Canadian real estate market outlook 2018

Most markets will simply flatline before rebalancing by the end of the year

Advertisement

Most markets will simply flatline before rebalancing by the end of the year

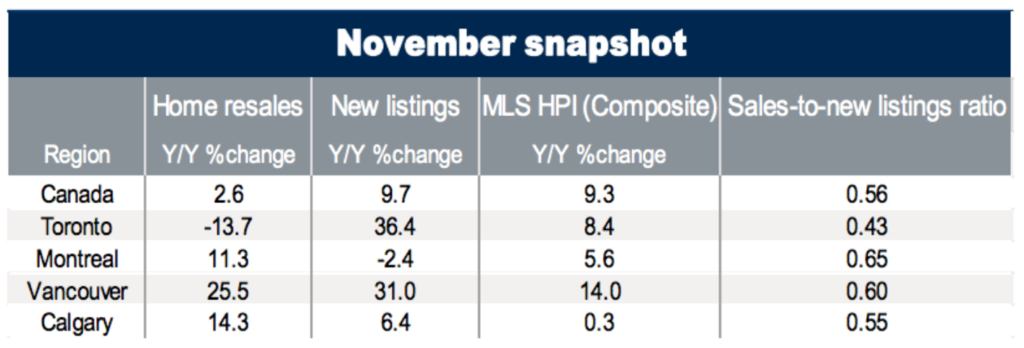

READ: Where to Buy Canadian Real EstateBut this last-minute year-end activity in 2017 is not likely to continue into 2018. Hogue’s outlook for the New Year suggests that further moderation of home sales activity across Canada will cool any price increases in the upcoming year. “Near-term volatility will be followed by a generalized softening in 2018.” The least optimistic outlook regarding Canada’s real estate markets in 2018 comes from the most unexpected place: The Canadian Real Estate Association. CREA, is the trade association that represents more than 100,000 real estate brokers, agents and salespeople across Canada. In December, CREA cut its home sales forecast for 2018. The association’s analysts cite the impact of tighter mortgage rules, the chill from the Toronto and Vancouver foreign buyers’ tax, as well as on-going affordability issues in the country’s biggest markets. CREA predicts that activity (that is, the number of actual home sales) will fall 5.3% in 2018. This continued decrease in buying activity, combined with the 4% decline in activity in 2017, prompted CREA to anticipate a 1.4% drop in national average housing prices in 2018. The expected national average housing price for 2017 was $503,400. If CREA’s prediction turns out to be true, 2018 will be the first year the national housing price will have fallen in Canada since the start of the global recession in 2008. But the impact of a slowing market will not be felt uniformly across the country. According to CREA estimates sales activity will decline across Canada (by 5.3%), as a well as in B.C. (by 3.7%), in Alberta (by 2.8%), in Saskatchewan and Manitoba (3.8% and 3.9%, respectively) and in New Brunswick and Nova Scotia (by 0.5% and 2.8%, respectively). The two hardest hit provinces will be Ontario, with an almost 10% decline in activity (9.6%) and Prince Edward Island, with a 7.4% decrease in sales activity. The only provinces predicted to have increased sales activity in 2018—albeit at anaemic rates—are Quebec (0.9%) and Newfoundland (1.3%). What do these predictions mean for average home prices? Volatility. While Newfoundland is expected to have increased sales activity in 2018, its annual price change is expected to drop by 1.9% in 2018. Other provinces with price drop forecasts include Alberta (0.3%) and Ontario (2.2%). The prices in the remaining provinces will either flat-line—like in B.C. and Saskatchewan where 0% price appreciation is expected in 2018—or move up incrementally, like in Manitoba with a 1% average price increase, PEI (0.9%), Nova Scotia (2%) and New Brunswick (1.8%). Only Quebec average prices are expected to beat the national anaemic rates, with a 4.2% increase in average sales prices.

MORE: Why a national real estate crash isn’t on the horizonBased on all these factors, we shouldn’t be surprised by an active spring market, particularly in the condo and townhouse market segments. As a buyer, you’d be wise to secure a mortgage pre-approval before shopping for a home. Don’t just do a quick, online calculation — talk to a mortgage broker. For those buyers struggling to get a loan, consider going through non-prime mortgage lenders. These alternative lenders specialize in buyers turned down by banks, as they allow for more non-traditional income and permit higher debt ratios (up to 50% total debt service ratio, versus the 42% guideline used by the banks). Another option is to increase the length of amortization on the mortgage, which lowers the debt service ratio used to qualify for the loan. Just don’t expect to get all this help without paying for it. In the past, non-prime lenders have charged higher mortgage rates (to reflect the higher risk of the borrower). Going forward these non-prime lenders may opt to cut the rate but make up the lost revenue by tacking on a fee. The result: Higher risk buyers will end up paying more with fees for amortization periods longer than 25 years, as well as fees for holding less than 20% equity in the house and fees to get access to rates low enough to allow them to qualify for the mortgage.

WATCH: The best city to buy real estate in Canada[bc_video video_id=”6023927816001″ account_id=”6015698167001″ player_id=”lYro6suIR”] For those homeowners who were proactive about paying off their mortgage debt and building up the equity in their home, this decision will be easy. You will qualify for a great rate whether you stay with your current lender or shop around. But homeowners who refinanced and added more debt to their mortgage loans, or those that weren’t proactive about building up the equity in their home, may feel the pinch. Those that choose to stay with their current lender may find the rates are not as competitive, but may not have options elsewhere, as they’ll be subject to the new mortgage stress test. Homeowners looking to obtain a Home Equity Line of Credit (HELOC) may be surprised at how much smaller this revolving loan will be in 2018. In 2017, anyone applying for a HELOC was stress-tested using the posted 4.89%. As of January 1, 2018, this rate increased to 5.7% (and will continue to increase as rate rise). It’s worse if you’re a homeowner looking to refinance. Those looking to consolidate their debt through a refinance in 2018, may be surprised by the less than attractive mortgage rates offered to them, or the inability to qualify for the loan amount needed. Typically, those that need to refinance have debt ratios that are above average and this will be very problematic when trying to qualify under the new mortgage rules.

MORE: Is a rental property a good investment?For those investors choosing to skip the single-family home and look at condos and townhomes, keep in mind that competition may increase in these segments quite substantially in 2018. More first-time buyers may be pushed into this pricing segment and this would mean even more competition for these units. Old rules of thumb remain, however. Try to find units that are well capitalized (lower purchase price, higher rental yield) and, where possible, look for neighbourhoods that support renters, such as urban centres, university and hospital communities as well as commercial complexes that offer newly built retail and office space. Any investor thinking of buying in 2018, should first start with a financial plan and a budget. Then talk to your accountant and mortgage broker to make sure the numbers work. If all this checks out and you’re lucky enough to find a property, then 2018 may be the year for you to become a landlord (and the real work begins).

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Hi! hello, I’m just reading.