One in five may never fully retire: global study

The lesson here is start saving at an early age.

Advertisement

The lesson here is start saving at an early age.

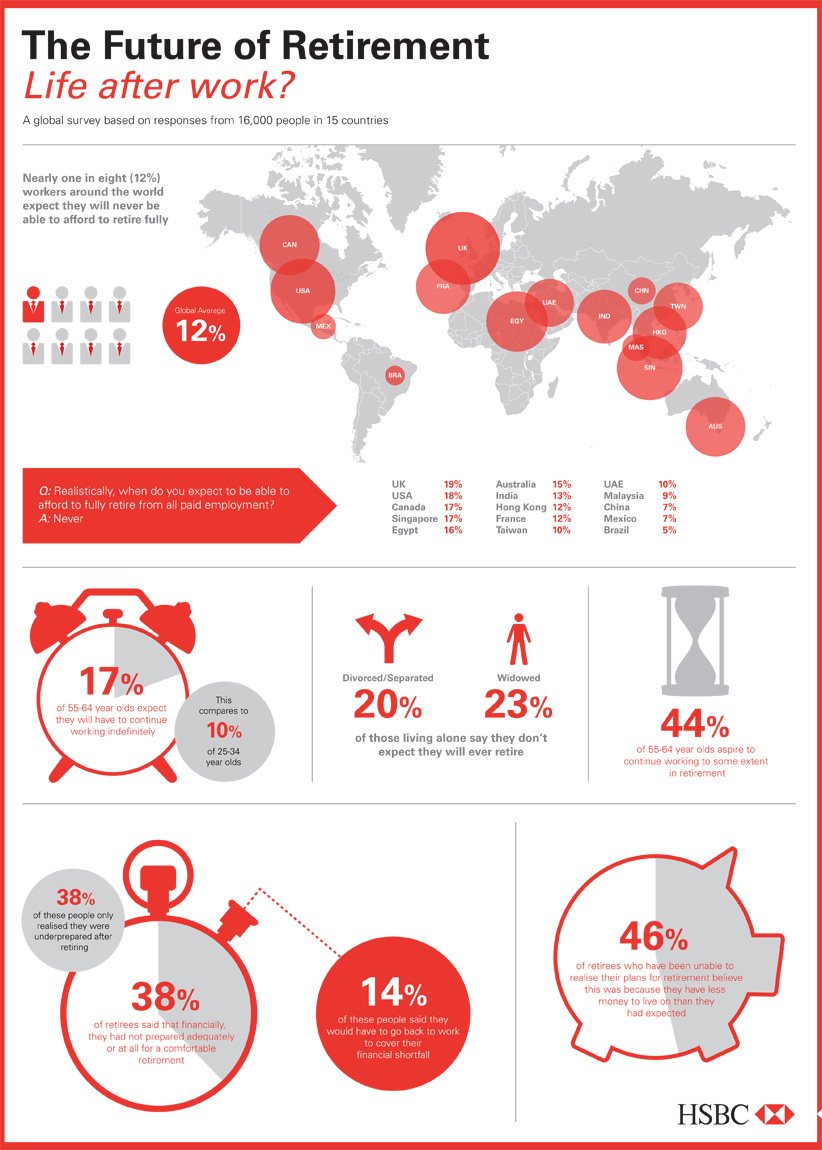

A global retirement survey finds 12% of workers in 15 countries—including almost one in five (17%) Canadians—expect they’ll never have enough money to fully retire.

The HSBC’s The Future of Retirement: Life After Work, being released today, found 54% of Canadian retirees who were unable to realize their retirement dreams cited having less money than they expected to have. Tellingly, almost two-thirds (64%) of the 16,000 people surveyed globally who had entered semi-retirement said they wish they’d kept working full-time for longer. The online survey was conducted between July 2012 and April 2013, and included 1,046 Canadians.

Still, for those who set their retirement plans early enough in life, working-age people globally still expect to retire on average by age 63, which is just two years later than the previous generation (their parents), who retired on average by age 61.

When retirees were asked about the best financial advice they ever received, the most popular response (and one I’d plump for) was “Start saving at an early age.”

If anything, semi-retirement appears to be in the future of many of today’s workers. Fully a quarter (26%) of those aged 55 to 64 say they have already semi-retired and 41% of those aged 25 to 34 expect they’ll semi-retire for a period before entering traditional full-time retirement.

Not surprisingly, most (72%) retirees experience a drop in income. However—and this is a bit scary—such an income drop was not matched by a comparable drop in spending. Less than half (48%) found they were spending less in retirement than when they were working full-time.

Similarly, the survey shows a disconnect between retirement expectations and the actual reality experienced by retirees. Retirement does seem to live up to its reputation when it comes to lower price-tag intangibles like spending time with family and friends, gardening or getting more exercise. For the most part, those who expected to travel extensively were able to do so.

On the other hand, a lot fewer retirees ended up living abroad (just 3%) compared to those who aspired to that goal (25%). Similarly—and as an author I found this interesting—while 20% expected they’d have time to write a book in retirement, only 3% actually achieved this goal. A similar dynamic was at work in learning a foreign language, and to a less pronounced degree, starting a business or going on to higher education.

Among those unable to achieve all their retirement aspirations, the biggest reason was having less money than they’d hoped: cited by more than half (54%). Within this group, almost three-quarters (74%) said they regretted not saving more.

While most people realize income in retirement will be lower than the working years, the study found that worldwide, retirement income tended to be even lower than they were expecting. While almost half (44%) found retirement income was “about the same” as they had expected, 18% found income was “a little less” than expected and a disturbing 20% found retirement income to be “a lot less” than hoped for. In other words, almost two in five (38%) discovered their income was less than they expected in retirement.

There are no surprises in the major sources of retirement income. Globally across both genders, the biggest chunk or 45% came from government pensions, with the runner-up (31%) from company pensions. Personal pensions or savings were a distant third at 9%, with the rest coming from real estate income, sale of a business and windfalls like inheritances or lotteries.

HSBC ends the survey with four actions, two of which I wholeheartedly agree with: The first is “Don’t rush into retirement.” The fourth is “Be realistic about your retirement outgoings.” Keep in mind that more than half surveyed (52%) saw no reduction in expenses in retirement and 17% actually saw outlays increase. (It’s a lot easier to spend money when you have nothing but time on your hands!)

It’s hard to argue with its second tip too: “Don’t rely on one source of retirement income.” For most Canadians that one source of income is some combination of CPP and OAS, which is one reason I always nag people to at least contribute to Tax Free Savings Accounts and ideally an employer pension plan if it’s offered. The third tip is to “Plan your retirement with family in mind.”

But the biggest takeaway, for those who are young enough, is the recommendation to start saving at an early age. Yes indeed, start that TFSA the moment you can, at age 18. And at the other end, think of all those surveyed who regretted leaving full-time work too soon. If you have any doubts, I suggest adopting the motto, “Just keep working!”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email