Making sense of the markets this week: January 14, 2024

What asset classes did best last year? Short sellers lose their shirts, Canadian housing market refuses to go down, and the loonie had a solid 2023.

Advertisement

What asset classes did best last year? Short sellers lose their shirts, Canadian housing market refuses to go down, and the loonie had a solid 2023.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

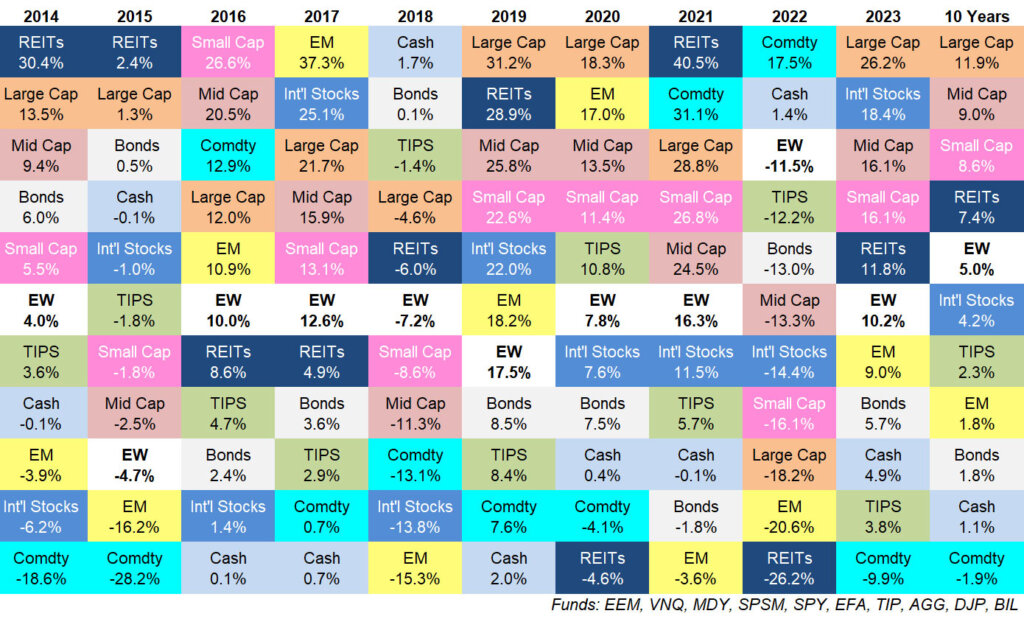

As we enter the New Year and investing columnists write their prediction columns, it’s also a worthwhile exercise to take a look back at the history of just how varied returns have been across various asset classes. The chart below comes from Wealth of Common Sense blogger Ben Carlson. It shows the equities available on the major U.S. stock exchanges.

Here’s the Canadian total market data below for comparison. Slide the columns right or left using your fingers or trackpad, or hover your mouse over the table to reveal a scroll bar below.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 10-year | |

| CAD total market | 10.55% | -8.32% | 21.08% | 9.10% | -8.89% | 22.88% | 5.60% | 25.09% | -5.84% | 11.75% | 7.62% |

My main takeaways from Carlson’s data:

I couldn’t track down the total return of Canadian stocks over the past 15 years, but the S&P/TSX Composite Index has increased by more than $2.75 trillion since 1998, when SPG Global started keeping track. That’s a total return of nearly 600%! (Exclamation point warranted.)

So, despite some bad years, for every $1 you invested in the broad Canadian stock market as far back back in 1998, you’d have $6 today. Sure, inflation would have eaten up some of that gain, but that’s still a great run.

Any time we look at these types of charts, we know that people who forecast based on trends of the preceding year are rarely correct. Returns over one-year timeframes are mostly “a random walk.” That said, equities (large-cap, small-cap, U.S. or Canadian) come out on top more often than not.

Speaking of asset classes, bitcoin exchange-traded funds (ETFs) started trading Thursday, after the U.S. Securities & Exchange Commission approved 11 ETFs tied to the spot price of bitcoin. I’ll have more to say about this next week.

Much of the world was introduced to short selling via the movie The Big Short, based on the book by Michael Lewis of the same name (WW Norton, 2011). When you “short” a stock, you’re essentially placing a bet that the stock’s price will go down within a given period of time. The more it goes down, the more money you make. If it goes up though, the losses can pile up quickly.

Data provider S3 Partners Research, recently revealed that short sellers lost about USD$195 billion last year by betting against U.S. and Canadian stocks.

While some profits were made amid the chaos of the brief banking crash last spring, billions of dollars were lost when shorts against Tesla, Nvidia, Apple, Meta Platforms, Microsoft and Amazon failed to pay off.

As the options trading market has grown considerably over the last few years, we hope Canadian investors take notice of the massive losses by the folks who are paid to do this for a living (like hedge funds and professional traders). Remember, the people trading options for big firms are recruited from the best schools in the world, given massive informational and technology advantages, and then paid huge bonuses if they can come out ahead of the rest of the pack. Yet, they still lost—big.

If you read that and still think it’s simple to make money at options trading, then we’re clearly reading from different playbooks. You can read more about my thoughts on options trading in Canada at MillionDollarJourney.ca.

Get up to 4.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.55%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

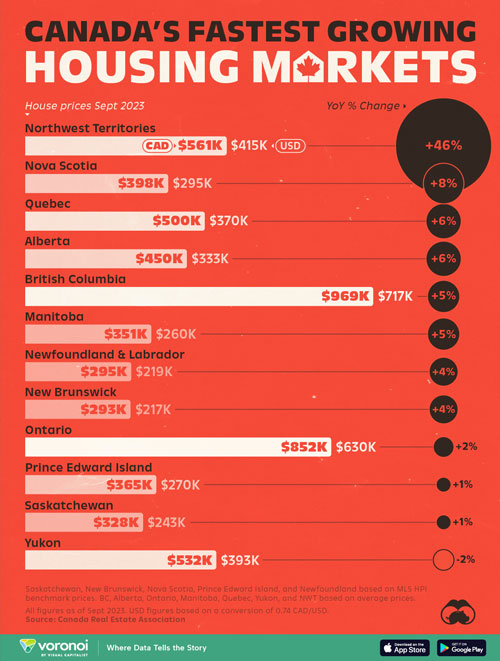

While many Canadians are used to seeing housing prices skyrocket every year without pause, 2023 saw the real estate market in most cities take a bit of a breather.

A note when reading this graphic:

Who would’ve guessed the Northwest Territories would have seen such massive price growth, despite massive interest-rate increases? That’s due to the entire housing market in northern Canada consisting of such a small number of houses and, consequently, supply and demand factors can move prices quite quickly. In this case, it appears a lack of new construction, plus a significant number of homes being destroyed in the awful forest fires were all enough to massively drive up demand in the small cities and towns that populate the Northwest Territories.

It’s also interesting to note that many Canadians were able to reach deep into their pockets and purchase houses at inflated prices, even in a year when so many headlines were about a lack of housing affordability. It appears the real estate doomsdayers will continue to wait for their time in the sun, as even with mortgage rates doubling, we still haven’t seen the massive collapse that was predicted.

We do feel for those young Canadians trying desperately to get on the first rung of the housing ladder. Especially in Nova Scotia, where increased internal migration has resulted in rapid rising real estate prices, despite not having the number of high-wage earners of cities like Toronto.

There appears to be no end in sight to increasing prices. They’re mainly driven by a combination of population pressure and speculation. If interest rates go down significantly in 2024, it’s possible we’ll see a flood of pent-up buying reignite the speculation super cycle yet again.

Check out MoneySense’s annual report: Where to buy real estate in Canada.

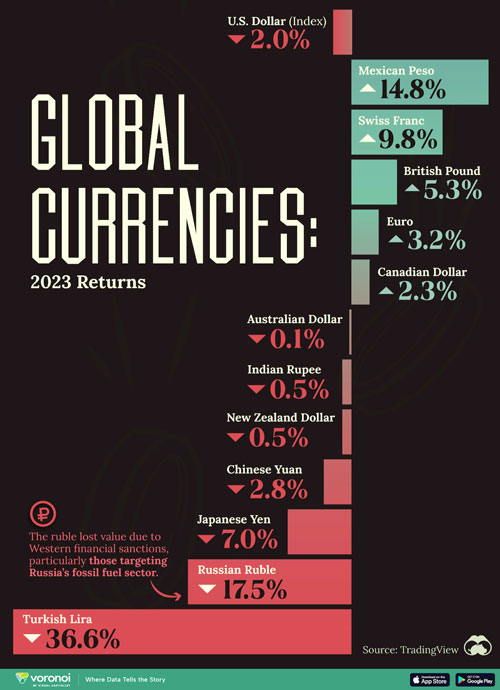

While negative currency movements tend to get a lot of press coverage, it’s important to keep it all in perspective.

Sure, the Canadian dollar could have had a better 2023, especially considering it had a rough 2022. But, it also could have been much worse.

We were a bit surprised at the slight gain for the Canadian on the U.S. dollar, given the relative weakness in the gross domestic product (GDP) data coming out of Canada versus what came from the U.S. It will be interesting to see which country decides to cut interest rates faster in 2023, and thus find its currency value lowered versus the other.

I think inflationary pressures are stronger in Canada, but the Bank of Canada (BoC) will not want to let the Canadian dollar gain too much versus the American dollar, and thereby make our exports look less attractive to the American market. (Read: Why is Canada so expensive)

Some good news for Mexico: Its economy is benefiting greatly from reshoring and corporate cost cutting, and is great at making and selling beer as well. As a consequence of all those Mexican-manufactured goods being purchased, its currency, the peso, has seen upward pressure.

Some bad news for those of us hoping to pay less for a winter vacation as we head south this year: our Canadian dollars aren’t going to stretch quite as far as they used to.

When we look at other countries’ currencies, it was a rough year for the Japanese yen, and the Canadian dollar is worth about the same amount of euros as it was in 2022. Of course, economic basket case Turkiye (formerly Turkey) continues to flounder.

What’s interesting about the situation in Turkiye is that Turkish citizens re-elected the same president and party in 2023 that got them into this mess. In Turkiye “It’s not the economy, stupid!”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email