Making sense of the markets this week: February 25, 2024

Nvidia continues to soar, Walmart and Home Depot have solid quarters, Canada’s inflation cools and more Canadian earnings are in.

Advertisement

Nvidia continues to soar, Walmart and Home Depot have solid quarters, Canada’s inflation cools and more Canadian earnings are in.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

Artificial intelligence chip maker Nvidia saw its shares surge 10% in extended trading on Wednesday after yet another massive quarterly earnings report.

All numbers in this section are in U.S. dollars.)

• Nvidia (NVDA/NASDAQ): Earnings per share came in at a scorching $5.16 (versus $4.64 predicted), while revenues totalled $22.10 billion (versus $20.62 billion predicted).

The growth story for this video-game-graphics-company-turned-AI-chip-master is unparalleled. With the latest 10% surge, Nvidia passed Amazon and Google to regain its spot as the third largest company in the world by market capitalization. It’s more than triple the size of Walmart by market capitalization despite having slightly less than one-tenth of Walmart’s revenue.

“Fundamentally, the conditions are excellent for continued growth.”

–Jensen Huan, Nvidia CEO

In its news release, Nvidia stated, “Strong demand was driven by enterprise software and consumer internet applications, and multiple industry verticals including automotive, financial services and health care.”

Many investment commentators have called the stock an AI bubble, meaning that its rapid share price growth may soon be followed by a contraction. And at a price-to-earnings (P/E) ratio of about 89x, there’s certainly room to debate if any company deserves a valuation that rich.

At the same time, the incredible earnings growth this company has seen might just justify the lofty future profit expectations.

Here are more takeaways from Nvidia’s earnings call:

Nvidia was up 14% on Thursday after earnings were announced after the close on Wednesday.

Two of the U.S.’s biggest retailers announced earnings this week.

All numbers below are in U.S. dollars.

• Walmart (WMT/NYSE): Earnings per share of $1.80 (versus $1.65 predicted). Revenue of $173.39 billion (versus $170.71 billion predicted).

• Home Depot (HD/NYSE): Earnings per share of $2.82 (versus $2.77 predicted). Revenue of $34.79 billion (versus $34.64 billion predicted).

Walmart continued to show why it deserves its best-in-class status for mass retailers. Quarterly revenue was up 6% and e-commerce sales were up a massive 23%. No doubt shareholders were excited about the 9% dividend raise the company announced.

The big news from “the big blue retailer,” a.k.a. Walmart, was that it’s buying TV manufacturer Vizio for $2.3 billion. The move makes sense given how many Vizio TVs Walmart sells. The company pointed out that the acquisition would be a major boost for its advertising business, as it could now better track customer data. Look forward to massive Black Friday Vizio sales for years to come.

“Our market is on its way back to normal demand conditions. We’re not quite there yet, but the pressures we saw in 2023 are receding.”

—Richard McPhail, Walmart CFO

Home Depot announced that its sales were down about 3% from 2022’s fourth quarter, but that was significantly less of a pullback than it had been expecting, given the current high interest rate environment.

Get up to 4.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.55%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

Sometimes you have to wonder if the analysts who predict quarterly earnings know what they’re talking about. Take Nutrien, Suncor and Loblaw, which all reported their earnings. Loblaw’s quarter was predictably boring, and the stock moved up slightly, score one for the analysts. However, Nutrien came in way below earnings expectations, yet the stock went up 7%. Suncor on the other hand had a great earnings report, but shares were down slightly on the day.

Here are the numbers released this week. Note: Nutrien is a Canadian company based in Saskatoon, but trades on the New York Stock Exchange and reports in U.S. dollars.

Analysts usually point to anticipated forward guidance being the key in instances like this. So, because the future doesn’t look great for oil prices (recessions, supply increases, etc.) and Nutrien believes potash demand will increase going forward, the stock market is looking ahead and not simply reacting to last quarter’s news.

Nutrien shareholders definitely miss the days of sanctions crippling the supply of Russian potash to the market, despite the bump on Thursday. The fourth quarter price was USD$235 per tonne, compared to USD$526 per tonne a year earlier.

In more positive news, Nutrien’s CEO Ken Seitz said, “We do see potential for firming of potash prices,” and went on to add that Red Sea logistics issues were likely to continue to add to cost pressures for the foreseeable future.

Suncor announced that it had set a new oilsands production record at 757,400 barrels per day, however, profit margins were down on lower oil prices. The oil giant also announced it would be bringing in a familiar corporate face as its next board chair, as Russ Girling (former CEO of TC Energy Corp) would be taking over fromMichael Wilson.

For more information, check out our article on investing in Suncor on MillionDollarJourney.com.

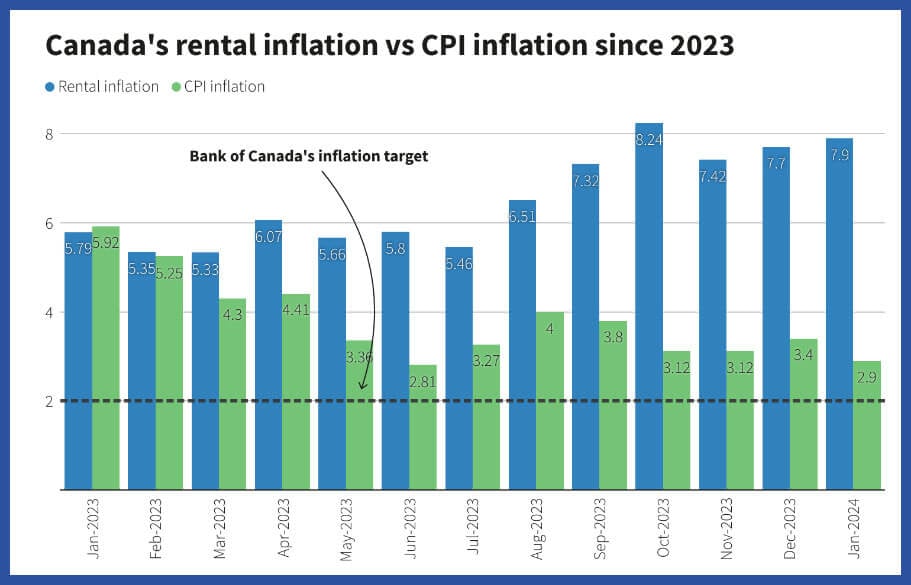

Statistics Canada released the January consumer price index (CPI) data this week, and the 2.9% inflation increase came in substantially lower than the 3.3% consensus amongst economists.

As a result of hearing about the lower-than-expected inflation rate, the five-year bond yield took a substantial dip. This is good news for anyone looking at an upcoming mortgage renewal, as those five-year bond yields are directly tied to what mortgage lenders will be charging on the five-year fixed mortgages.

Here are some takeaways from the January CPI report:

Also noteworthy, the BoC’s preferred metric of inflation, CPI-trim, is still up 3.4% – significantly higher than the 2% target. The reason the BoC prefers “CPI-trim” relative to “headline CPI” is that it’s a measurement that seeks to strip out some of the “noise” of volatile price movements, thus giving a more reliable overall trend indicator.

Also, it appears to be increasingly clear that there are two distinctly different buckets of inflation in Canada.

Bucket 1: Housing

Bucket 2: Everything else

The problem with this divergence of the price of “housing” and the price of “everything else” we buy is that the Bank of Canada (BoC) doesn’t really have tools to target a specific part of the economic measure.

BoC Governor Tiff Macklem said as much earlier in February: “Housing affordability is a significant problem in Canada, but not one that can be fixed by raising or lowering interest rates.”

Due to the chronic shortage of housing in Canada and the fact that shelter is weighed at 30% of the overall CPI basket, the BoC sits in a tough spot. It has two options:

If it chooses the first door, the increased price of new mortgages is still going to lead to increased inflation data. It also runs the risk of crashing the rest of the economy as consumer demand is destroyed for products and services, and headlines about recession dominate the news.

If it chooses the second door, it’ll watch housing prices go through the roof. Then it runs the risk of losing credibility as an inflation fighter. As a result, you could quickly see inflation expectations get baked in and be much more economically destructive over the long term.

Either way, it’s not an easy decision. Canadian politicians could make Mr. Macklem’s life easier by getting serious about increasing housing supply. Let’s just say I’m not holding my breath.

Here are the current mortgage rates:

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email