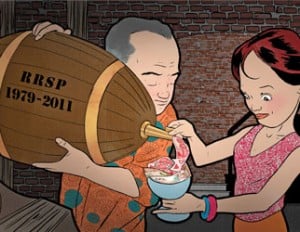

Above the RRSP limit

What do can you do if you put too much into your RRSP? Bruce Sellery runs through the options.

Advertisement

What do can you do if you put too much into your RRSP? Bruce Sellery runs through the options.

Question

I know the majority of Canadians under-contribute to their RRSP, but I have the opposite problem. Miscalculations at the time of retirement resulted in an $800 over-contribution, above the $2,000 allowed, that could not be used due to a lack of “qualified earned income.” I have now been retired for 12 years and just received notice from Revenue Canada that this “over-contribution” may be taxed away. Are you aware of any method to de-register this amount without incurring excessive penalties? All my current income is derived from CPP, OAS pensions and investments. Returning to work to earn qualified income is not an option. I would appreciate any advice you have to help me resolve this matter.

Answer

Sometimes virtue, taken to its extreme, can have unintended consequences. You demonstrated great temperance over the years, maxing out the allowable limit on your RRSP. But as far as the CRA regulations are concerned, you went just a little too far and now they are planning to penalize you.

Luckily your issue is easily rectified. Withdraw that $800 from your RRSP or RRIF, says Dean Paley, a CGA in practice in Burlington, Ont. You will pay tax on it because it will be considered income, but you’ll avoid incurring the penalty of 1% per month, or $96 a year.

As you know, an RRSP allows Canadians to contribute and deduct up to their annual limit. Paley explains that, “the CRA allows everyone to be over their contribution limit by $2,000 at any given time without incurring costly penalties.” After that you may have to start to pay. I say “may” because there is some grey area. Check out the CRA website for more information.

There are benefits to using that additional $2,000 room, points out Paley. “You can over-contribute to an RRSP, and while you don’t get the deduction, the money can grow tax free until withdrawn.”

The key point here is to watch your contribution limit and stay within it. You’ll find it on the Notice of Assessment you receive every year a few months after you file your tax return. As smug as you might feel about being one of the few who has been able to use up their allowable RRSP limit, you really don’t want to have to pay the penalty tax.

Question

I know the majority of Canadians under-contribute to their RRSP, but I have the opposite problem. Miscalculations at the time of retirement resulted in an $800 over-contribution, above the $2,000 allowed, that could not be used due to a lack of “qualified earned income.” I have now been retired for 12 years and just received notice from Revenue Canada that this “over-contribution” may be taxed away. Are you aware of any method to de-register this amount without incurring excessive penalties? All my current income is derived from CPP, OAS pensions and investments. Returning to work to earn qualified income is not an option. I would appreciate any advice you have to help me resolve this matter.

Answer

Sometimes virtue, taken to its extreme, can have unintended consequences. You demonstrated great temperance over the years, maxing out the allowable limit on your RRSP. But as far as the CRA regulations are concerned, you went just a little too far and now they are planning to penalize you.

Luckily your issue is easily rectified. Withdraw that $800 from your RRSP or RRIF, says Dean Paley, a CGA in practice in Burlington, Ont. You will pay tax on it because it will be considered income, but you’ll avoid incurring the penalty of 1% per month, or $96 a year.

As you know, an RRSP allows Canadians to contribute and deduct up to their annual limit. Paley explains that, “the CRA allows everyone to be over their contribution limit by $2,000 at any given time without incurring costly penalties.” After that you may have to start to pay. I say “may” because there is some grey area. Check out the CRA website for more information.

There are benefits to using that additional $2,000 room, points out Paley. “You can over-contribute to an RRSP, and while you don’t get the deduction, the money can grow tax free until withdrawn.”

The key point here is to watch your contribution limit and stay within it. You’ll find it on the Notice of Assessment you receive every year a few months after you file your tax return. As smug as you might feel about being one of the few who has been able to use up their allowable RRSP limit, you really don’t want to have to pay the penalty tax.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email