When to tap into government pensions

Take them early or defer? Here’s how to get the most out of OAS and CPP

Advertisement

Take them early or defer? Here’s how to get the most out of OAS and CPP

When you reach the cusp of retirement, you’re no doubt aware the Canada Pension Plan (CPP) and Old Age Security (OAS) provide much of the financial bedrock for your golden years. But you might be wondering whether you should start your government pensions as soon as possible after you retire or wait until later. An early start will give you a longer stretch of reduced payments, whereas waiting will provide fewer payments but in larger amounts. Which is better?

A lot of complicated factors can affect this decision, so the choice can seem daunting. But you usually won’t go far wrong either way. “If you have reasons for starting your government pensions now, do it and don’t worry about it,” says retirement expert and retired actuary Malcolm Hamilton. “If you have reasons you’d rather not draw it now, defer it and don’t worry about it.” While that should leave you re-assured, you still need to understand how different personal factors can affect your decision.

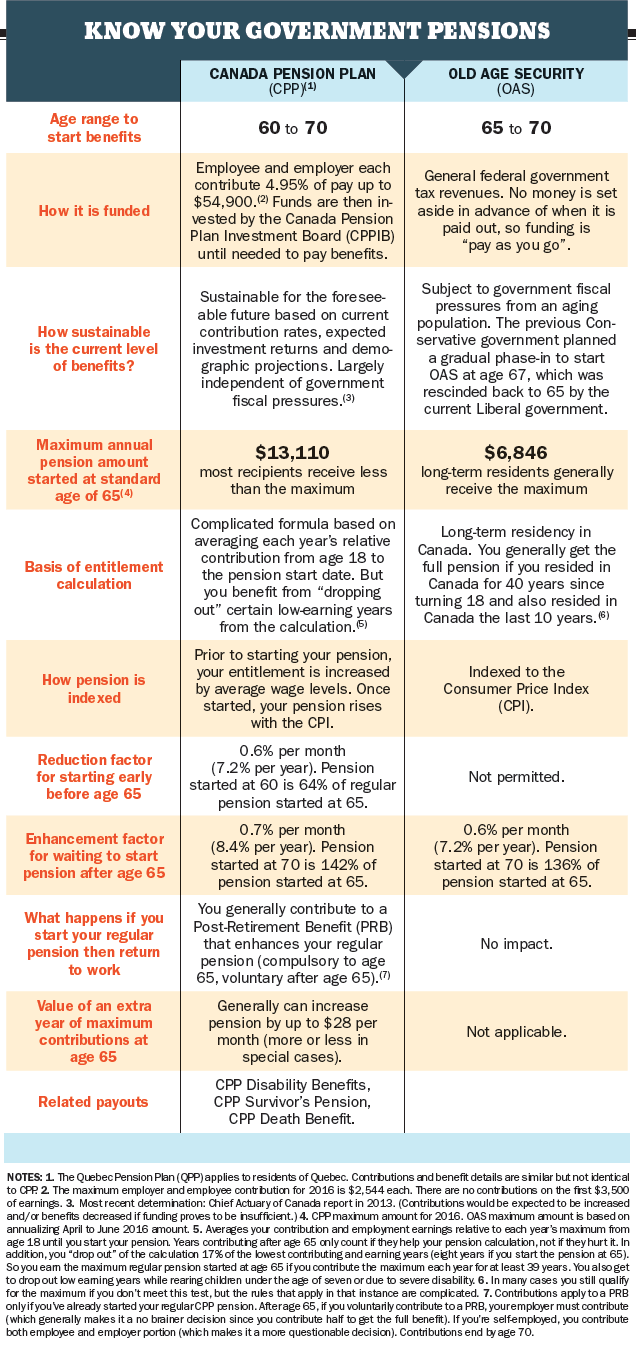

Start with the core facts. You can begin your CPP benefits between the ages of 60 and 70, and your OAS benefits between 65 and 70. Think of the process of figuring out your pensions as a two-step process: First figure out what you would get if you started them at the “standard” retirement age of 65. Most Canadians who retire at 65 receive the maximum OAS pension which is currently $6,846 per year, but less than the maximum CPP pension for that age which is $13,110 per year.

Then if you start pensions earlier or later than 65, you need to apply an adjustment factor. Specifically, you would reduce your CPP payment if you started it before 65 (by 7.2% per year), and enhance your pensions by starting it later (8.4% per year for CPP and 7.2% per year for OAS). See “Know Your Government Pensions” for more details on how your CPP and OAS benefits work.

The basic reason why you usually won’t go far wrong with taking your pensions earlier or later than 65 is that the government sets the adjustment factors to be reasonably fair either way. In technical terms, they’re roughly “actuarially neutral,” which means they confer no general financial advantage for taking your pensions early or late, assuming you have average life expectancy. (We’ll discuss this more in a minute. You will note that the concept isn’t applied precisely because the adjustment factor for deferring CPP is higher than for deferring OAS.)

However, there are also a number of other individual factors that can tilt your decision either way and they vary from person to person. First we’ll discuss factors that can nudge you towards starting pensions early.

If you’re in your early 60s and suffer from serious terminal or chronic conditions that give you good reason to think your life expectancy is shortened, then it generally makes sense to start your pensions as early as you can. However, there is an exception, says Doug Runchey, an OAS and CPP calculations expert at DRpensions.ca. If you’re not yet 65 and suffer from “severe and prolonged” disability then you’re usually better off starting, if eligible, the CPP Disability Benefits and not starting your regular CPP pension until 65, he says.

If you don’t have an employer pension or much in the way of savings and you retire early, you probably need a source of money to live on. It then makes natural sense to start government pensions when you can if you’re no longer working. But there is another factor. In that situation, there’s a good chance you’ll qualify for the Guaranteed Income Supplement (GIS) which starts at 65 for low-income Canadians. For GIS recipients, most types of income including CPP payouts (but not OAS payouts) result in a deep clawback: You give up roughly 50 cents of GIS for every dollar of CPP payout. As a result, a likely GIS recipient who is no longer working should generally start their CPP pension as soon as possible before 65. That way you might collect several years of CPP without impacting GIS, and then your reduced CPP pension after age 65 results in a smaller GIS clawback compared to a CPP pension started at age 65.

If you spent a lot of time away from work years ago and have now stopped working, there’s a technicality in the way CPP is calculated that can provide a modest incentive to start CPP as soon as you can.

It’s complicated. Your CPP entitlement depends on averaging your contributions and earnings in relation to the maximum each year from age 18 until you start taking CPP (or effectively age 65 if you start your pension later than that). You’re allowed to drop 17% of your lowest-earning years from the calculation, which amounts to eight years if you retire at 65. You can drop out additional years if you had little or no income due to serious disability or due to looking after children before the age of seven.

The thing is, it is easy to use up all your standard 17% drop-out years if you spent many years getting an education or doing other unsalaried pursuits. If you then stop working in your early 60s and don’t start CPP immediately, then you’ll add more years of zero contributions and zero earnings to the calculation. The impact of that factor in these cases in isolation is to reduce your annual CPP benefit when you do start it by about 2.5% for each additional year of zero income, says Runchey. So for people in this situation, the net impact is that the payoff they would otherwise get for deferring CPP would be curtailed to around 4.7% per year. (That’s the general deferment factor of 7.2% minus the 2.5% from adding additional zero income years.) “You get a larger slice of a smaller pie, but you still get more pie in total,” says Runchey.

If you live an exceptionally long life, then you’ll collect more money by delaying the start of CPP and OAS as long as possible. Favourable factors include: You’ve reached your early 60s in excellent health; you don’t smoke; you aren’t overweight; you exercise and generally take care of yourself; and your forbearers have generally lived into their 90s.

There’s a technical factor at play that provides a minor reason for deferring CPP (although OAS isn’t affected). And that’s the fact that before you start your CPP benefits, your entitlement grows by the average Canadian wage. After you start your CPP pension, it is then indexed to inflation as measured by the Consumer Price Index. Historically, average wages have usually (but not always) grown a little faster than inflation. The difference has averaged a little under 1% a year over the last 10 years. So if you think that wages will continue to grow a little faster than inflation, then it provides a modest sweetener for CPP deferral.

When rates for deferring OAS and CPP were set a few years ago, interest rates were higher than they are now. That means it’s probably “mildly advantageous” to defer today, says Hamilton. That’s because when you start pensions immediately, you free up money in your nest egg to invest for later, and therefore you’re more dependent on your investments. With low interest rates it’s harder to earn decent returns from the fixed income part of your portfolio, which is important for older investors. If you’re going to defer either OAS or CPP but not both past age 65, defer CPP because the deferral factor is slightly higher.

While there are a few instances where these factors can push you decisively in favour of one decision or the other, in most cases their influence is modest. “It’s largely personal preference,” concludes Hamilton.

Whether you take your benefits earlier or latter, one thing you need to figure out next is how much you will get. Figuring out your OAS pension is usually straightforward (all long-time Canadian residents retiring at 65 get the same amount), but it can get complicated for CPP. If you’re about to start your CPP pension in the near future, your Service Canada account usually provides you with a reasonably accurate figure, confirms Runchey.

However, if you’re trying to plan for a CPP pension to start years from now, the Service Canada estimates can be significantly misleading, he points out. That’s because your future CPP pension will depend on the amount and pattern of your contributions, whereas the estimates assume you continue making the same level of contributions.

Runchey says some of the larger discrepancies occur where the Service Canada estimates assume that you continue to make maximum contributions but instead you retire, stop contributing, defer on CPP benefits and have also used up all your standard low-income “drop-out” years. In that case, Runchey says the estimates may be too high by about 2.5% a year, or a total of 12.5%, if you’ve just turned 60 and are trying to estimate your CPP pension started at 65.

Notes: 1. The Quebec Pension Plan (QPP) applies to residents of Quebec. Contributions and benefit details are similar but not identical to CPP. 2. The maximum employer and employee contribution for 2016 is $2,544 each. There are no contributions on the first $3,500 of earnings. 3. Most recent determination: Chief Actuary of Canada report in 2013. (Contributions would be expected to be increased and/or benefits decreased if funding proves to be insufficient.) 4. CPP maximum amount for 2016. OAS maximum amount is based on annualizing April to June 2016 amount. 5. Averages your contribution and employment earnings relative to each year’s maximum from age 18 until you start your pension. Years contributing after age 65 only count if they help your pension calculation, not if they hurt it. In addition, you “drop out” of the calculation 17% of the lowest contributing and earning years (eight years if you start the pension at 65). So you earn the maximum regular pension started at age 65 if you contribute the maximum each year for at least 39 years. You also get to drop out low earning years while rearing children under the age of seven or due to severe disability. 6. In many cases you still qualify for the maximum if you don’t meet this test, but the rules that apply in that instance are complicated. 7. Contributions apply to a PRB only if you’ve already started your regular CPP pension. After age 65, if you voluntarily contribute to a PRB, your employer must contribute (which generally makes it a no brainer decision since you contribute half to get the full benefit). If you’re self-employed, you contribute both employee and employer portion (which makes it a more questionable decision). Contributions end by age 70.

Read: Does the CPP factor in recent contributions?

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

If I have an employer pension that I will begin at age 65 will my govt pensions be clawed back. I am recieving cpp disability’s now due to cancer and I was told that would continue to age 75. At age 65 I expect to start recieving OAS if I’m still alive and my union pension. What’s the best way to receive the most amount of earnings without being penalized?

Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. We invite you to email your question to [email protected], where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor.