Making sense of the markets this week: April 19, 2021

What David Bowie and bitcoin have in common; investing in fine wine isn't just for the ultra-wealthy any longer; moaty stocks are on sale; and more.

Advertisement

What David Bowie and bitcoin have in common; investing in fine wine isn't just for the ultra-wealthy any longer; moaty stocks are on sale; and more.

“The entire $2T crypto asset class rests on scarcity cred. Bitcoin’s attractiveness as a store of value is a function of its scarcity cred, as it has a built-in limit of 21 million coins. Compare that to the USD: Almost 30% of the U.S. money supply has been created since 2020.”

Yikes, that U.S. money supply number is scary. That is some scary non-scarcity. And, of course, not everyone gets this new digital creation and this new type of scarcity. From that same post…“Unencumbered by regulation, reticence to destroy legacy assets, or boomer brains that just don’t ‘get it,’ crypto is a $2-trillion disruptive force. I can validate that anybody over 50 has trouble understanding this stuff, and am fairly certain that the number of candles on the CEO’s office party birthday cake is inversely correlated to their understanding of crypto.”

I am over 50, but surprisingly managed to write a go-to post for investors on crypto—“Should you invest in cryptocurrency?” And I continue to receive some wonderful feedback from that post. Most importantly, the post helped readers “get it.” I’ll admit that I don’t yet “get” the other crypto stuff. In fact, I’m starting to feel like an old guy who only invests in bitcoin, and not Ethereum, Dogecoin or Polkadot. How times have changed. Galloway adds…“Crypto is firing on the walls of the world’s financial citadels. Naturally, the generation of leaders behind those walls is not inclined to acknowledge the Wildlings outside. But scoffing at novel technology, be it a mangonel, black powder, or blockchain, rarely ends well for the legacy asset holders. Bigger castles are already being erected on the hill just above the naysayers…in this case, in mere years vs. generations. It’s likely that on the day of its imminent public listing, Coinbase will be more valuable than Goldman Sachs.”

And sure enough crypto exchange Coinbase went public this week and is assigned a value of more than $85 billion. But it fell short of Goldman Sachs. Things have value because enough people desire that “thing.” It can be purely subjective at times. And who is to say when and where folks are wrong in the things that they desire? And the same can go for digital art. Non-fungible tokens, or NFTs, are all the rage these days. They might be digital, and that throws many for a loop; but they are also scarce. For each NFT, there will only be one or limited quantities available. “By contrast, non-fungible tokens, (NFTs) reflect a digital-native approach to credible scarcity.” I will take a pass on those NFTs, but again who am I to say? In the new crop of entities that are scarce, I will stick to bitcoin. That has the scarcity cred I’m looking for.“‘A lot has changed over the past two years in the markets,’ said Mr. Tiwari, chief executive officer of Cult Wines Canada. ‘It has not been a broad market rally and we are concerned about the concentration seen in a few stocks. We believe it is the right time for investors, active and passive, to diversify out of broad indexes that are not providing sector diversification’.”

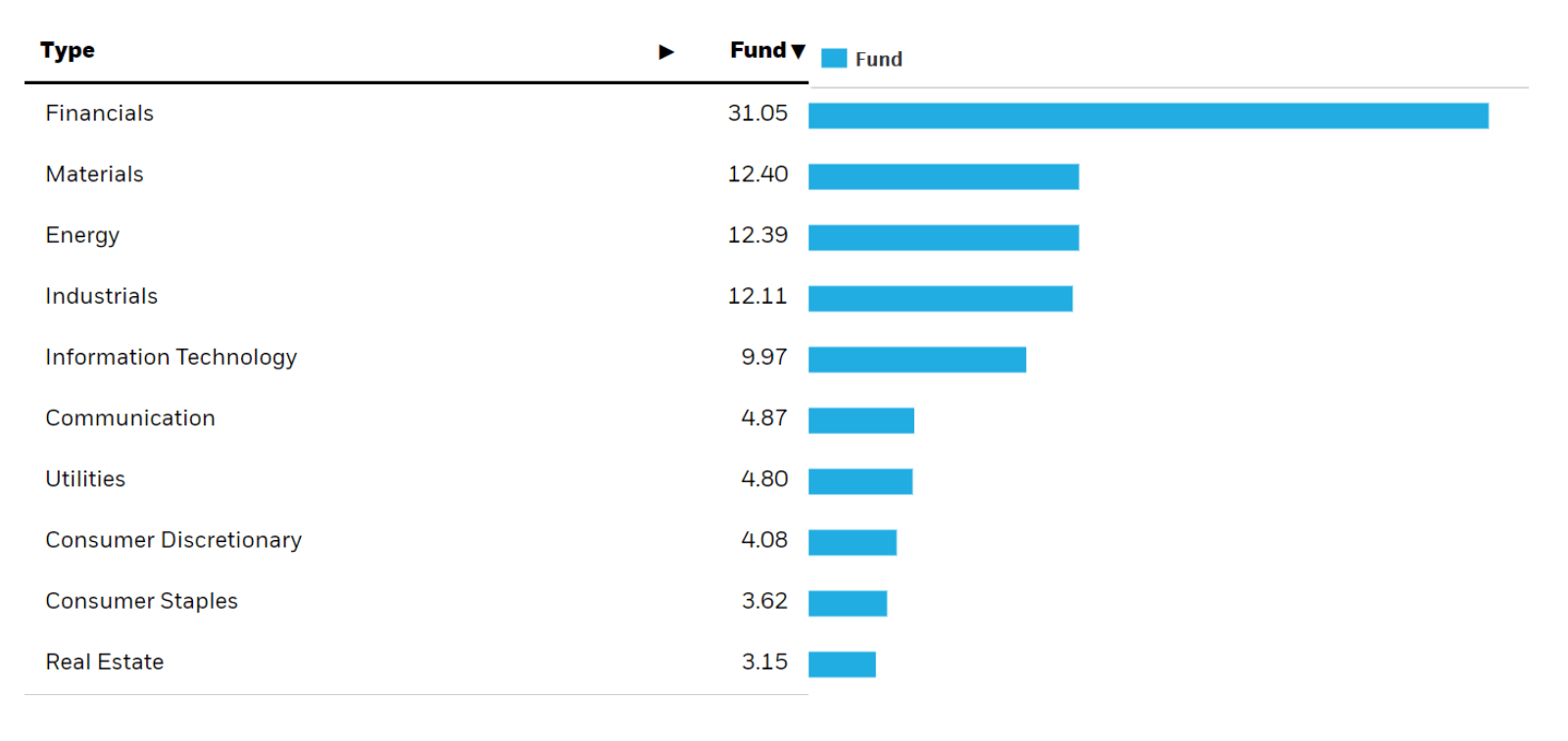

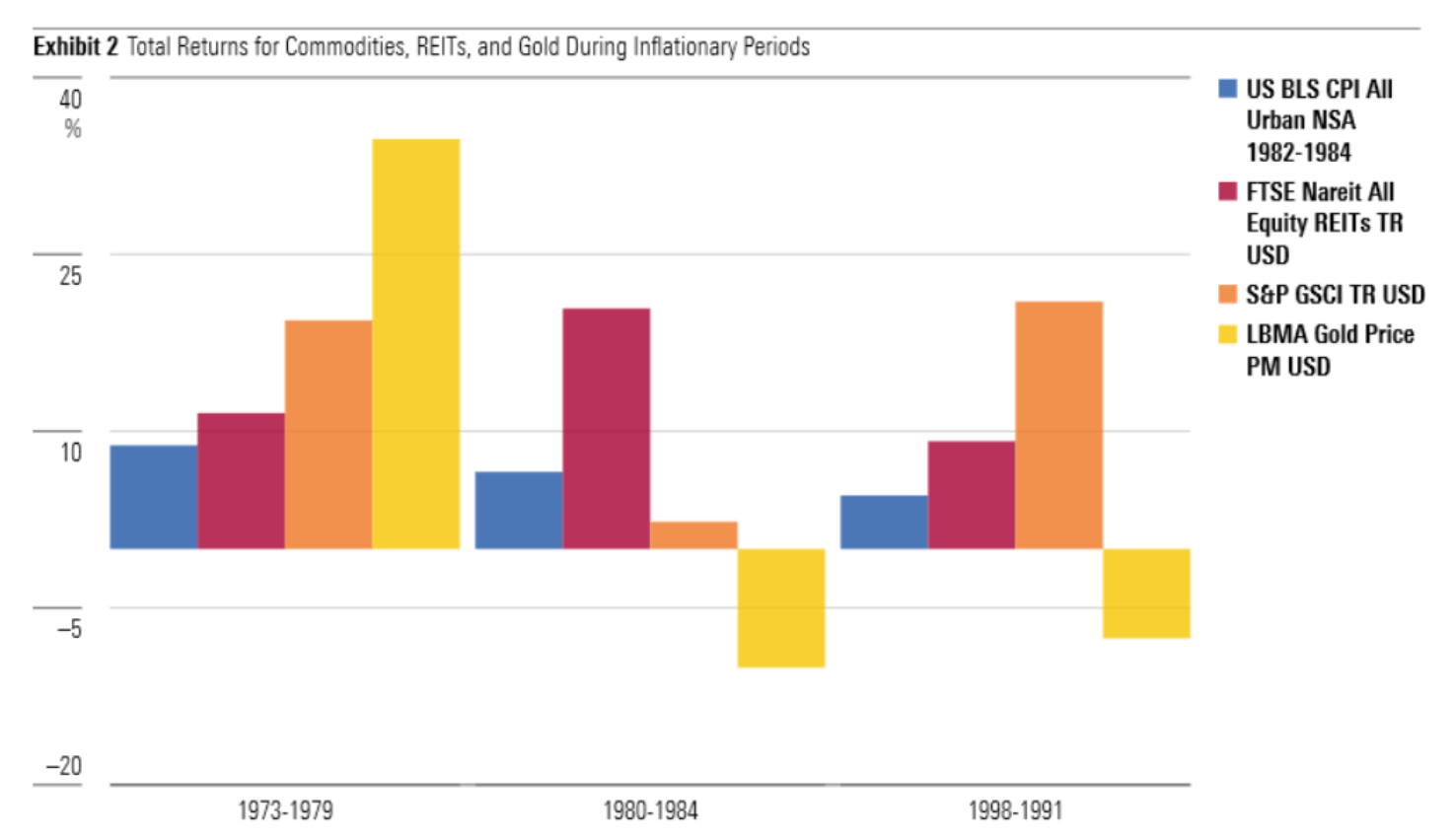

Tiwari believes that diversification can be found in bottles of wine. I would certainly raise a toast to that notion. Diversification can come in many different shapes and forms. It can even be a liquid, and available in red and white and rosé. Real assets and scarce assets can be very valuable portfolio assets. Those scarce assets can also be commodities, as we’ve discussed many times in this space. You can read more, and find links to Cult Wines here. You might consider investing like the rich.For energy producers, the potential for free cash flow at $55 to $60 was and is hiding in plain sight. But fund managers are afraid to go out on their own and bet against the index. “I think it’s because the EV narrative is so strong, sucking capital away from oil and gas,” Pelletier told me via e-mail. “Initially it was an oversupply problem with U.S. shale and now it’s a capital problem as institutional money moves towards the clean-tech narrative. This leaves the sector stranded and, as a result, you will see a supply response (curtailment) paired with an overestimation of the demand response from the transition to EVs. As a result, the market will be out of balance. This is why [there is] a large disconnect between the commodity and the stocks. Much cheaper to own a barrel of oil through a company than [to own] the commodity directly.” I’ve scoured many of the top Canadian mutual funds, and the active managers pricing the market, and they are not taking advantage of this (potential) opportunity. If they were buying, they would be moving the energy weighting of the Canadian market. Here are the sector weightings for the TSX Composite, on the XIC ETF page. Energy is only just above 12%, and that energy weighting is mostly due to pipelines and utilities, not Canadian energy producers.Look at just how bearish oil stock investors are compared to their underlying commodity – oil.

— Martin Pelletier (@MPelletierCIO) April 13, 2021

5 years:

Oil +50%

Oil Stocks -40% pic.twitter.com/yLesrxDgyk

A few industry types have suggested to me that it is the ESG (environmental social governance) effect. Mutual funds and ETFs are rated for ESG, and energy producers are not going to help the “E” ratings, to say the least. Perhaps the leading energy expert in Canada is Eric Nuttall of Ninepoint Partners. I asked Nuttall for his opinion on why fund managers did not add to their energy weightings. Here’s his input via an email exchange…Canadian E&P Perspectives

— Burnsco (@garquake) April 15, 2021

First Quarter Intermediates Preview$psk.to $vet.to $wcp.to $aav.to $bte.to $ath.to $tve.to $tou.to $kel.to $cr.to $tpz.to $erf.to $fru.to $nva.to $cpg.to $bir.to $pey.to $srx.to $cj.to $pipe.to $lxe.to #oott pic.twitter.com/X6H9ozTSS4

“The explosive energy rally earlier in the year combined with recent volatility has kept much of the sidelined generalist money away from the energy space despite hugely compelling valuations. At the current oil price, the average company I model could buy back all of their outstanding shares and pay off all of their debt within about seven years with free cash flow (operating cash flow less required capital expenditures to maintain production levels). With Q1 results just around the corner and ‘modelled’ free cash flow about to become reality, I’m hopeful that ‘return of capital’ messaging will re-gnite interest in the sector and bring back the generalists resulting in a sector re-rating. Given severely depressed valuations, I see meaningful upside without relying on oil rallying any further (even though we see $100+WTI in the years ahead).”

And, once again, that cash-flow potential is nothing short of incredible. The energy reality is that as we move through any sensible green shift, oil and gas will continue to play a needed role. Those energy needs might be even more exaggerated over the short term as the economy fires up. I hold the energy producer ETF XEG along with those pipelines. I am also looking to initiate a position in Nuttall’s energy fund. As I’ve suggested for quite some time, if you want some meaningful exposure to oil and gas producers (there’s not much in the index funds), you will have to shade in an energy fund or a few of the individual stocks. As an investor, I am happy to go with the flow as I also hope for a ramped-up shift to green energy solutions.

“While positive wealth-management flows, market gains and the acquisition of additional wealth management operations have led to a dramatic increase in assets under advisement, fee pressures continue to drag on the firm’s top-line growth, with the net result being a positive 2.8% CAGR for revenue during 2021-2025….”

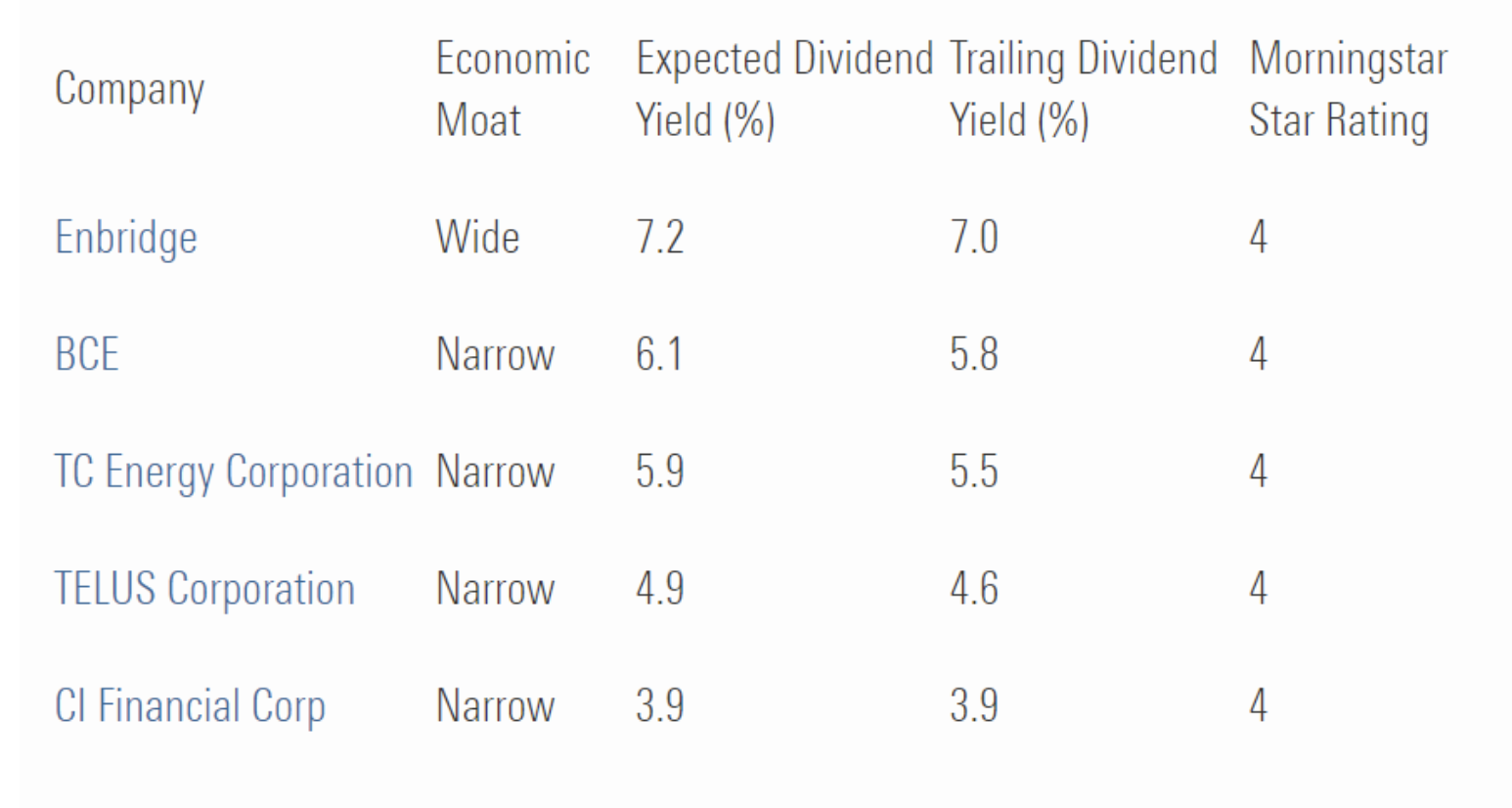

Wealth management companies face the tough task of navigating the structural shift, as investors embrace low-fee ETF options over higher fee mutual fund offerings. It’s my observation that these guys and gals at CI get that reality and are positioning for the future and those trends. Ironically, on my site I recently offered that the CI Wisdom Tree Quality Canadian Dividend ETF might be the fund that best captures the Canadian wide moat spectrum. That fund coves the moats and tops it up with many of the most successful and durable Canadian businesses. So, of course I like that article and suggestion. I am human. And as humans we often seek confirmation that we are “right.” It is perhaps one of our greatest faults, or traps, as investors and humans. It is a challenge to proofread our own work. I invite you to challenge your own biases. Treat it as if it was your neighbour’s portfolio and you wanted to show them how smart you are; what holes would you find? Back to those moat-y stocks: They are on sale and they do offer some very juicy dividends. I am torn between adding to my Canadian moat stocks, and fixing some of my concentrated stock portfolio “problem.”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email