This post is the second of three that outline nine critical factors in investment success, as identified by Keith Matthews, a portfolio manager with Tulett, Matthews & Associates in Montreal.

Leave a comment on any of three posts to be automatically entered in a draw to win a copy of Keith’s book, The Empowered Investor, which explores these concepts in more detail.

–

4. Value and small stocks outperform over time.

Many investors look for opportunities in growth companies. But long-term data show that investments in value companies (which have low price-to-book ratios, and are often out of favor) have produced higher returns than growth companies. Small companies have also produced higher returns than larger, more well-known companies. These premiums appear to exist in all parts of the world.

These observations were reported by finance professors Eugene Fama and Kenneth French in the early 1990s. They explained that investors perceive higher risk in value and small companies and, accordingly, their stocks should provide higher expected returns. This is consistent with the notion that markets are efficient.

Portfolios that are “tilted” toward value and small-cap stocks add more risk, and therefore should have higher expected returns than the broad-market indices over the long term.

–

5. Markets move randomly and unpredictably.

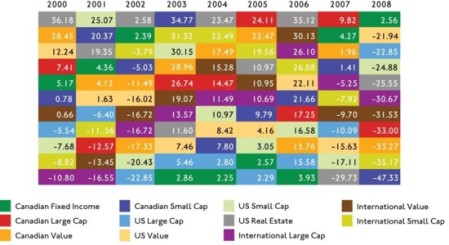

The chart below ranks the best and worst performing asset classes each year from 2000 through 2008. Can you spot the pattern and use this information to predict which asset class will lead the pack in the years to come?

Of course, that was a trick question: there is no pattern. Markets and asset classes move randomly and unpredictably, and investors often regret bold portfolio moves based on forecasts and predictions. There is no evidence that tactical asset allocation — that is, moving in and out of asset classes in an attempt to enhance returns — is an effective strategy over the long term.

Index investors use a “set and rebalance” approach to asset allocation that is not based on crystal balls. Rather than trying to predict the next hot asset class, they get exposure to all of them at all times.

–

6. Passive outperforms active over the long term.

Few actively managed strategies have matched index or asset-class returns over any period longer than a few years. Only a very small percentage of actively managed Canadian, US and international equity funds beat their benchmarks over the last five years, according to Standard & Poor’s. There is nothing new here: similar results have been seen since the first studies of manager performance in the 1960s.

What’s more, there is no way to identify the winning funds in advance with any real confidence.

Index funds and ETFs will never rank number one in any given year, but they are the best choice for long-term investors. By doing nothing more than tracking the major indices, the iShares S&P/TSX Composite (XIC), the iShares DEX Universe Bond Index (XBB) and the Vanguard Total Stock Market (VTI) have all ranked in the top quartile over the last five years, according to Morningstar. (In other words, they beat at least three out of every four funds in the same asset class.) The longer the time period under review, the wider the gap between index funds and their active counterparts.

In addition to superior performance, index funds and ETFs also offer excellent transparency, pure asset allocation, low fees and greater tax efficiency.

–

See also:

9 Secrets of the Empowered Investor, Part 1

9 Secrets of the Empowered Investor, Part 3

Filed under: Asset classes, Couch Potato basics, Index funds, Research

![]()