Build a portfolio to leave a legacy

Niilo Khartikaine of Winnipeg wants to build a tax-efficient portfolio that will grow to $500,000 in 30 years

Advertisement

Niilo Khartikaine of Winnipeg wants to build a tax-efficient portfolio that will grow to $500,000 in 30 years

Niilo Khartikaine, the 90-year-old electrical technician and retired president of the Princess Auto chain of stores, has a plan. Last month, he set aside $60,000 in an investment account with the aim of growing it to $500,000 in 30 years so that his legacy—the family cottage on the Winnipeg River—can be rebuilt by his grandchildren, from scratch. “I bought the cottage 27 years ago and it was my retirement project,” says Niilo, who wants a low-cost, tax-efficient portfolio. “I don’t want to pay high MERs and I want the portfolio to be simple to manage so my adult kids can keep it on track over the long term.”

Certified investment advisor Shannon Dalziel of PWL Capital in Toronto says that in order for Niilo’s investment of $60,000 to grow to $500,000 in 30 years, he needs an average annual rate of return of between 7.3% and 9.1% before taxes and fees. “To achieve that amount of growth, an all-equity portfolio could be the one to go with if his children can handle the volatility.”

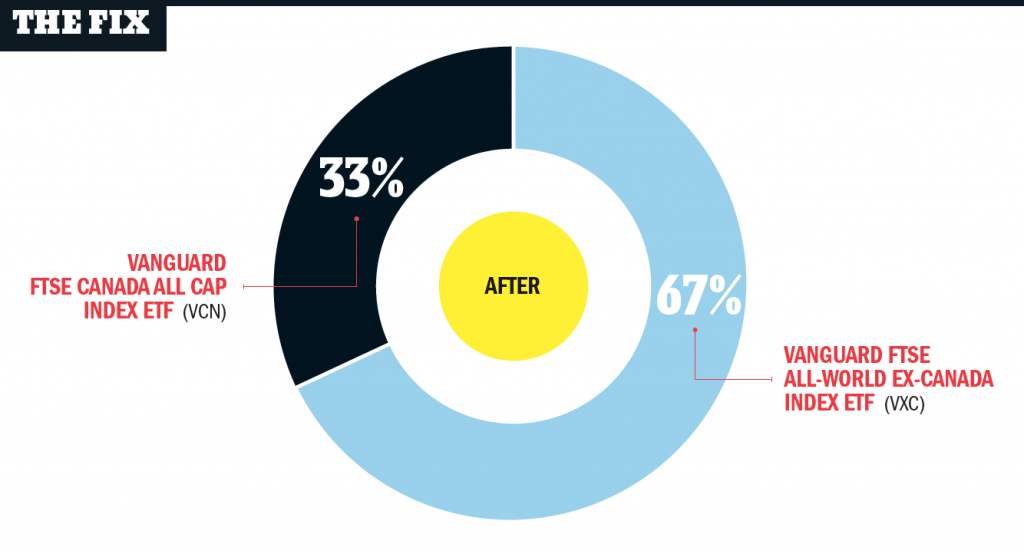

If Niilo’s adult children are in a lower tax bracket, it would be tax-efficient to gift the money to them before he passes. The family would avoid probate fees, and possibly pay less ongoing taxes on investment earnings. “This means Niilo would lose control of the funds, but he could let his children know his wishes and provide them with instructions on how to manage the assets,” says Dalziel. She recommends a portfolio divided equally between Canadian, U.S. and international equities. The portfolio should have only two holdings with 33% of the money invested in Vanguard FTSE Canada All Cap Index ETF (VCN) and 67% in Vanguard FTSE All-World ex-Canada Index ETF (VXC). The average MER is just 0.20%.

Niilo Khartikaine, the 90-year-old electrical technician and retired president of the Princess Auto chain of stores, has a plan. Last month, he set aside $60,000 in an investment account with the aim of growing it to $500,000 in 30 years so that his legacy—the family cottage on the Winnipeg River—can be rebuilt by his grandchildren, from scratch. “I bought the cottage 27 years ago and it was my retirement project,” says Niilo, who wants a low-cost, tax-efficient portfolio. “I don’t want to pay high MERs and I want the portfolio to be simple to manage so my adult kids can keep it on track over the long term.”

Certified investment advisor Shannon Dalziel of PWL Capital in Toronto says that in order for Niilo’s investment of $60,000 to grow to $500,000 in 30 years, he needs an average annual rate of return of between 7.3% and 9.1% before taxes and fees. “To achieve that amount of growth, an all-equity portfolio could be the one to go with if his children can handle the volatility.”

If Niilo’s adult children are in a lower tax bracket, it would be tax-efficient to gift the money to them before he passes. The family would avoid probate fees, and possibly pay less ongoing taxes on investment earnings. “This means Niilo would lose control of the funds, but he could let his children know his wishes and provide them with instructions on how to manage the assets,” says Dalziel. She recommends a portfolio divided equally between Canadian, U.S. and international equities. The portfolio should have only two holdings with 33% of the money invested in Vanguard FTSE Canada All Cap Index ETF (VCN) and 67% in Vanguard FTSE All-World ex-Canada Index ETF (VXC). The average MER is just 0.20%.

NiilBy investing in VCN, Niilo’s children will receive preferential tax treatment (in the form of the dividend tax credit) on dividends received from Canadian corporations. These dividends should be taken in cash to make it easier to track their cost base for tax purposes: the cash can be reinvested when they rebalance the portfolio. “This is a simple, tax-effective plan that will see them through the long haul,” says Dalziel.

NiilBy investing in VCN, Niilo’s children will receive preferential tax treatment (in the form of the dividend tax credit) on dividends received from Canadian corporations. These dividends should be taken in cash to make it easier to track their cost base for tax purposes: the cash can be reinvested when they rebalance the portfolio. “This is a simple, tax-effective plan that will see them through the long haul,” says Dalziel.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email