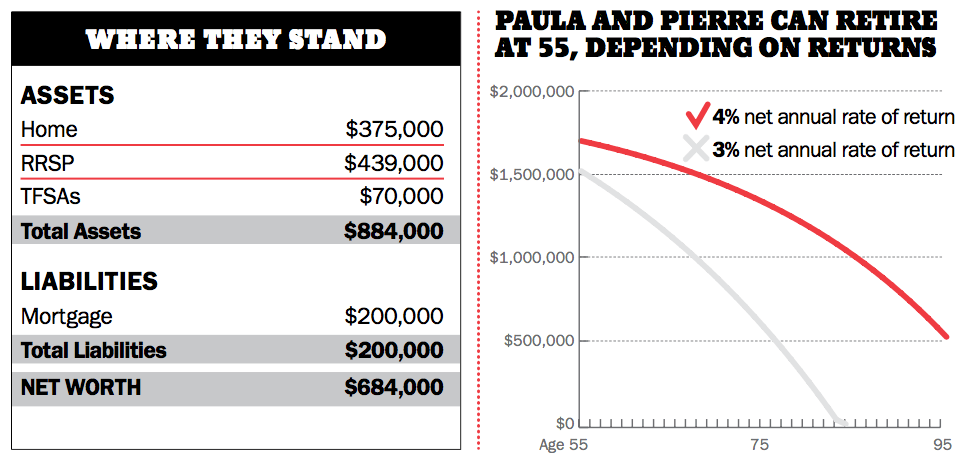

Paula Lorimer, 40, is a psychologist living in Montreal. Right now, Paula is self-employed but is looking forward to changing gears at age 55. “I’ve worked hard and want time to do some teaching, attend workshops and do more volunteer work,” says Paula, who is married to IT manager Pierre Sopel, also 40. Paula handles the couple’s finances and the two of them are on track to pay off their $375,000 house in 13 years. As well, the couple has $509,000 total in RRSPs and TFSAs, mostly invested in a mix of dividend, equity and fixed-income mutual funds, averaging a 5% net annual rate of return. Paula figures they can save about $30,000 annually—$18,000 annually through authorized payment plans to her RRSP and TFSA, and another $12,000 annually at year-end to top up retirement savings. Pierre also puts $3,600 annually into his company’s defined-contribution pension plan, an amount his company matches. “I’d like our investments to give us $55,000 net annually to live on at age 55 with no further savings. I’d like to confirm the accuracy of my budget numbers to ensure I am on track,” says Paula.

If Paula and her husband Pierre want to retire when they are both hit age 55 it will depend on one thing: their net average annual rate on investment returns. “If the couple averages 4% net per year for life, their money will definitely last until age 95 and beyond,” says Ayana Forward, a certified financial planner with Ryan Lamontagne in Ottawa. “But if the couple is only able to achieve an average return of 3% annually, their investment money will run out at age 84. That doesn’t sound promising, but the good news is they have options.”

There are two things to consider to ensure the couple’s money lasts. If they start their retirement at age 55 they could lower their withdrawals from $55,000 to $44,396 annually—do this and their money will last a lifetime, says Forward. Alternatively, they can assume their investments will grow at 3% a year, start withdrawing $55,000 annually at age 55, then, in their 80s, sell their home and and add the proceeds to their investment portfolio. “Knowing about these possible changes will give them the flexibility and peace of mind to make retiring at 55 attainable,” says Forward.

Do you want MoneySense to see if you’re on track to meet your own financial goal? If so, drop us a line at [email protected]

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email