Royal LePage sees a nationwide revision to the mean in 2017

The drama of property markets will start to dwindle this year, but GTA will still see price surges

Advertisement

The drama of property markets will start to dwindle this year, but GTA will still see price surges

Disparity, erosion, feast, famine. You’d be forgiven if these words reminded you of high school English class (think Of Mice and Men or The Grapes of Wrath). Turns out, however, these are the very terms used by one of Canada’s largest real estate brands to describe our country’s varied property market.

“The disparity in home price appreciation between Canadian regions has never been greater than that seen in 2016, with rates ranging from double-digit extremes in some cities to negative growth in others,” said Royal LePage President and CEO, Phil Soper. He adds: “This economic drama put real estate at the forefront of everybody’s mind last year, from the Prime Minister to the recent grad.”

Soper explains that in the last eight years Canada’s real estate markets have been divided—with Ontario and B.C. leading a steady expansion, while other markets continued their relatively standard growth and still others experienced major declines. “In the last two years, these extremes within the Canadian real estate market really became pronounced and appears to have come to a head in 2016.”

Perhaps this is why 2017 will be the year to change all this; the year where we move away from regional extremes and away from “real estate feast and famine.”

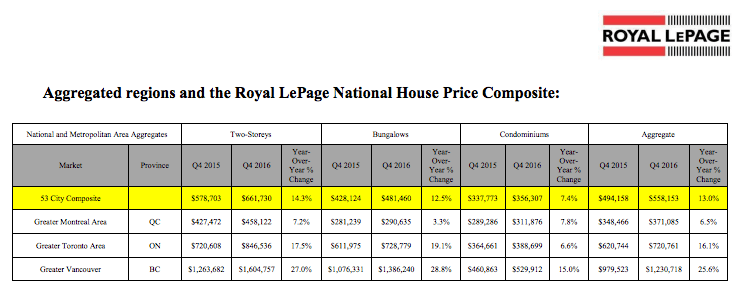

Based on the Royal LePage National House Price Composite data, here’s what to expect across Canada in 2017:

Disparity, erosion, feast, famine. You’d be forgiven if these words reminded you of high school English class (think Of Mice and Men or The Grapes of Wrath). Turns out, however, these are the very terms used by one of Canada’s largest real estate brands to describe our country’s varied property market.

“The disparity in home price appreciation between Canadian regions has never been greater than that seen in 2016, with rates ranging from double-digit extremes in some cities to negative growth in others,” said Royal LePage President and CEO, Phil Soper. He adds: “This economic drama put real estate at the forefront of everybody’s mind last year, from the Prime Minister to the recent grad.”

Soper explains that in the last eight years Canada’s real estate markets have been divided—with Ontario and B.C. leading a steady expansion, while other markets continued their relatively standard growth and still others experienced major declines. “In the last two years, these extremes within the Canadian real estate market really became pronounced and appears to have come to a head in 2016.”

Perhaps this is why 2017 will be the year to change all this; the year where we move away from regional extremes and away from “real estate feast and famine.”

Based on the Royal LePage National House Price Composite data, here’s what to expect across Canada in 2017:

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email