Price of bitcoin hits new high after Trump victory, and more crypto news

Bitcoin surges, Coinbase makes a splash in Canadian football, and could bitcoin’s creator be Canadian?

Advertisement

Bitcoin surges, Coinbase makes a splash in Canadian football, and could bitcoin’s creator be Canadian?

Welcome to the Canadian Crypto Observer. Financial journalist and author Aditya Nain offers perspective on market-moving headlines to help Canadian investors navigate the cryptocurrency market.

Before Donald Trump won the U.S. election on Nov. 5, it was widely believed among crypto investors that a Trump administration would be more crypto-friendly than a Kamala Harris administration. This view was bolstered by Elon Musk’s public support for Trump. The logic was simple: since Musk is a supporter of crypto—including meme coins such as dogecoin—this would somehow rub off on or influence how Trump views crypto.

The markets have confirmed that belief. On the night of the U.S. election—as it became clearer that Trump would win—the price of bitcoin jumped about 8%, from about $69,400 to over $75,000 (figures are in U.S. dollars). With this move, bitcoin recorded a new all-time high, surpassing its March 2024 high of about $73,000. In the days since the election, BTC’s price has continued to rise, and at press time was over $85,000.

Source: Google

Hold your horses, though; we have yet to see what a Trump presidency will really mean for crypto legislation in the U.S. And, while POTUS is important in deciding what happens with crypto, he doesn’t hold all the cards. Possibly even more important is the chairperson of the U.S. Securities and Exchange Commission (SEC). That’s Gary Gensler, an MIT professor who is knowledgeable about bitcoin and blockchain—he’s even taught a course called “Blockchain and Money.” Despite this, though, Gensler has been widely considered to be hawkish on crypto during his tenure leading the SEC, since June 2021. The question for investors is: With Trump in office, will Gensler be allowed to complete his term until June 2026? And if he’s replaced, will the new chairperson be more crypto-friendly?

Given these uncertainties, another explanation for the BTC price jump is the inflationary expectations that accompany the Trump presidency. Trump brings with him the prospect of tariff wars with key U.S. trading partners such as China. When tariffs on imported goods rise, the total cost of those products rises for consumers as well. In other words, inflation rises. And, as explained in our previous column, higher inflation could lead to higher crypto prices.

We’ve ranked the best crypto exchanges in Canada.

On Oct. 29, 2024, BTC touched $100,000… Canadian dollars.

Canadians often track crypto prices in U.S. dollars, and rightly so, since that matters the most in the crypto market. However, a week ago, the price of BTC reached the important milestone of $100,000.

Does this really matter? Only a little bit.

Firstly, it excites Canadian crypto investors—and emotions like this often play a role in investment decisions.

Secondly, as the Canadian crypto market becomes bigger, and as investors begin to perform technical analysis on crypto prices in Canadian dollars, these milestones would hold some significance—if only technical.

Allow me a slight digression on how Canadian crypto pricing works. In most markets, BTC prices are quoted in U.S. currency. For Canadian investors, the price of BTC is calculated by converting the U.S. price into Canadian dollars based on the current exchange rate. So, the Canadian price of bitcoin is affected not only by the appreciation or depreciation of BTC but also by fluctuations in the CAD–USD exchange rate. Here’s how it works:

U.S.-based crypto exchange Coinbase has become the “Official Crypto Partner” of the Canadian Football League (CFL) and the 111th Grey Cup. Coinbase—the league’s first-ever partner in the crypto space—will also sponsor the opening coin toss ahead of the championship game in Vancouver on Nov. 17, 2024.

Source: Facebook

Why is this a smart move for Coinbase? According to the cryptocurrency company’s own research, Canada is one of its most crypto-aware non-U.S. markets. It’s estimated that Canada is home to about five million crypto holders—that’s 12% to 13% of the population. Canada was also the first country to approve and launch a spot BTC exchange-traded fund (ETF). In short, Coinbase sees Canada as a strong growth market.

But why the CFL specifically? CFL fans and Canadian crypto investors have something in common: a large portion of both are male. Research conducted by Leger shows that about 64% of CFL fans are male. And a survey conducted by the Ontario Securities Commission two years ago found that the majority of crypto investors are male.

Plus, crypto firms have a history of marketing through professional sports—the most prominent example, perhaps, is Crypto.com spending USD$700 million on 20-year naming rights for the Los Angeles arena where the Lakers, Clippers and Kings play.

To compare crypto ETFs, check the MoneySense ETF screener.

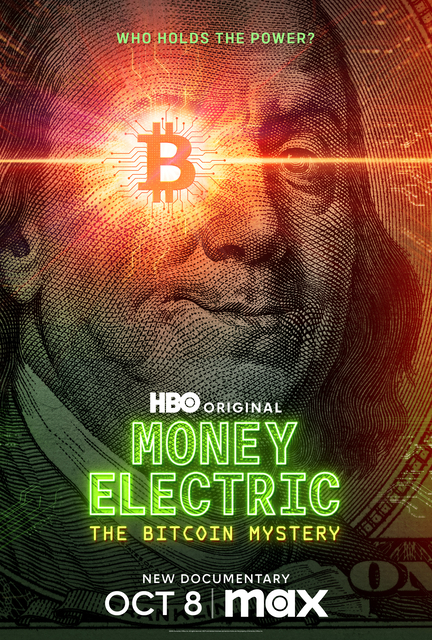

According to a recent HBO documentary, the elusive creator of bitcoin could be Peter Todd—a Canadian software developer. Money Electric: The Bitcoin Mystery, released in October and streaming on Crave, explores whether Todd could be Satoshi Nakamoto, the pseudonym used by the mysterious creator(s) of bitcoin. Satoshi—which could refer to an individual or a team—created the bitcoin blockchain in 2009, only to completely disappear in 2011.

Satoshi still holds the keys to 1 million BTC. That’s over USD$70 billion, based on the current price of BTC. Those coins have never moved, which further adds to the intrigue surrounding the creator of bitcoin.

So, could Todd actually be Satoshi? Likely not. Todd himself rubbishes the claim. On X (formerly Twitter), he says this is just a publicity stunt by documentary maker Cullen Hoback.

I probably shouldn't admit it… But @JoeNakamoto's mostly right.

— Peter Todd (@peterktodd) October 9, 2024

This nonsense is a genuine danger, as crazy people might try to get my non-existent fortune. But it's also hilarious.

Thing is, I didn't trick @CullenHoback. I think he just needed a stunt to hype up his film. https://t.co/vs60kcEqaG

In 2009, Todd would have been 23 years old, and around this time he was a fine arts student at the Ontario College of Art and Design (now OCAD University).

It is more likely that Todd’s name is one on a list of people who have either claimed to be, or been claimed by others to be, Satoshi. Here’s a list of some others who’ve been speculated to be Satoshi:

| Name | Background | Connection to bitcoin | Self-claimed or claimed by others | Denied being Satoshi |

|---|---|---|---|---|

| Hal Finney | Computer scientist and cryptographer | Early bitcoin adopter, corresponded with the real Satoshi, received the first BTC transaction | Claimed by others | Yes |

| Nick Szabo | Computer scientist and cryptographer | Creator of “bit gold,” a precursor to bitcoin | Claimed by others | Yes |

| Adam Back | CEO of Blockstream, creator of “Hashcash,” an early proof-of-work system | Early involvement in bitcoin, and bitcoin mining uses his creation “Hashcash” | Claimed by others | Yes |

| Wei Dai | Computer scientist | Creator of “B Money,” which partially inspired the creation of bitcoin | Claimed by others | Yes |

| Gavin Andresen | Software developer | Worked closely with Satoshi in the early days of bitcoin, and was lead bitcoin developer after Satoshi | Claimed by others | Yes |

| Dorian Nakamoto | Physicist and engineer | None apart from the surname and some personal characteristics; claims to have first heard of bitcoin in 2014 | Claimed by others | Yes |

| Craig Wright | Computer scientist and entrepreneur | Claims to have developed bitcoin | Self-claimed | No |

The big unknown looming over crypto last month was clearly the U.S. presidential election. While the crypto market seems enthused by Trump’s election, Canadian investors would do well not to base their investment decisions purely on this. The crypto landscape is fast evolving, and its regulatory framework is still in its infancy. While POTUS may be able to impact some aspects of the crypto market, that influence is limited. In any case, whether or not you’re happy with the result of the election, it’s usually a good idea to divorce investment decisions from your political views.

As with any speculative asset, cryptocurrencies are volatile investments. The price of bitcoin is at an all-time high, and you may feel some FOMO. But investors should be careful, since investing based on FOMO could be a recipe for disaster. As always, invest only as much money as you’re willing to lose.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Bitcoin is the biggest scam going….