Last June, a new ETF provider appeared in Canada with little fanfare. I didn’t write anything about the launch of XTF Capital at the time, because their first lineup of products was a series of covered call ETFs and a convertible bond ETF that have little or no relevance to Couch Potato investors. However, last week XTF launched the first three ETFs in a new family that will track indexes provided by Morningstar. One of these, the XTF Morningstar Canada Dividend Target 30 (DXM), may be of interest to passive investors who use a dividend-focused strategy. So it’s worth a closer look.

Of course, the Canadian dividend ETF space is already a little crowded, with the iShares Dow Jones Canada Select Dividend (XDV) and Claymore S&P/TSX Canadian Dividend ETF (CDZ) currently holding almost $1.7 billion between them. Broken down by sector, this new XTF fund is about 25% financials (that’s half as much as XDV, but about 4% more than CDZ) and almost 30% energy, which is a far greater share than either of its competitors. It also holds 13% in utilities and almost 20% in telecoms.

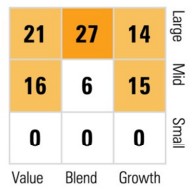

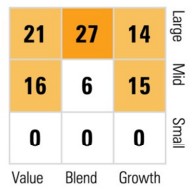

The ETF’s fact sheet also breaks down the fund’s exposure to size and value factors using the Morningstar style boxes, which is an interesting feature. These style boxes tell you what percentage of the fund’s assets is in large, mid, and small cap stocks, and what percentage is in value, blend and growth stocks:

Of the 30 stocks in the new ETF, only five are also in both XDV and CDZ (Scotiabank, Fortis, IGM Financial, Shaw Communications and Telus), which is a bit surprising. Another 15 are in one or the other competitor, leaving 10 stocks that appear only in DXM.

What’s in the box?

Barry Gordon, president of XTF’s parent company, First Asset, was quoted in The Globe and Mail as saying that with these Morningstar indexes, “we are striving to deliver better returns with less risk than the broader market.” The ETF’s fact sheet includes hypothetical returns for the Morningstar Canada Dividend Target 30 Index, which would have outperformed the S&P/TSX Composite dramatically over the last three, five and 10 years, with a lower standard deviation to boot.

That’s quite a claim, but backtested returns of new indexes are almost worthless—it is always possible to identify a strategy that would have worked in the past, but this offers no guarantee that it will work going forward. The claim is especially dubious when it’s unclear exactly what strategy is being employed. That’s my biggest concern with this new ETF. The individual holdings are transparent, but the methodology is anything but: we’re told only that the Morningstar index is “based upon proprietary research” and that “it reflects the performance of 30 dividend-paying, Canada-based equities, screened for, among other things, above-average returns on equity and high cash flows relative to debt.” It seems to weight all of its holdings equally, rather than by market cap or yield, though even that is not made explicit.

While I fully understand the business reasons for creating products that keep their strategy under wraps, I’m not attracted to them as an investor. Black-box ETFs like this one suggest that there are magic formulas that can beat the market, and that investors should be paying for access to an exclusive club. But one of the pillars of passive investing is that returns come from exposure to known risk factors, not from secret sauce. This ETF provides a reasonably well diversified basket of Canadian dividend stocks and may be just fine for investors who want that in their portfolios. But whether it will provide superior risk-adjusted returns in the real world is an open question.

[Update: After this post went live, XTF Capital supplied a copy of the index methodology. See the comments section for an explanation and a link.]