I recently interviewed Keith Matthews for a forthcoming column in MoneySense. Keith is a partner and portfolio manager at Tulett, Matthews & Associates (TMA), an investment counsel firm in Montreal. Index investing is at the heart of TMA’s philosophy: the firm builds widely diversified, passively managed portfolios for its clients using mutual funds from Dimensional Fund Advisors and iShares ETFs.

During our discussion, Keith explained that he recently boiled down his 15 years of investment management experience into a concise framework that he shares with his clients. He’s identified nine factors that contribute to an investor’s long-term success, and he’s agreed to share them with readers of Canadian Couch Potato. I’ll present them this week in a series of three posts. (The material was originally written for TMA clients only, so I have made a few modifications to give them broader appeal.)

What’s more, Keith provided me with a copy of his excellent book, The Empowered Investor, which explores these ideas in greater detail and eloquently makes the case for index investing. By adding a comment to any post in this series, you’ll be automatically entered in a draw to win a copy of the book.

“A structured portfolio is not just about diversification,” Keith explains. “It is about bringing together a series of concepts or principles to match each investor’s unique situation. What follows are nine critical factors you must consider when thinking about your long-term investments. Each is essentially a pillar in a structured investment planning process. Ignoring them can lead to costly outcomes. Implementing all of them together will help you reach your personal financial goals and increase your odds of creating a successful long-term investment experience.”

Disclosure: I am not a client of Tulett, Matthews & Associates (their minimum portfolio size is a wee bit out of my league) and this is not a sponsored post. I asked Keith if he would be willing to share his insights simply because I think they will be an enormous help to readers. He generously agreed to do so.

–

1. Investors with a financial plan will have a better outcome.

The lack of a financial plan is at the root of many challenges that investors experience. If you want to achieve financial independence, you need to start by reviewing your goals and life targets, saving rates, and your consumption and lifestyle habits.

The lack of a financial plan is at the root of many challenges that investors experience. If you want to achieve financial independence, you need to start by reviewing your goals and life targets, saving rates, and your consumption and lifestyle habits.

An investment plan comes next. This will map out your long-term investment objectives, time horizons, target asset allocation, tax consequences, risk tolerance and investment strategy. Seeking advice from a financial planning professional can be an important part of this process.

Successful investors keep their long-term goals in mind at all times. This helps them avoid being swayed by market movements and other distractions.

–

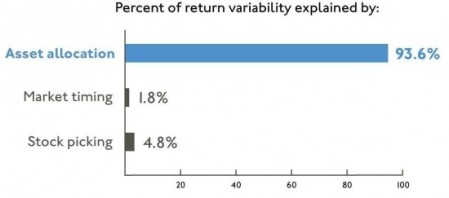

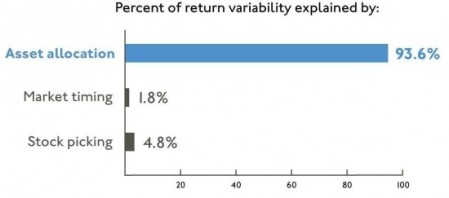

2. Asset allocation is the dominant factor in a portfolio.

Choosing an asset allocation — the relative mix of stocks, bonds and other asset classes in your portfolio — is one of the most important decisions an investor can make. While market timing and stock picking may be exciting, the academic literature has shown that asset allocation decisions have a far greater impact on portfolio performance.

As a result, asset class investing is the most prudent and successful long-term strategy. It’s the one that has been used for decades by the smart money, such as pension fund managers. The best way for retail investors to adopt an asset class strategy is to use index funds or ETFs that track broad-based stock and bond indexes.

–

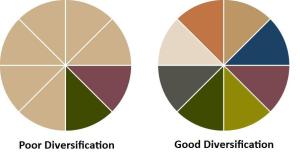

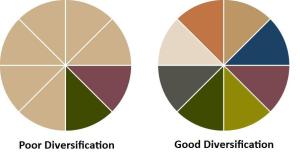

3. There’s a difference between good and bad diversification.

Many investors believe that they are diversified because they own 15 stocks or 10 mutual funds. But often their holdings overlap: a portfolio of five bank stocks, five mining stocks and five income trusts is not well diversified. Similarly, if you hold four Canadian equity funds, chances are that they hold many of the same companies. That’s bad diversification, and it can be costly in the long run.

Many investors believe that they are diversified because they own 15 stocks or 10 mutual funds. But often their holdings overlap: a portfolio of five bank stocks, five mining stocks and five income trusts is not well diversified. Similarly, if you hold four Canadian equity funds, chances are that they hold many of the same companies. That’s bad diversification, and it can be costly in the long run.

Good diversification means having exposure to all of the major asset classes with little or no overlap. These asset classes include government bonds, corporate bonds, real return bonds, Canadian stocks, US stocks, international stocks, and emerging market stocks. The equity components can be subdivided further into large- and small-cap stocks, and value and growth stocks.

–

See also: 9 Secrets of the Empowered Investor, Part 2

9 Secrets of the Empowered Investor, Part 3

Filed under: Couch Potato basics

![]()

The lack of a financial plan is at the root of many challenges that investors experience. If you want to achieve financial independence, you need to start by reviewing your goals and life targets, saving rates, and your consumption and lifestyle habits.

The lack of a financial plan is at the root of many challenges that investors experience. If you want to achieve financial independence, you need to start by reviewing your goals and life targets, saving rates, and your consumption and lifestyle habits.

Many investors believe that they are diversified because they own 15 stocks or 10 mutual funds. But often their holdings overlap: a portfolio of five bank stocks, five mining stocks and five income trusts is not well diversified. Similarly, if you hold four Canadian equity funds, chances are that they hold many of the same companies. That’s bad diversification, and it can be costly in the long run.

Many investors believe that they are diversified because they own 15 stocks or 10 mutual funds. But often their holdings overlap: a portfolio of five bank stocks, five mining stocks and five income trusts is not well diversified. Similarly, if you hold four Canadian equity funds, chances are that they hold many of the same companies. That’s bad diversification, and it can be costly in the long run.