Everything an investor needs in a single ETF

Vanguard launches gamechanging balanced single-ETF portfolios with low fees

Advertisement

Vanguard launches gamechanging balanced single-ETF portfolios with low fees

Vanguard Investments Canada Inc. has announced the listing of three new low-cost Asset Allocation ETFs that give investors one-stop shopping to the firm’s globally diversified strategies. This is a significant move that not only creates a smart, low-fee, all-in-one portfolio but will also act as a challenge to the rise of so-called robo advisors.

In essence, the middle (Balanced) of the three Asset Allocation ETFs is the equivalent of the global balanced fund, which I’ve argued in the past should — in theory anyway — be the only investment fund you need. Similarly, while Vanguard’s ETFs are invariably components of the robo-adviser services out there (along with BlackRock iShares), any of these three new ETFs could serve as a one-size-fits all alternative to them. It also compares with Franklin Templeton’s Quotential.

The difference is that at 22 basis points and change, the three Vanguard products are quite a bit less costly: less than half what many robo services charge, which is typically about 50 basis points (half a per cent) plus the underlying ETF fees.

Both investors and advisors are asking for “simple yet sophisticated single-ticket investment solutions that provide well-diversified global equity and bond exposure within a low-cost ETF structure,” says Atul Tiwari, managing director for Vanguard Canada. The new ETFs offer investors three different risk profiles and regular rebalancing.

In effect, each ETF is a fund of funds although Vanguard describes them as having an “ETF of ETFs structure.” Each holds seven existing core Vanguard index ETFs (which I list in the postscript below). Each new ETF of ETFs has a management Fee of 0.22%. Vanguard says that when one of its ETFs invests in underlying Vanguard funds, “there shall be no duplication of management fees.” Spokesman Matthew Gierasimczuk said “There are no duplicate fees beyond the 0.22 management fee, other than a basis point or two for operating expense and the trading fee for buying or selling the ETF.”

RELATED: How to declutter your portfolio

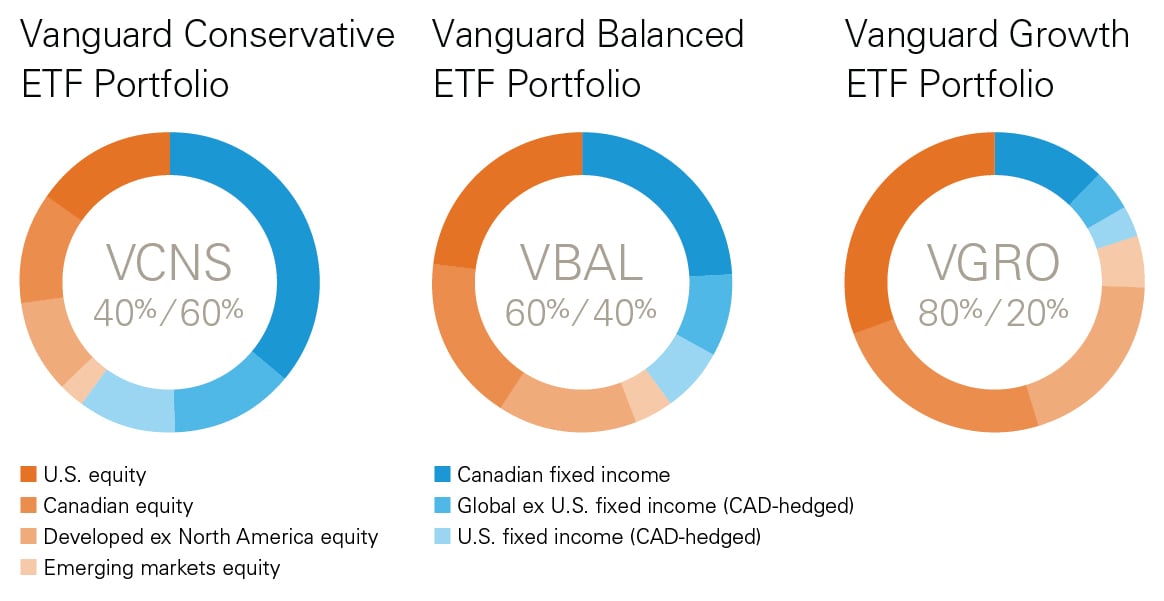

The three asset allocation ETFs cover the normal range from Conservative to Balanced to Growth, as reflected in the product names. Equity weights range from 40% for the Conservative offering, to 60% for the Balanced and 80% for the Growth.

Certainly for do-it-yourself investors who no longer want to be constantly watching the markets and the disparate movements of individual stocks, any of these three new ETFs could be a good substitute and means for getting your life back. Younger people should pick the Growth version with 80% stocks, cautious mid-career people could favour the balanced 60/40% stocks version and older investors and retirees could choose the conservative version with only 40% stocks.

Since it’s arguable even retirees need that high a proportion of stocks to hedge against the possible future ravages of inflation, it too makes sense, although 40% stocks may be a tad high for older retirees. Alternatively, they could put half in the Conservative ETF and another half in ladders of two-year GICs, taking the combined equities down to a very conservative 20%.

It’s not clear to me whether fee-based advisors will flock to these products, although here too it would free them up to do true financial planning, deal with taxes, estate planning and other minutiae. The really good ones might well gravitate to it; the asset gatherers not so much.

I also see this as a core holding in Tax-free Savings Accounts (TFSAs), since the $5,500 current annual contribution limit constitutes a relatively small “ticket” and these give you all the world and all asset classes in a single punch of the ticket. The Growth version (VGRO) certainly has healthy exposure to both Canadian and global securities, both stocks and bonds.

According to the fact sheet, it is 30.1% in the Vanguard U.S. Total Market Index ETF, 24% the Vanguard FTSE Canada All Cap Index ETF, 20% in the Vanguard FTSE Developed All Cap ex North America Index ETF, and 5.9% in the Vanguard FTSE Emerging Markets All Cap Index ETF. That’s exposure to the whole world’s stocks. The 20% fixed income comes from 11.7% in the Vanguard Canadian Aggregate Bond Index ETF, 4.7% in the Vanguard Global ex-US Aggregate Bond Index EFF (CAD Hedged), and 3.6% in the Vanguard U.S. Aggregate Bond Index ETF (CAD Hedged). All rebalanced regularly!

Because TFSAs can still be added to into advanced old age — my 101-year old friend Meta still contributes to hers! — I’d lean to going with the Growth or Balanced versions, and view the Conservative one as more appropriate for RRSPs and RRIFs, particularly the latter once forced annual minimum withdrawals commence (and therefore need to generate cash).

Finally, for couples where one spouse is the “finance” person and the other disinterested, this kind of product seems ideal for older do-it-yourself investors who are beginning to worry that dementia and related ills might impair their cognitive skills for investing.

In the case of a financially literate wife and a financially uninterested husband, if the wife were concerned about her dying first and wishing to put the collective portfolio on autopilot, the Balanced or Conservative version might also do the trick, short of just handing the whole lot over to a professional money manager.

Here are the 3 ETFs and their ticker symbols on the TSX:

In a press release, Vanguard Canada head of product Tim Huver said the ETFs offer “a simplified and scalable solution for financial advisors, and a one-stop globally-diversified and transparent option for investors … Investors can rely on Vanguard’s global investment experts to continuously assess their portfolio’s exposure and rebalance it back to its intended risk level.”

With the three new ETFs, Vanguard Canada now offers 36 ETFs, with C$14 billion in assets under management. Vanguard Investments Canada Inc. is a wholly owned indirect subsidiary of The Vanguard Group, Inc.

Jonathan Chevreau is founder of the Financial Independence Hub and co-author of Victory Lap Retirement. He can be reached at [email protected].

MORE ABOUT ETFS:

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email