Debt demystified: How to calculate your debt

Created By

Credit Canada

Many Canadians carry credit card, loan or mortgage debt. Here’s how to calculate how much debt you have, plus strategies for paying it down.

Advertisement

Created By

Credit Canada

Many Canadians carry credit card, loan or mortgage debt. Here’s how to calculate how much debt you have, plus strategies for paying it down.

If you are struggling with mounting debt as the cost of living rises in Canada, you are not the only one. It may be student loans, a line of credit, a mortgage or balances owing on credit cards, but few people these days are completely debt-free. The average Canadian owes $21,183 in consumer debt (excluding mortgages), according to a December 2022 report from Equifax.

In under 60 seconds, get matched with a personalized list of loan providers based on your needs and approval likelihood. No SIN required.

If you’re carrying multiple debts, you might be unsure which to tackle first, or what is the best way to repay it. First, we’ll show you how to calculate the amount of personal debt you have, and then we’ll look at proven strategies for paying it down.

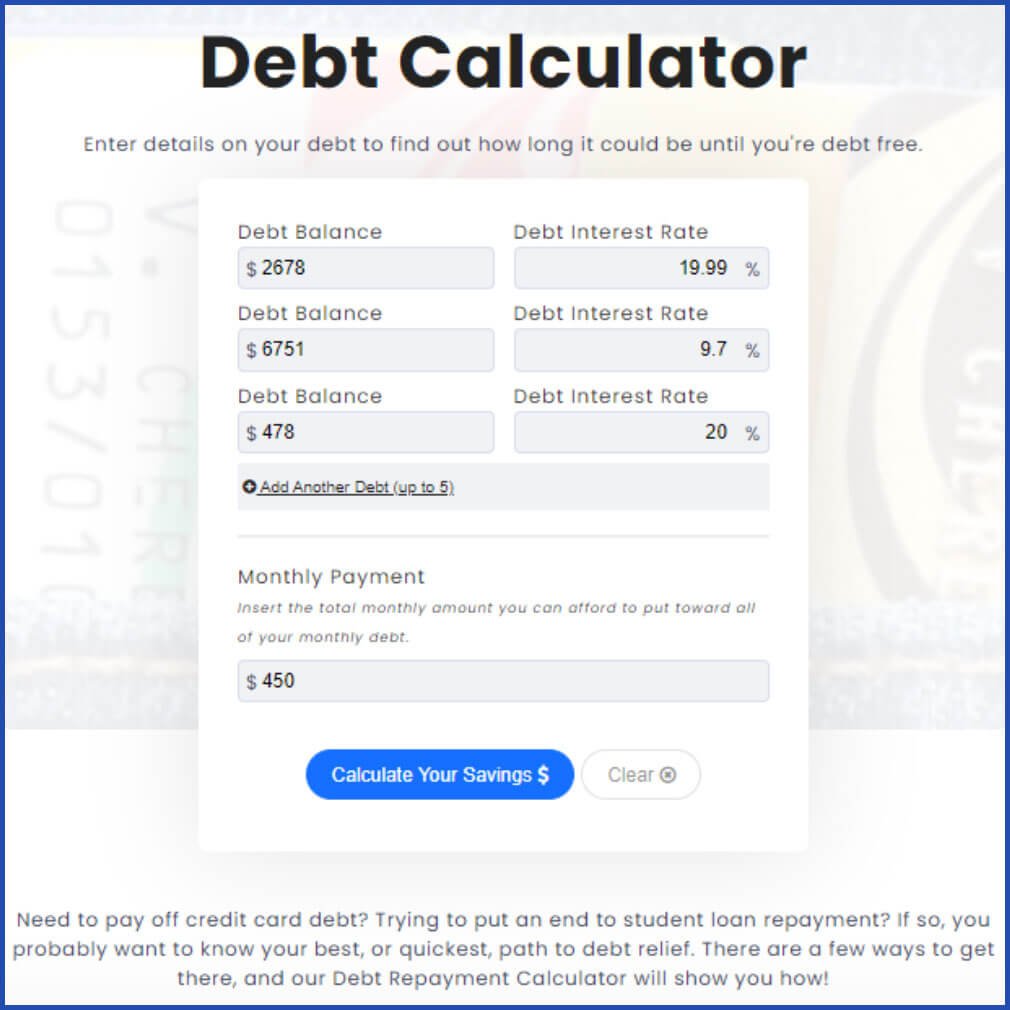

When it comes to paying off debt, most people want to know their best or quickest route to getting it done. There are a few ways to get there, and using an online debt calculator can help you decide what to do.

Here’s how it works: For each bill, enter the balance (the amount you owe) and the interest rate you’re paying (if you use Credit Canada’s debt calculator, you can enter up to five debts at once). Enter how much you can afford to put towards your debt each month. The calculator then estimates how long it will take you to become debt-free.

Using the calculator can also help you budget as you put together a repayment plan. It shows you how increasing or decreasing your monthly payment will affect your financial goals.

A debt calculator can only provide an estimate based on current information; it does not take into account any fees you may have with certain repayment methods, such as debt consolidation.

Apply for a personal loan with a 8.99% to 29.49% APR. Plus, 100% online application and no early repayment fees.

Apply for a personal loan with a 9.99% to 35.00% APR. Plus, fast e-transfers and no hit to your credit score when you apply.

Apply for a personal loan with a 19.90% to 34.90% APR. Plus, fast funding (as soon as the same business day). Not available in Quebec, PEI, Manitoba, Newfoundland and Labrador, Northwest Territories, Nunavut and Yukon.

Instead of making irregular payments towards various debts, consider one of these three strategies:

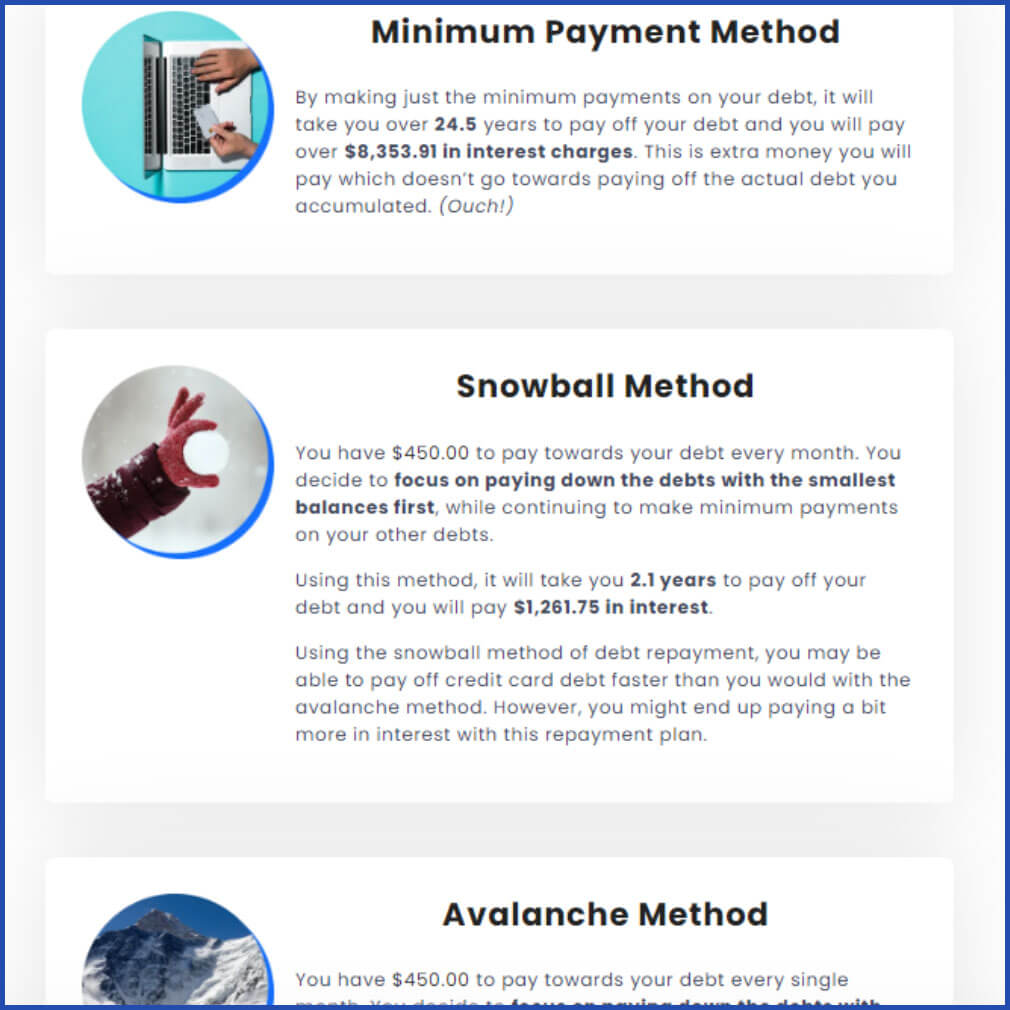

The avalanche method involves making the minimum payments on all your debts, then putting any remaining funds towards the debt with the highest interest rate. When it’s paid off, you tackle the debt with the next highest interest rate, and so on. This method could save you the most money over time, if your highest-interest debt is sizeable.

Paying off the smallest debt first, then working your way up to the larger ones, is known as the snowball method. It can help build motivation as entire debts are eliminated. However, this approach can end up being more expensive overall, as you are prioritizing low balances over high interest rates.

If you are having difficulty repaying multiple loans and credit card balances, consolidating the debts may be a solution. Debt consolidation combines two or more debts into a single monthly payment. The debt consolidation options available to you are based on several factors, including:

Debt consolidation might hurt your credit score initially, but it could also be the first step towards rebuilding your credit history over time.

No matter your debt situation, you can always reach out to a non-profit credit counselling agency like Credit Canada for free advice on a debt solution plan customized to your needs.

Credit Canada is a non-profit credit counselling agency that has been helping Canadians get out of debt and back into life for over 50 years. Our counselling is confidential, non-judgmental and 100% free.

This is not advertising nor an advertorial. This is an unpaid article that contains useful and relevant information. It was written by a content partner based on its expertise and edited by MoneySense.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email