Am I on track to pay off the mortgage in 10 years?

Income from a basement suite will help this couple

Advertisement

Income from a basement suite will help this couple

The verdict

Provided they adhere to a strict payment schedule, building a basement rental suite will help the Mountjoys own their home outright sooner, says Tom Feigs, a money coach in Calgary. “I’m usually wary of people spending a lot of money on home renos. But the Mountjoys’ goal is to create an income stream through a basement suite. Such renos are much more positive for the bottom line.”

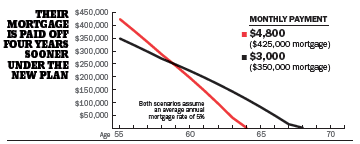

If the Mountjoys go ahead with their basement reno and increase their existing $350,000 mortgage to $425,000, the couple can have their home completely paid off by age 64—but only if they put all of the $1,800 monthly rental income from the basement suite toward their mortgage in addition to their regular $3,000 payments. By comparison, if the couple foregoes the reno and continues with their current mortgage payment plan, they won’t have it paid off until they’re both 68. “It can make sense to take on more mortgage debt—even if the couple is in their mid-50s, provided they aggressively pay it down,” says Feigs. “By age 65 they’ll have both a paid-off home as well as a healthy income stream to supplement retirement travel.”

The verdict

Provided they adhere to a strict payment schedule, building a basement rental suite will help the Mountjoys own their home outright sooner, says Tom Feigs, a money coach in Calgary. “I’m usually wary of people spending a lot of money on home renos. But the Mountjoys’ goal is to create an income stream through a basement suite. Such renos are much more positive for the bottom line.”

If the Mountjoys go ahead with their basement reno and increase their existing $350,000 mortgage to $425,000, the couple can have their home completely paid off by age 64—but only if they put all of the $1,800 monthly rental income from the basement suite toward their mortgage in addition to their regular $3,000 payments. By comparison, if the couple foregoes the reno and continues with their current mortgage payment plan, they won’t have it paid off until they’re both 68. “It can make sense to take on more mortgage debt—even if the couple is in their mid-50s, provided they aggressively pay it down,” says Feigs. “By age 65 they’ll have both a paid-off home as well as a healthy income stream to supplement retirement travel.”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email