[Note: This post was an April Fool’s joke!]

The volatility we’ve experienced in the last five years has challenged every investor. Yes, diversification can help, but many of the leading minds in finance have been looking for ways to improve on the now discredited Modern Portfolio Theory. I recently met with a quantitative analyst who believes he’s made a breakthrough.

The analyst did not want me to reveal his identity, so I’ll call him Sheldon. His model is based on a concept he calls “quantitative arbitrage,” or QA. The basic idea is combining long and short positions in a portfolio to dampen market volatility. “You remember Newton’s laws of motion from high school physics,” Sheldon says. “The third law says that for every force applied, there is an equal and opposite force. QA is essentially the same idea, but with much more advanced equations.”

At first, I didn’t believe it either. After all, long and short positions should cancel each other out and produce a return of zero. Indeed, after expenses the returns should be negative. But Sheldon has compensated for that by using leverage. “I’ve designed an algorithm that determines the right balance between a leveraged long position and its inverse corollary,” he says. “Now instead of the two positions cancelling each other out, there is a positive return, regardless of whether the markets move up or down. It’s simple when you understand stochastic variables.”

I asked Sheldon if he could apply the QA algorithm to the Global Couch Potato, and here’s what he came up with:

The Canadian and international equity components use double-leveraged ETFs, and Sheldon found the sweet spot to be a 7.49% leveraged long position, paired with a 12.51% inverse position, for a total of 20%. The US holdings use a triple-leveraged ETF, which therefore requires only a 5.12% allocation offset by a 14.88% inverse holding, also adding up to 20%.

To construct the 40% fixed income side, things got more challenging. With no leveraged bond fund available, Sheldon had to balance the iShares DEX Universe Bond Index Fund (XBB) with the Claymore Inverse 10 Yr Government Bond ETF (CIB). In this case, the incremental alpha comes from the fact that XBB’s holdings have an average maturity of 9.5 years, whereas CIB is pegged to the 10-year bond. “It’s not perfect,” he said, “but you have to make do with what you have available. I’m like the MacGyver of portfolio construction.”

The results

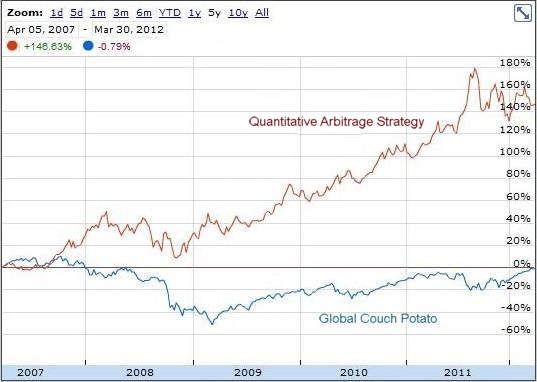

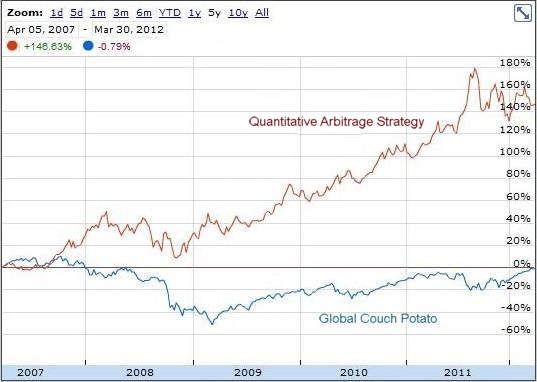

When Sheldon compared the backtested performance of the QA portfolio with the regular Global Couch Potato over the last five years, and the results were remarkable. The QA portfolio (red line) produced a total return of 146.63%, or 19.79% annualized, with minimal volatility. The Global Couch Potato, meanwhile, was slightly negative over this period:

A note of caution

As exciting as these results appear, I caution investors to consider the following before deciding whether the QA strategy is right for you:

- This is a sophisticated strategy that requires a profound inability to understand mathematics. Make sure you have a sufficient level of innumeracy before you try it.

- Like all arbitrate strategies, this opportunity may disappear if too many investors use it. If you decide to adopt the QA strategy, don’t tell anyone else.

- No investing strategy comes without risk of catastrophic loss. You should only use this strategy with money that you will never need—preferably other people’s money.

- Leveraged and inverse ETFs pay no yield, so the strategy may not be appropriate for dividend investors.

- Start and end dates can have a dramatic effect on performance. This strategy is only effective on April 1.