Warning: steer clear of extended auto loans

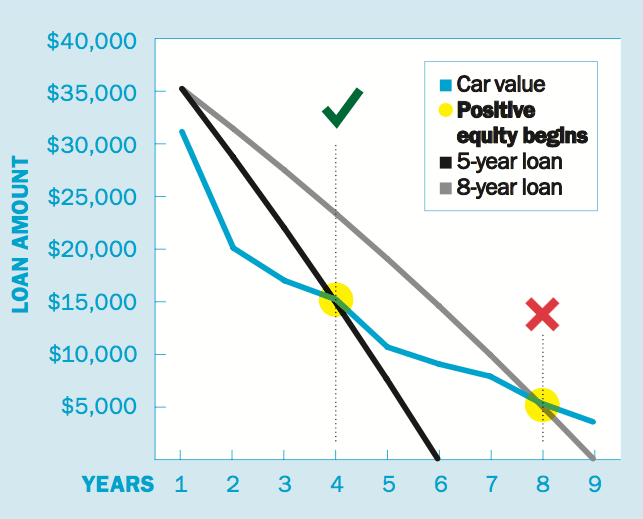

Don't fall victim to "negative equity"

Advertisement

Don't fall victim to "negative equity"

Read more:

Should I get a long-term loan? »

How to get out of a bad car loan »

Buying your first car »

Read more:

Should I get a long-term loan? »

How to get out of a bad car loan »

Buying your first car »

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email