Q: The iShares Comex Gold Trust (IGT) trades on the Toronto Stock Exchange, but I can’t find it on your page of Canadian ETFs. It’s also not listed on the iShares Canada website. Can you tell me why? — Jim O.

The iShares Comex Gold Trust is an exchange-traded product that tracks the price of gold. Like its competitor, SPDR Gold Shares (GLD), the trust is backed by gold bullion held in a vault by a custodian.

But although IGT is listed on the Toronto Stock Exchange, it is not a Canadian product. It’s simply a cross-listing of the iShares Gold Trust (IAU), which is domiciled in the US and traded on the NYSE. That’s why I haven’t listed it in my directory of Canadian ETFs and why it isn’t included on the iShares Canada site.

If you’re not familiar with cross-listing, it’s a common practice among large corporations that want their shares to trade in more than one currency (and sometimes more than one time zone). For example, while Research in Motion is a Canadian company traded on the TSX, you can also buy its shares in US dollars on the NASDAQ. There are many other examples of companies with dual listings, including Potash Corporation, Canadian Natural Resources, and all of the big banks.

When shares of a company (or a product like the iShares Gold Trust) trade in two different currencies, there is no benefit to buying one or the other, except for the convenience of not having to convert your currency. At the market close on July 22, for example, the last trade in IGT was made at $14.86 CAD, while the last trade in IAU went through at $15.65 US. At the current exchange rate, those two amounts were identical.

Why have they performed so differently?

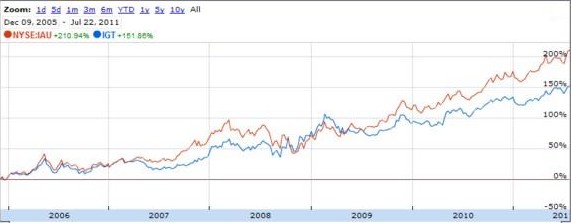

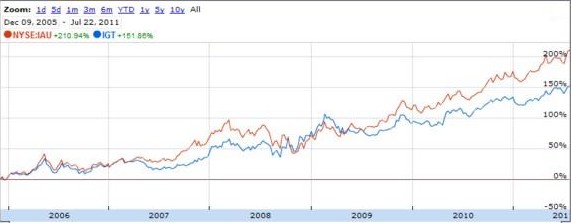

IAU was launched early in 2005, and the cross-listing was added in December of that year. If you enter both ticker symbols in a stock chart, they seem to have performed very differently. Over the last five and a half years, IAU shows a much higher return: almost 211% versus just 152% for IGT:

You might conclude from this chart that you would have been better off holding IAU. But this is an illusion: the returns of IAU are expressed in US dollars, while those of IGT are given in loonies. To an investor measuring her returns in Canadian dollars (as most of us do), the returns of the two versions would have been the same. The apparent difference is entirely the result of the USD/CAD exchange rate.

Here’s how the math works, with the numbers rounded for simplicity:

- In December 2005, $1 US was worth $1.16 CAD. A Canadian investor could have bought $100 USD worth of IAU, or $116 CAD worth of IGT. These amounts would have bought an identical number of shares.

- By July 2011, the value of IAU had increased by 211%, so $100 USD would have become $311 USD.

- Meanwhile, an investor in IGT would have enjoyed a 152% return, turning $116 CAD into $292 CAD.

- During this period, the value of the US dollar declined from $1.16 to $0.94 CAD.

- If both sold their shares in July 2011, the IAU investor would have received $311 USD, while the investor in IGT would have pocketed $292 CAD. At the current exchange rate ($1 USD = $0.94 CAD), those two amounts are equivalent.

This should make intuitive sense when you remember that IAU and IGT are the same fund, holding the same gold bars in the same vaults. A gold bar is a gold bar, no matter what country you live in or what currency you use. If you buy an ounce of gold in Windsor, Ontario, and then drive across the border to sell it in Detroit—or vice-versa—you can’t expect to make a profit.

Or to use a different example, if you buy 100 shares of a cross-listed company like Research in Motion on the TSX, wait for the loonie to go up 10%, and then sell them on the NASDAQ, you won’t make a 10% profit. You’ll just have 10% more US dollars, each of which is worth 10% less.

The bottom line for investors is that if you want exposure to gold and you have Canadian dollars in your account, then buy IGT. If you have US dollars in your account, then you can use IAU. Either way, your exposure to gold is the same, and your exposure to the US dollar is zero.

Got a question about index investing? Send it to [email protected] and it may be answered in a future installment of “Ask the Spud.” Answers are provided as information only and do not constitute investment advice.