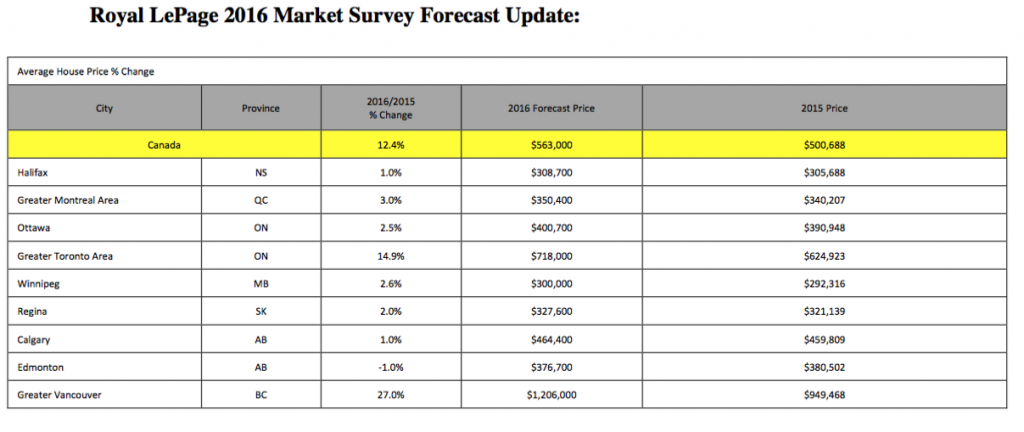

An almost 13% increase in national home prices by end of year

Most of the gains will come from Vancouver and GTA suburbs, as Alberta and Saskatchewan still struggle

Advertisement

Most of the gains will come from Vancouver and GTA suburbs, as Alberta and Saskatchewan still struggle

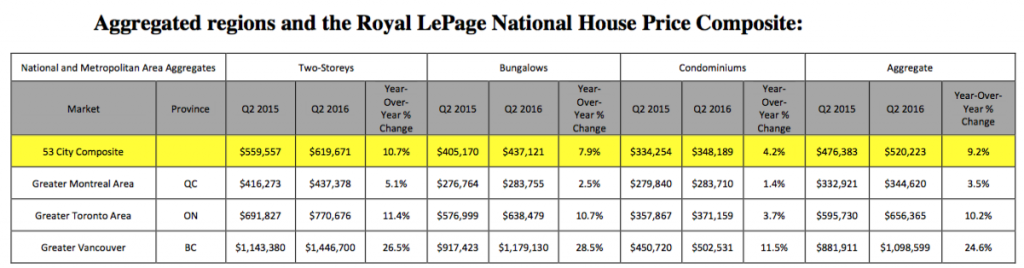

Soper’s prediction is based on Royal LePage’s “price composite” formula that focuses on typical properties and excludes sales of luxury mansions. By omitting outliers, Royal LePage believes its forecasting model provides a better barometer of trends than average prices, which are skewed upward by sales of high-end properties.

Soper’s prediction is based on Royal LePage’s “price composite” formula that focuses on typical properties and excludes sales of luxury mansions. By omitting outliers, Royal LePage believes its forecasting model provides a better barometer of trends than average prices, which are skewed upward by sales of high-end properties.

8 reasons why Vancouver’s real estate market is so crazy » 8 solutions that could help fix Vancouver’s real estate problems »

“The quest for affordability in Vancouver seems to be influencing consumer housing type choices,” continued Soper. “Alongside skyrocketing prices of single-family homes, we have seen an uptick in the rate of price appreciation for condominiums over 1,000 square feet, when compared to smaller units in this market. This may indicate that families being priced out of the single-family detached home market in Vancouver are looking to condominiums.” Best Deals in Real Estate 2016: Vancouver »Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email