RRSP vs TFSA: Which should you top up in retirement?

The TFSA wins because it's flexible

Advertisement

The TFSA wins because it's flexible

Q: I’m a 60-year-old retired school teacher as of this past July 2017. I have $44,000 in unused RRSP contribution room. Should I max out my contribution room on my 2017 taxes? Or just stick to topping up my TFSA?

—Chris

A: Hi Chris. Thanks for the question. Please note that RRSP only counts as a deduction against “earned income” which includes:

Q: I’m a 60-year-old retired school teacher as of this past July 2017. I have $44,000 in unused RRSP contribution room. Should I max out my contribution room on my 2017 taxes? Or just stick to topping up my TFSA?

—Chris

A: Hi Chris. Thanks for the question. Please note that RRSP only counts as a deduction against “earned income” which includes:

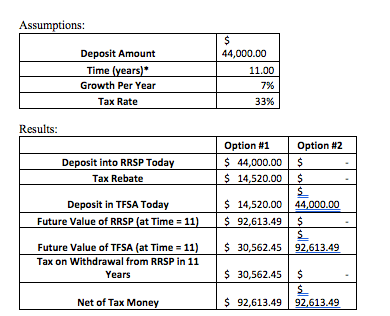

Conclusion: Both result in the same end value since you are facing a constant tax rate. Further, your RRSP must be converted upon your 71st birthday whereas you can leave your TFSA to grow for as long or short as you desire. Additionally, it is usually recommended to draw out of your RRSP rather than your TFSA earlier in retirement as your TFSA will incur no tax upon your passing or any withdrawals as compared to your RRSP which will be taxed fully.

What we can conclude is this. If your income will be staying constant throughout your retirement I would advise you to top up your TFSA rather than your RRSP for the following reasons

Conclusion: Both result in the same end value since you are facing a constant tax rate. Further, your RRSP must be converted upon your 71st birthday whereas you can leave your TFSA to grow for as long or short as you desire. Additionally, it is usually recommended to draw out of your RRSP rather than your TFSA earlier in retirement as your TFSA will incur no tax upon your passing or any withdrawals as compared to your RRSP which will be taxed fully.

What we can conclude is this. If your income will be staying constant throughout your retirement I would advise you to top up your TFSA rather than your RRSP for the following reasons

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email