Making sense of the markets this week: April 14, 2024

U.S. inflation comes in hot, Delta says revenge travel is alive and well, doubling your CPP benefits, and AI stocks must have crushed the market, right?

Advertisement

U.S. inflation comes in hot, Delta says revenge travel is alive and well, doubling your CPP benefits, and AI stocks must have crushed the market, right?

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

We were supposed to be entering the time of the year when inflation should be trending downward and stock markets could get back to a “normal” state of slow growth or perhaps marginal pullbacks.

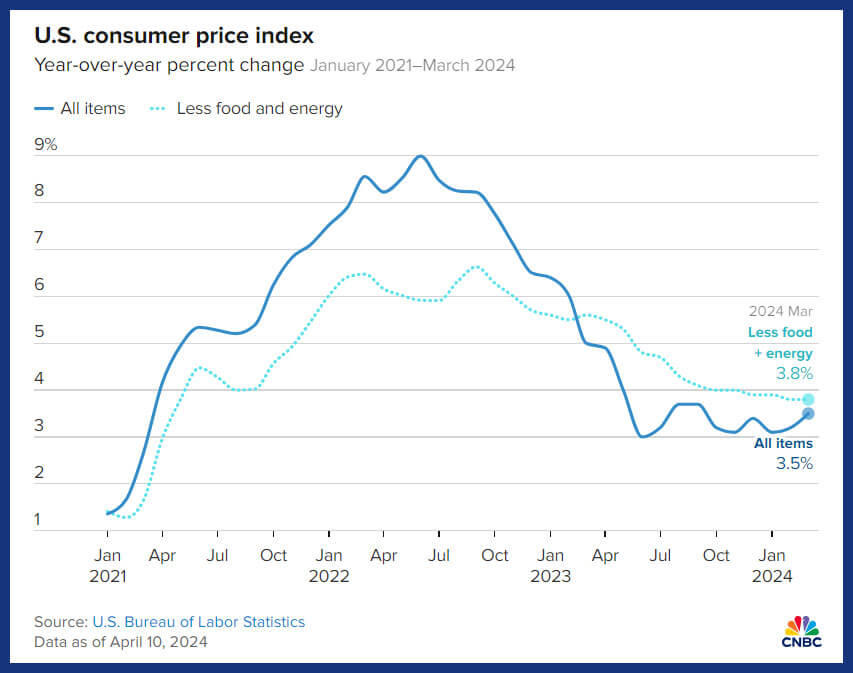

Instead, the U.S. stock market has been on a relatively fast climb, even though high inflation should have begun to drag it down. Something had to give. And on Wednesday, the stock market gave back about 1% of its gains so far this year, as the U.S. Bureau of Labor Statistics reported that the U.S. consumer price index (CPI) jumped 3.5% in March 2024. Core CPI (excluding food and energy) was even higher at 3.8%.

Shelter and gas costs were the main culprits in driving the increased CPI number, and were responsible for more than half of the 3.5% increase. New and used cars were bright spots in the report, as they had price declines, when compared to a year ago. Groceries costs were largely unchanged, but prices were up across virtually all services.

U.S. President Joe Biden said, “Today’s report shows inflation has fallen more than 60% from its peak, but we have more to do to lower costs for hardworking families. Prices are still too high for housing and groceries, even as prices for key household items like milk and eggs are lower than a year ago.”

Meanwhile, the Bank of Canada (BoC) decided—as was widely anticipated—to continue to hold interest rates at 5% on April 10. BoC governor Tiff Macklem stated that a June rate cut was “within the realm of possibilities,” but he needed to see a further decline in core inflation to be sure the recent downward inflation trend was “not just a temporary dip.”

This latest inflation reading out of the U.S. led several market commentators to speculate that summer rate hikes may be off the table for our neighbours to the south. If the U.S. Fed continues to delay rate cuts, it’s going to put pressure on the BoC not to cut rates, too, as doing so will drive the value of the Canadian dollar down, relative to the U.S. dollar.

Don’t miss my take on the best investments for inflation hedging at MillionDollarJourney.com.

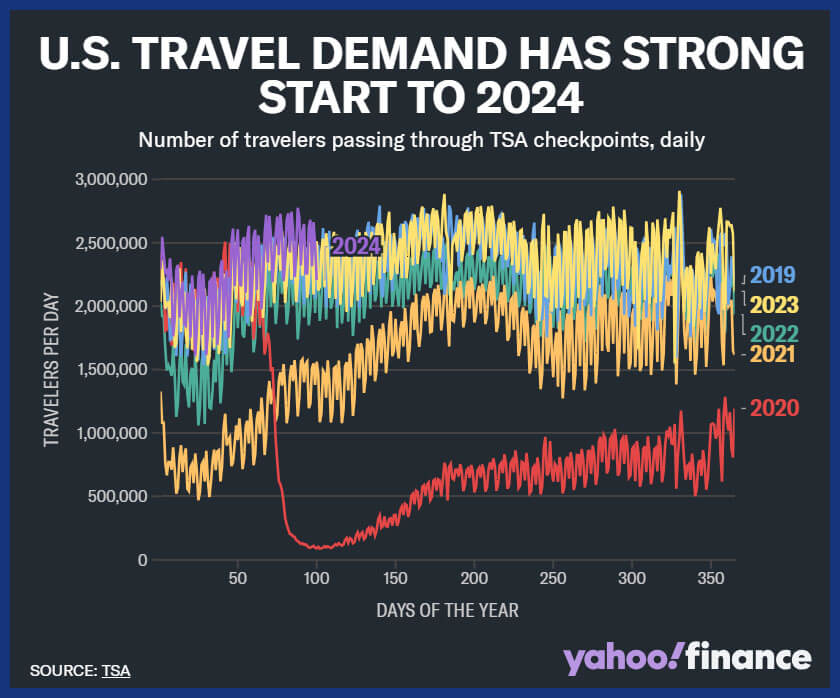

Delta CEO Ed Bastian summarized the strong demand, saying: “Consumers continue to prioritize travel as a discretionary investment in themselves. […] We’re flying even higher level of capacity this summer than last, and we expect our overall pricing levels are going to remain largely the same.”

Delta was one of the first large companies to release Q1 earnings this week, and posted a solid earnings beat.

• Delta (DAL/NYSE): Earnings per share of USD$0.45 (versus USD$0.36 predicted). Revenue of USD$12.56 billion (versus USD$12.59 billion estimated).

What else? Delta’s earnings report also highlighted the following points:

CFO Dan Janki stated, “Growth is normalizing and we are in a period of optimization, with a focus on restoring our most profitable core hubs and delivering efficiency gains.”

It’s tough to see a recession in the immediate future when the demand for travel looks like this:

While Air Canada (AC/TSX) lost money in its fourth quarter of 2023, its mid-quarter update last month revealed that it anticipated a core profit in 2024 of $4.2 billion. Air Canada will release its next earnings report on May 6, 2024.

Get up to 4.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.55%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

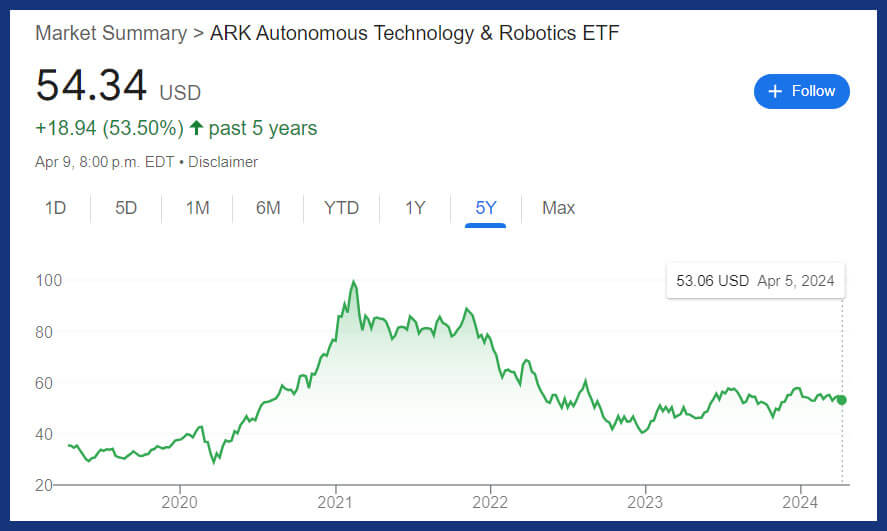

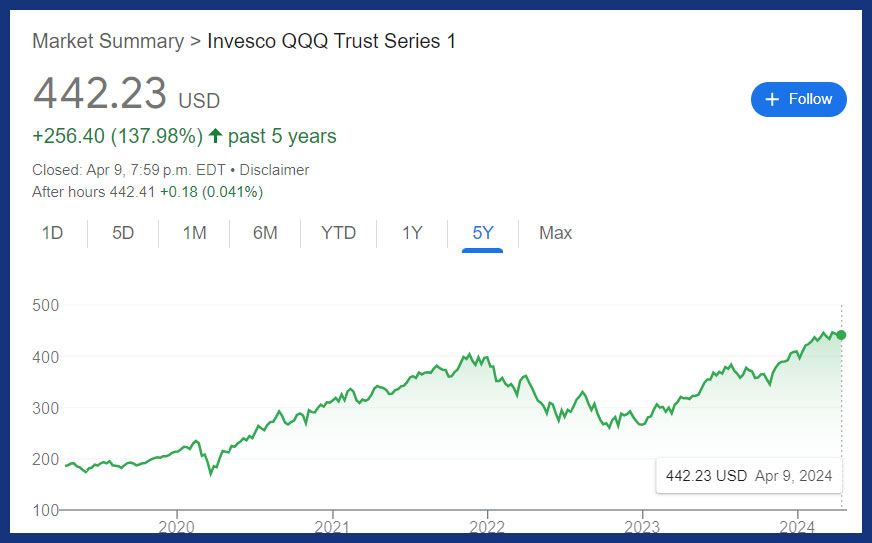

If you ever wanted proof that trying to pick stocks and beating the market are really hard to do, just take a look at the rise of artificial intelligence (AI) companies over the last five years.

Even if you rightly predicted that AI would be the wave of the future, simply tossing your money into a bunch of AI companies wouldn’t have worked out. See below for how three of the largest AI exchange-traded funds (ETFs) have fared versus those ETFs that track the basic NASDAQ 100 and S&P 500 indexes.

As you can see, the largest AI ETF (BOTZ/NASDAQ), with its current market cap of USD$2.7 billion, did not beat the basic S&P 500 index fund. Nor did the AI ETF put out by Cathie Wood’s vaunted ARK investments (ARKQ/NASDAQ). The standout of the group: AIQ/NASDAQ. It did manage to outperform the broad S&P 500 index, but was soundly beaten by the popular QQQ ETF that invests in all of the U.S.’s biggest tech companies. (Check out MoneySense’s Canada ETF screener and finder tool.)

All this to say: Even if you had an edge on the market, when it comes to understanding how important a new technology is, or where a specific trend is headed, it’s still incredibly difficult to know which companies will benefit the most. Niche assets, such as AI ETFs, always come with a relatively high management expense ratio (MER). It’s 0.68% to 0.75% for the ETFs discussed above. And that significantly lowers the chances of long-term outperformance.

If you’re betting you can ask AI to pick you some stocks instead of investing only in AI stocks, then you might want to reconsider. AI-powered stock-picking ETFs haven’t performed better at beating the market average than humans.

AI continues to be the buzzword that seemingly all CEOs need to repeat a minimum number of times during their public statements. Vague proclamations about the dominance of AI in the future is the stock prediction du jour. No one knows which companies will benefit most from AI. Chat GPT does make excellent drinking game recommendations such as, “Every time the CEO says AI, you drink!”

Who will come out ahead? The car companies using AI to create driverless taxis? Nvidia as it continues to dominate by selling the “picks and shovels” of AI’s gold rush? Or, will it be old technology stalwarts, like Microsoft, that have found ways to fund and integrate the cutting edge of AI breakthroughs?

Not every innovation increases (or will increase) profitability, and it’s impossible to know to what degree old-school companies (like Walmart, 3M or Johnson & Johnson) will be able to use AI to make their companies even more efficient and more profitable.

For my money, I’ll let all those big companies figure out what they do best—make money using whatever technologies are available to them—and I’ll continue to benefit from breakthroughs via broad index investing strategies.

MoneySense’s investing editor-at-large Jonathan Chevreau published a thought-provoking piece on his Financial Independence Hub this week. The article draws on research from the National Institute of Ageing (NIA) that shows:

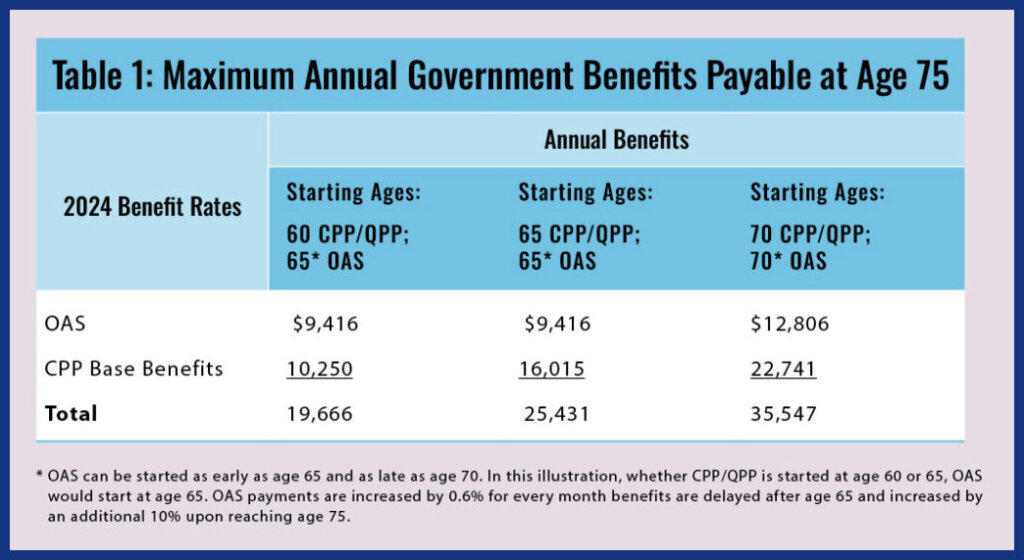

As a result of this widespread lack of knowledge about how these programs work, and despite this topic being a staple of personal finance media coverage, most Canadians take CPP long before the optimum age of 70. The NIA chart below illustrates just how much money retirees are leaving on the table by taking CPP too early at 60, or even at the traditional retirement age of 65. While you can’t take OAS until age 65, a similar pattern is apparent with OAS.

As I pointed out in my Worry-Free Retirement course, because CPP and OAS payments are indexed to inflation and essentially guaranteed for life, they can be incredibly valuable pieces to the retirement paycheque puzzle.

I’m looking forward to reading the upcoming NIA upcoming papers on the financial decisions facing Canadian retirees.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email