A scientific review of portfolio diversification

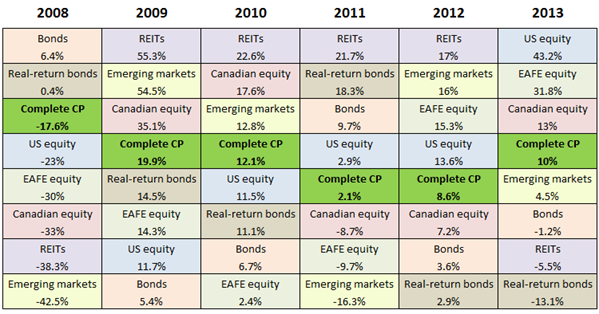

This periodic table of returns for seven individual asset classes shows the balanced Couch Potato portfolio fell near the middle every time.

Advertisement

This periodic table of returns for seven individual asset classes shows the balanced Couch Potato portfolio fell near the middle every time.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email