Many readers have used our white paper, As Easy as ACB, to learn how to calculate the adjusted cost base of their Canadian ETF holdings. I’ve received several comments and questions from readers who wonder whether the process is the same for US-listed ETFs—and the answer is no.

You already know that dividends and interest from US securities are taxed at your full marginal rate. What you may not realize is that return of capital (ROC) and capital gains are also fully taxable. And although ROC and reinvested capital gains affect your ACB with Canadian, they are unlikely to be a factor with US-listed ETFs.

Schmidt happens

First some background: in a 2012 court case, a Calgary investor named Hellmut Schmidt argued that ROC and capital gains distributions from a US-listed security should get the same tax treatment as they do when they come from Canadian funds. He argued the ROC should not be taxable, and that he should be on the hook for only half the capital gain. But the judge disagreed and ruled that all the US fund’s distributions were fully taxable as foreign income.

Let’s consider the implications of that ruling. Recall that ROC from a Canadian fund is not taxable in the year it is received, but it lowers your adjusted cost base, thereby increasing the future capital gains tax liability. The Schmidt case made it clear that if you receive return of capital from a US-listed ETF, it is fully taxable as income, and it does not affect your ACB.

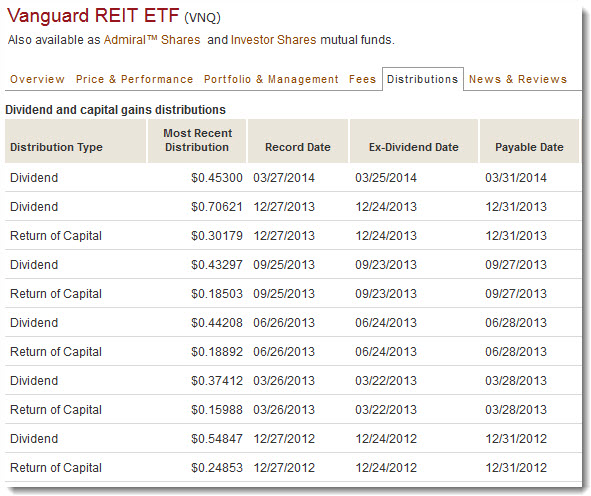

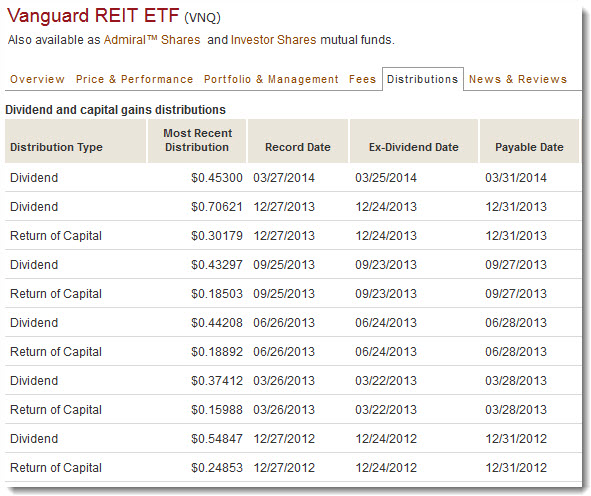

Fortunately, return of capital does not seem to be a common characteristic of US-listed ETFs. You should be able to tell if there were ROC distributions by visiting the ETF’s website. One example is the Vanguard REIT ETF (VNQ), which had four ROC distributions in 2013:

The lesson here is you should probably not hold this ETF in a non-registered account. Indeed, foreign REIT ETFs can be extremely tax-inefficient, because they throw off a lot of fully taxable income. If foreign REITs are part of your portfolio, consider holding them in an RRSP.

The lesson here is you should probably not hold this ETF in a non-registered account. Indeed, foreign REIT ETFs can be extremely tax-inefficient, because they throw off a lot of fully taxable income. If foreign REITs are part of your portfolio, consider holding them in an RRSP.

At a loss for gains

Capital gains reported by Canadian ETFs will appear on your T3 slip and are taxed at half your marginal rate. But as we’ve seen, any capital gains distributed by a US-listed ETF will be reported as foreign income on your T5 slip, and they are fully taxable.

More good news, however: capital gains distributions from US-listed ETFs are even rarer than ROC. According to a Morningstar article published at the end of last year, “at five large ETF providers—iShares, Vanguard, State Street, PowerShares, and Schwab—just 38 out of 670 funds are facing capital gains distributions of any kind.” Moreover, the Vanguard and iShares ETFs that did have capital gains in 2013 were mostly bond funds, and there can’t be many Canadians who hold US bonds in taxable accounts.

Even when a US-listed ETF does have a capital gains distribution, it is likely to be in cash, which means you don’t have to worry about adjusting your cost base. So this one is a moot point for Canadian ETF investors.

Making the exchange

All of which is to say that calculating your ACB with US-listed ETFs is largely about keeping track of purchases and sales. Lowering your ACB to account for return of capital is not permitted, and increasing it for reinvested distributions is almost never necessary.

Of course, that doesn’t mean it’s straightforward. ACB calculations for US securities need to be done in Canadian dollars, which means you will need to learn the USD-CAD exchange rate for the settlement date of each transaction. For a detailed explanation, see pages 13 and 14 of our white paper, As Easy as ACB.

The lesson here is you should probably not hold this ETF in a non-registered account. Indeed, foreign REIT ETFs can be extremely tax-inefficient, because they throw off a lot of fully taxable income. If foreign REITs are part of your portfolio, consider holding them in an RRSP.

The lesson here is you should probably not hold this ETF in a non-registered account. Indeed, foreign REIT ETFs can be extremely tax-inefficient, because they throw off a lot of fully taxable income. If foreign REITs are part of your portfolio, consider holding them in an RRSP.