This week saw the launch of the Claymore S&P US Dividend Growers (CUD), an ETF that will have great appeal for income-oriented investors. The fund tracks the S&P High Yield Dividend Aristocrats Index, made up of the 60 highest-yielding US stocks that have increased their dividends every year for at least 25 years. (The stocks are then weighted by yield, not by market cap.)

These are companies with a very impressive record of paying their shareholders. By comparison, the S&P/TSX Canadian Dividend Aristocrats Index requires only five consecutive years of rising dividends. Of course, a fund of Canadian companies with a 25-year record of increasing payouts would have one holding: Fortis.

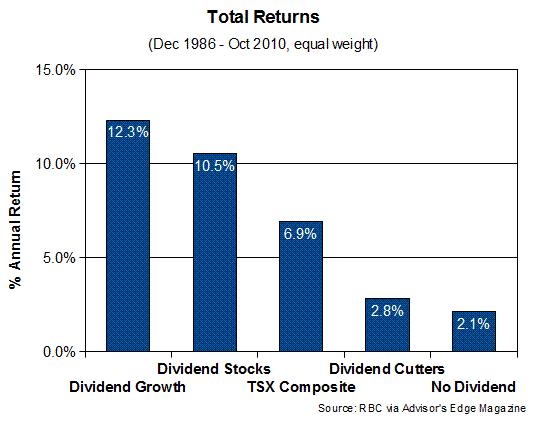

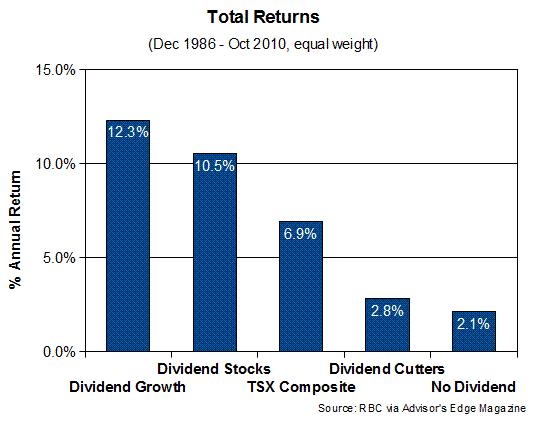

In my series of posts about dividend investing last January, I expressed some skepticism about the devotion to dividend growth strategies. It’s not that there’s anything wrong with the companies that have paid reliable dividends, of course. It’s just that some investors seem to take it for granted that these stocks will deliver above-market returns. They’re influenced by graphs like this:

The problem with this graph is that it’s entirely backward looking. If you knew in December 1986 which companies would be dividend growers over the next 24 years and which would cut their payouts, you would indeed have crushed the market. But of course, you couldn’t know that. You can only identify dividend growers after many years of increasing payouts. (This survivorship bias is brilliantly explained in this article on Seeking Alpha.)

Of course, by that time much of the advantage will be gone, because the company’s reputation will be priced into the stock. For what it’s worth, over the last five years, the Aristocrats index has performed almost identically to that of the broad US market (about 3.5% annualized), which should not be surprising if you believe that markets are at all efficient.

There’s value in low volatility

That said, mature businesses with a history of rising dividends are often less volatile. Indeed, have a look at the new PowerShares S&P 500 Low Volatility Portfolio (SPLV), which includes the 100 companies in the S&P 500 with the most moderate price swings over the previous 12 months. You’ll find many names that are also in CUD: stable, blue-chips like Exxon Mobil, Procter & Gamble, McDonald’s, Consolidated Edison, Johnson & Johnson, Kimberly-Clark, PepsiCo, Wal-Mart. It’s hard to go too far wrong with a lineup like that.

The new Claymore ETF isn’t wholly new in the marketplace: the SPDR S&P Dividend ETF (SDY) tracks the same index and has been around since 2005. The differences are that CUD trades in Canadian dollars and uses currency hedging. The Claymore ETF’s management fee is 0.60%, which should make its total MER about 0.68% when you include the taxes. That’s about double SDY’s expense ratio of 0.35%.

If you’d like to chew over the CUD, you can download the fact card here. Claymore has also produced a document outlining dividend growth strategies.