Making sense of the markets this week: September 3, 2023

Takeaways from the Fed Chair’s speech at Jackson Hole, looking at the value of Canadian banks, AI stocks soar, and seasonal impacts on markets.

Advertisement

Takeaways from the Fed Chair’s speech at Jackson Hole, looking at the value of Canadian banks, AI stocks soar, and seasonal impacts on markets.

Allan Small, Senior Investment Advisor at the Allan Small Financial Group with iA Private Wealth, shares financial headlines and offers context for Canadian investors.

Investors and pundits alike were on pins and needles when U.S. Federal Reserve Chair Jerome Powell returned to Jackson Hole, Wyoming, for the economic summit to make his annual address last week.

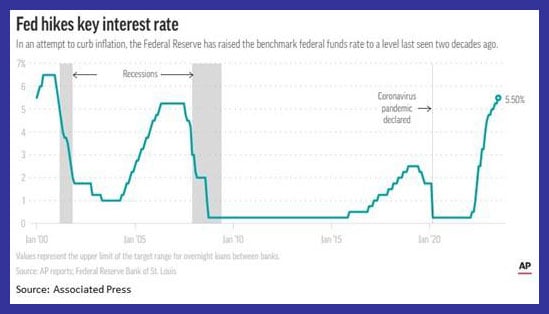

In the days leading up to the main event, Friday August 25, 2023, the markets were just as skittish with stocks selling and Treasury yields rising. The big question: Would Powell declare victory over rising inflation and stop raising interest rates? Or, would he stay the course and hike rates again?

In the end, even though inflation was much lower than last year, he remained hawkish and steadfast in his mission to bring the inflation rate down to 2%.

Here’s what Powell said:

“It is the Fed’s job to bring inflation down to our 2% goal, and we will do so. We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further, if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

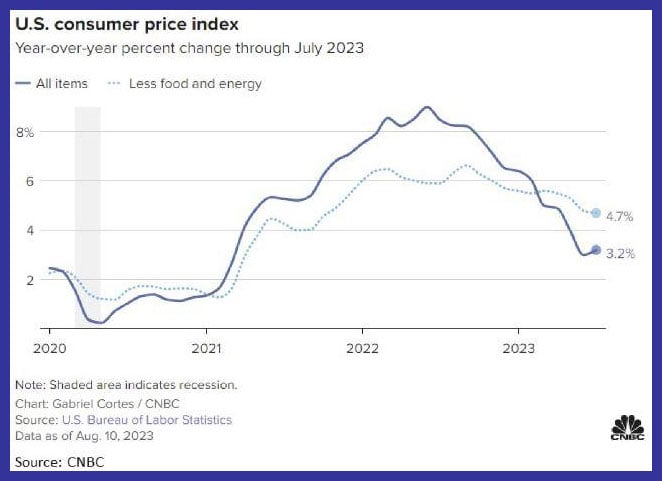

That said, Powell and the U.S. Federal Reserve’s board of governors have proof now that what they’ve been doing is working. And, that was relayed at Jackson Hole, too. From June 2022 to July 2023, the consumer price index (CPI) dropped from 9% to 3.3% in the U.S. So, even though the board remains committed to fighting inflation and potentially raising interest rates—at least one more time—Powell’s speech also imparted a sense of confidence to the markets.

The result: U.S. stocks have ticked up on news that the Fed is staying the course. On August 25, the day of the meeting, the Dow rose 125 points (0.4%), the S&P 500 gained 0.2%, and the Nasdaq Composite added 0.1%

At the same time, even though the job market is softening, the fact the U.S. unemployment rate is just 3.6% is unbelievable, given interest rates have risen essentially from 0% to 5% in the span of 18 months. This is good news. When you have full employment, it’s hard to have a recession. Still, everything is OK… until it’s not. The risk of recession increases with each central bank interest rate increase. The market has struggled at times because of that fear.

Did the Chair’s comments allay those fears? Or did they provide clarity for investors? No. There’s still uncertainty, which is why the market wavers some days, but there wasn’t anything in his speech that was unexpected. The U.S. Fed will continue to affect markets going forward. It’s up to investors to stay on top of what Powell and the Fed governors are saying and what the markets are doing.

It’s been a busy couple of weeks for Canadian investors, as the Canadian big banks continue to roll out their latest earnings reports. This week BMO, Scotiabank and CIBC shared their respective third-quarter results:

Overall, Canadian bank earnings are coming in as expected—soft. This is understandable given the impact of inflation in Canada, the Bank of Canada’s increased interest rates and a slowing economy here, too. Credit and loan availability is under pressure as banks set aside more money to protect against bad debt.

At the same time, to stay competitive, Canadian banks are paying out much more interest on the money they take in and hold through high-interest savings accounts and guaranteed investment certificates (GICs). If they don’t offer higher interest rates, investors will move to Treasury bills or other types of investments. As a result, the spread between what Canadian banks charge for loans and the money they pay to attract deposits is narrowing.

Another challenge of this high interest environment? Businesses aren’t borrowing to expand as much as they did prior to the pandemic. This drop in earnings is creating a fear especially among small, regional banks in the U.S. that their ratings will be downgraded. While this is not the case for Canadian banks, it does not change the fact that banks are a direct reflection of the economy. When the Canadian economy does well, Canadian banks do well. When the economy slows, this is what you get.

Even though earnings aren’t what they have been projected, Canadian banks are still a good investment. They look to be cheap and pay fantastic dividend yields: Scotiabank pays 6.57%, CIBC pays 6.29%, BMO pays 5.15%, TD pays 4.62% and Royal Bank pays 4.41% dividends (at the time of writing).

Canadian investors who buy bank stocks tend to buy them for the dividends and for growth. But, on the growth side, they may have to be more patient. Bank stocks can grow, and their share prices often appreciate, but it may have to be a long-term investment. In my world, “long term” means 12 to 18 months. So, it may be worth having the mindset that they could go higher once there is more certainty about how high interest rates will go.

It’s finally happened. Decades in the making, the promise of artificial intelligence (AI) to change how we live and work is finally turning into real-world applications. And it’s all thanks to generative AI and the 2022 release of OpenAI’s ChatGPT, which stands for Chat Generative Pre-trained Transformer. ChatGPT is a language-based model chatbot that can answer all sorts of questions, create a multitude of content, explain complex topics, solve math problems and more. It’s like Google but way more interactive. (Read: Can you trust AI with financial advice?)

On the business front, articles and white papers are touting this powerful AI and how it’s going to improve productivity, enhance efficiency and drive revenues. Now, AI is only as good as the data used in its programming, and many people are worried about its accuracy and the ethical implications of its use. Another big concern is that AI will replace humans as workers. It’s early days and hard to say how its uses will all play out. But, one thing is certain: There’s no going back. AI opens the door to massive opportunities and it will change how we do many things in our lives. It’s already happening.

Any company that has implemented AI has seen its stock price appreciate. Computer chip maker Nvidia (NVDA/Nasdaq) emerged as the leading AI chip maker and it’s reaping the rewards of the AI boom with soaring earnings and share prices. It’s not alone. Google and Microsoft are also experiencing turbocharged earnings thanks to the use of AI in their products.

Are the stocks of these expensive companies worth considering buying? Yes, and I’ll tell you why. Technology is one of the few industries in significant growth mode, and it’s growing because of AI. If you are OK with medium risk and volatility, it could be worth paying a premium to add growth stocks to your portfolio, if that aligns with your risk and goals.

Hedge fund exposure to mega-cap technology stocks just crossed 30% for the first time in history.

— The Kobeissi Letter (@KobeissiLetter) August 30, 2023

There has never been more hedge fund exposure to large technology stocks.

Institutional money really believes that AI is the next big thing.

Will AI live up to the hype? pic.twitter.com/6FwDbImy8T

Many investors are looking for companies that were already worth owning before they started using AI. For example, Google was solid to own before it incorporated AI into its search algorithms. Same with Microsoft and Nvidia. Right now, I have my eye on Amazon, Google and AMD, which has announced it’s developing an AI chip that is less expensive than Nvidia’s. Oracle is another company within this category. (Read: The “Magnificent Seven” stocks dominating)

Historically, September and August have proven to be the worst and second worst performing months, respectively, for the markets. We’re not talking doom-and-gloom, double-digit downturns, but returns are either negative or breakeven. So, not great.

Why’s that?

In addition to what’s happening with the economy and monetary policy, seasonality can also move stock prices up and down. July tends to be strong, setting us up for a weaker August, when people take some profits off the table. Trade volumes are also typically down by half in August as people enjoy the last few weeks of summer. Fewer active traders in the market can cause prices to fall. Conversely, more traders in the market can lead to higher prices.

In Canada, the markets start to rebound and pick back up in mid-October and end with a strong November and December. I think if we can get through the next six weeks stable, flat or slightly up or down, that would be a win as we head into what is hopefully and traditionally a good time of year for investors.

January brings its own energy: the January effect. As go the first two weeks of January, so goes the rest of the month, and so goes the rest of the year. January sets the tone for the next 12 months. More often than not, when the markets are positive in January—which has been the case about 75% of the time—the rest of the year is positive. This year in particular January was fantastic for the markets. The Nasdaq was up 10.7% (its best January performance since 2001), the S&P 500 gained 6.3%, the Dow added 2.9% and the Russell 2000 rose 9.7%. This bodes well for November and December.

Of course, the fact that we are used to seeing certain trends happen at specific times in the year can lead us to expect them to happen again and then that expectation becomes self-fulfilling.

That’s because that was around the time when the Federal Reserve will be announcing what will hopefully be the last interest rate increase of the year. To me, if central banks haven’t gone too far already, we’ll see rising rates. While seasonality is something Canadian investors should be aware of, I also think it’s important to remember it does not always apply,so it should not be a key factor in your investment strategy. I tell my clients, stay the course. Invest in good-quality investments with strong fundamentals. If and when there is a pullback in the markets, use it as an opportunity to buy more of the same.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email