Making sense of the markets this week: October 15, 2023

Walking Dead-like inflation, Pepsi’s sugar high, Exxon’s bid for Pioneer, and utilities suffer from more competitive bonds.

Advertisement

Walking Dead-like inflation, Pepsi’s sugar high, Exxon’s bid for Pioneer, and utilities suffer from more competitive bonds.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

Clearly, the biggest world news is the conflict in Israel and Gaza. This week we are holding off discussing the effects on the markets as it is too difficult to comment as there is just so much pain and human loss to sort through.

With Halloween (and horror flick) season upon us, economists are staring at a scary sight indeed: Inflation is refusing to die, no matter what is thrown at it.

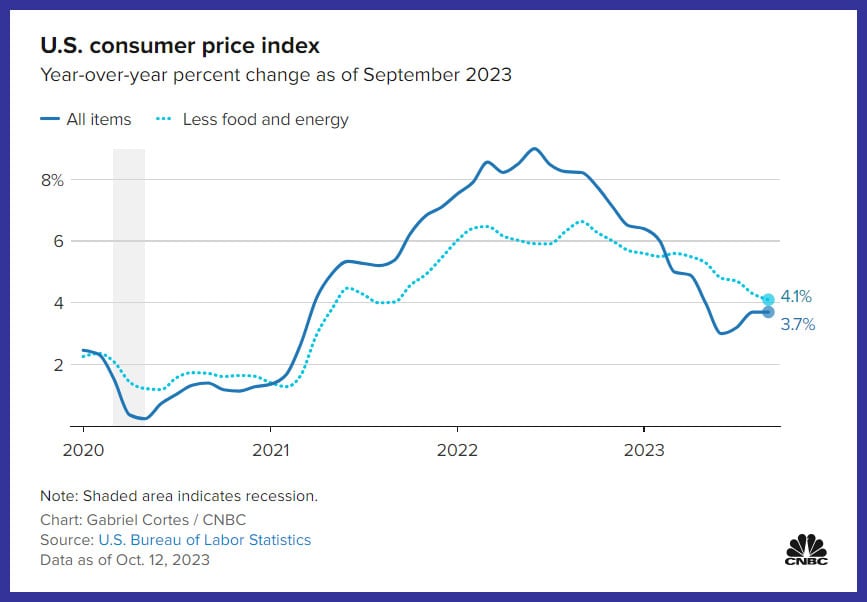

The U.S. Labour Department released the Consumer Price Index (CPI) report on Thursday, and the headline was that overall inflation was up 3.7% and core inflation was up 4.1%. Those numbers were slightly higher than expected.

Here’s a few takeaways:

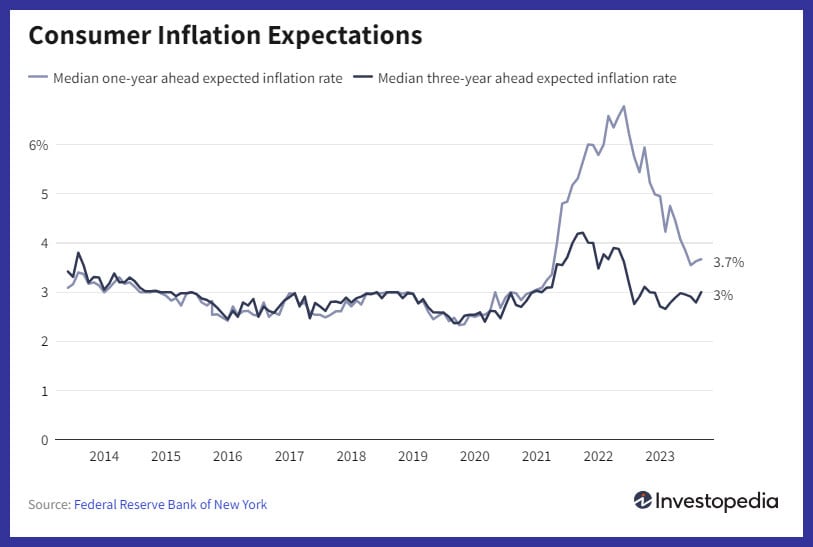

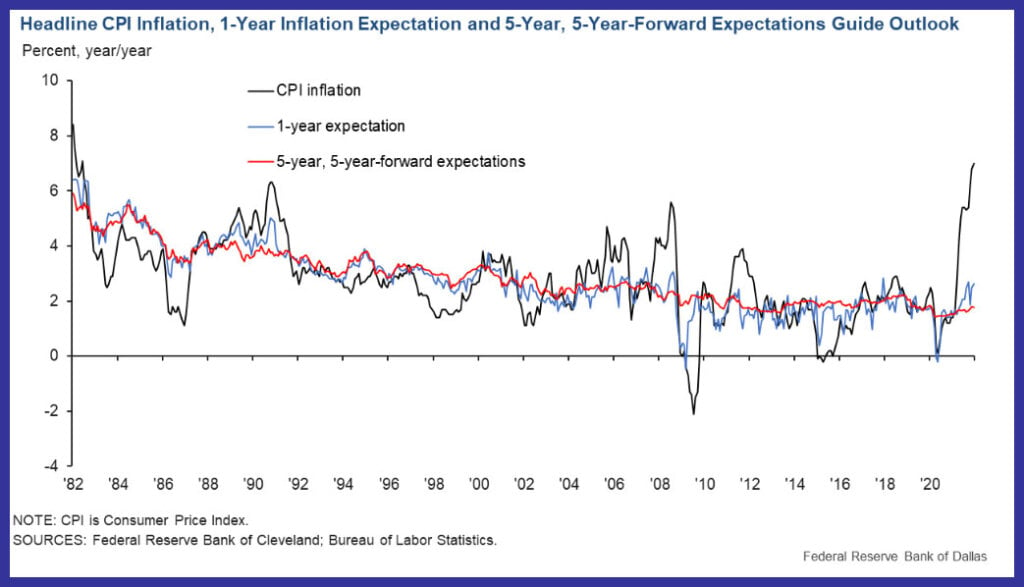

We think the good news in regard to inflation is that our medium- and long-term expectations are still pretty firmly anchored, as revealed by the U.S. Federal Reserve Bank of New York’s consumer expectation survey on Tuesday.

Consumer expectations (referred to as “inflation vibes” by columnists flexing how trendy they are) often get lost in the month-to-month report of inflation percentages, but it may be the most important indicator we have. It’s not that the average person really understands where inflation is trending, or is able to make accurate predictions. Instead, what the consumer expectations survey tells us is how people feel about the future, and whether they are likely to demand higher wages, collectively normalize the idea of quickly increasing costs, and so on.

This month’s survey shows that Americans expect inflation to be at 3% in three years, and that it would be down to 2.8% in five years. That’s higher than economists would like, but it in no way resembles the runaway inflation expectations of the past.

As long as Americans believe inflation will come down, and they have faith in the power of the U.S. Federal Reserve to execute its mission, then the vibes should continue to trend in the right direction.

Pepsi (PEP/NASDAQ) released an interesting earnings report on Tuesday. (All numbers in this section are in U.S. currency.) The raw numbers: earnings per share came in at $2.25 (versus $2.15 predicted), and revenue was $23.45 billion (versus $23.39 predicted). Shares were up nearly 2% on Tuesday after earnings were announced.

Behind those numbers, the inflation-related picture told a more nuanced story.

The amount of volume that Pepsi sold fell again this quarter. Pepsi has been hiking prices fairly aggressively the last couple of years and clearly it has been using the “shrinkflation” playbook to sell “less-for-more.” For example, Pepsi’s North American beverages unit reported a volume decline of 6%, but that was mostly mitigated by higher prices. It appears consumers are finally starting to push back a bit on purchasing ever-smaller amounts of product for higher prices. And Pepsi may have reached the end of how high it can raise profit margins for this cycle.

In brighter news for the company, Gatorade revenue was up by more than 10%. In the absolute brightest news possible, the company will be relaunching Mountain Dew Baja Blast.

Those holding their breath in anticipation of being without their Baja Blast fix can now breathe again.

Despite making some unpopular changes to its lounge access and frequent flyer loyalty program, Delta Air Lines Inc. (DAL/NYSE) was happy to present a positive earnings report on Thursday. Earnings per share came in at $2.03 (versus $1.95 predicted) and revenues were $14.55 billion (versus $14.56 predicted).

The markets reaction was slightly negative, as shares were down 2.3% after Thursday’s announcement.

Delta’s profit was up 60% in the third quarter on the strength of an increase in international travel revenue. Total capacity edged up 1% to 88%, even though the airline had focused on adding additional capacity both domestically and internationally. It appears that the end to “revenge travel” hasn’t quite reached its destination.

Who needs all of those newfangled renewable energy assets?

Exxon Mobil (XOM/NYSE) made the news on Wednesday when it offered to purchase U.S. shale oil giant Pioneer Natural Resources for nearly USD$60 billion. The potential acquisition represents a doubling down by Exxon on the Permian Basin’s low-cost shale oil resources. Shareholders weren’t in love with the move, given Exxon shares fell 2.5% upon announcement.

That being said, the deal has been in the works for a while, so it was priced-in to a large degree.

It’s a bit of a sad day for the “oil will die a natural death sooner rather than later” camp (and many would argue for the “I don’t want the world to burn” camp, as well). Exxon is sitting on a record USD$56 billion in profits from last year. And it will now be using a lot of that money to ensure pumping “black gold” from the ground stays very profitable for the long term. Essentially, CEO Darren Woods is reaping the benefits of not shifting the company to a greener future, and doubling down on traditional fossil fuel production.

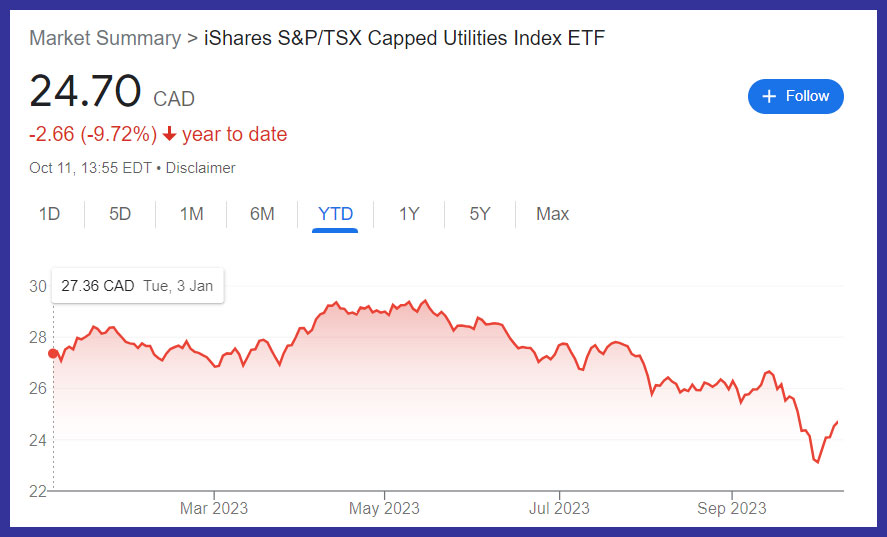

It’s been a rough year to be a utility stock investor in Canada, as you can see by looking at the iShares S&P/TSX Capped Utilities Index ETF (XUT/TSX) below.

The recent underperformance of Canadian utility stocks is likely due to two main factors.

While those two reasons make a lot sense intuitively, we would encourage Canadian investors to think about the pros/cons of any assets, including trading in utility stocks for fixed-income investments like GICs or bond ETFs for the following reasons:

You can read more about Canadian Utility Stocks on MillionDollarJourney.com. Of course utility stocks and GICs aren’t mutually exclusive and a diversified portfolio can include many types of assets.

In case you missed it, we released the 2023 speaker lineup for the Canadian Financial Summit this past week, including sessions with familiar faces from MoneySense (see below). Registering for the Summit is completely free, and you can click here for more details.

With so many ETF options available, it can be hard for investors to know what to put into their portfolios. MoneySense’s executive editor, Lisa Hannam, hosts as journalist Michael McCullough looks at the makeup of the ETF market. He will share, based on MoneySense’s ETF All-Stars Report, the ETF products Canadians could consider buying today.

The first-home savings account is brand spanking new, and Canadians have questions. In the similar format of MoneySense’s popular Ask A Planner column, executive editor Lisa Hannam will ask Certified Financial Planner Allan Norman real questions from Canadians about the FHSA, from what it is to where to open this account.

MoneySense executive editor Lisa Hannam and columnist Kyle Prevost work together on the popular column Making Sense of the Markets. It contextualizes headlines for Canadian investors, so together the duo will be looking at the headlines from the year and those to come, including interest rates, crypto (remember that asset?), employment, AI, GICs and so much more.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email