Couche-Tard takes aim at Slurpee King

Because I grew up in near Winnipeg, the Slurpee Capital of the World, I thought I knew everything the 7-Eleven universe had to offer. Then, I visited Japan and Thailand last year. I realized that I hadn’t seen anything yet. (All figures in U.S. dollars in this section.)

In much of Thailand and Japan (among other places in Asia), the convenience store is a daily touchstone stop. In Tokyo, there are more than 3,000 7-Eleven stores, a large part of the country’s 56,000-plus convenience store locations. While 7-Eleven was a big part of my childhood, it pales in comparison to the role it plays within many Asian communities.

So, it quickly caught my attention when Canadian corporate darling Alimentation Couche-Tard (ATD/TSX) announced it was making a friendly takeover bid for Tokyo-based Seven & I Holdings Co (SVNDY/NIKKEI). The possible deal is historic for many reasons.

- The acquisition of Seven & I Holdings Co is the largest-ever Japanese target of a foreign buyer.

- It’s the first test of new 2023 takeover rules by Japan’s Ministry of Economy, Trade and Industry (METI), designed to make foreign acquisitions more welcoming and Japanese companies more internationally competitive.

- It would likely top Enbridge’s $28 billion acquisition of Spectra Energy Corp back in 2016, to become Canada’s largest-ever corporate takeover.

- It would combine Couche-Tarde’s convenience store empire of 16,700 stores in 31 countries, with 7-Eleven’s 85,800 stores in 19 countries.

- By combining ATD’s and 7-Eleven’s U.S. market share, Couche-Tard would control more than 12% of the U.S. convenience store market, with the closest competitor being Casey’s General Stores at only 1.7%.

- It’s a massive bite to take for ATD, currently valued at about $56 billion, since 7-Eleven is currently worth about $38 billion.

- The potential acquisition is so large that many analysts believe ATD would have to raise $18 billion in new equity to complete the deal. That would be the biggest stock offering in Canada by a wide margin. It would also be in addition to the $2 billion in cash on hand ATD has, and its ability to borrow about $20 billion. There’s speculation that Canadian pension plans would be a key source of capital in order to get a deal done.

Neither company disclosed the precise terms of the deal, but Couche-Tard described the offer as “friendly, non-binding.” That’s a key differentiator from a “hostile takeover.” (A hostile takeover is when a company tries to purchase more than half of another company’s shares on the free market against the wishes of the targeted company’s management, thus taking over operational control.)

This move is not totally out of the blue for ATD, as the company has taken big acquisitional swings before. The Quebec-based operator has a long history of successfully integrating new acquisitions. Its attempt three years ago to purchase French grocery chain Carrefour for $25 billion was scuttled at the last minute by the French Finance Minister citing food security issues. Similar protectionist governmental instincts could prevent this massive deal from getting done.

That said, Couche-Tard has been circling (Circle K-ing?) 7-Eleven for over two years now. Perhaps it believes it has what it takes to navigate the new Japanese corporate legal waters and get the deal done.

While there will likely be some nervous customers of 7-Eleven (nobody wants to see change at their favourite corner store), Seven & I Holdings’ shareholders must be happy. Shares were up 22% upon announcement of the proposed acquisition.

Canada’s best dividend stocks

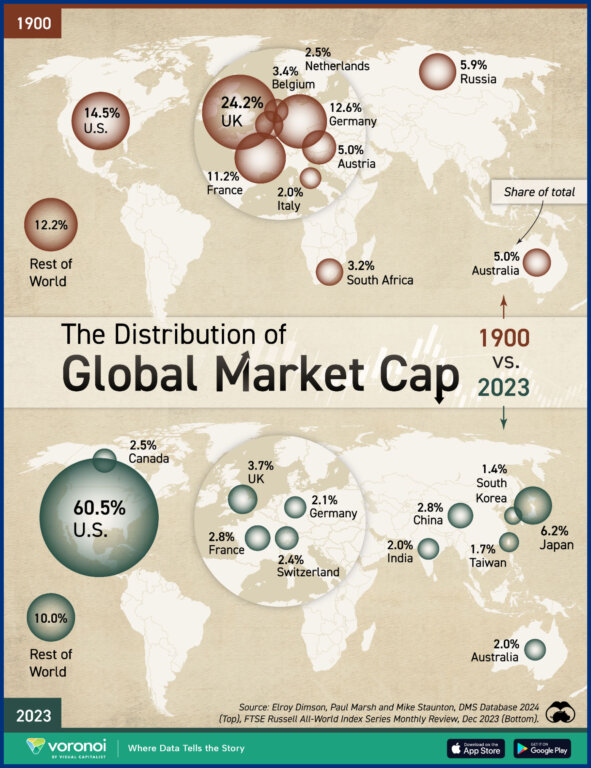

1900 vs. 2023 stock markets

It’s always worth keeping the long run in mind when thinking about trends and market forces. When we consider just what an incredible run the U.S. stock market has achieved over the last few years, it’s important to remember that it’s unlikely to continue that outperformance forevermore.