Foreign Withholding Tax Explained

The Couch Potato strategy calls for a significant allocation to US and international stocks. When you live in a country with a small, poorly diversified stock market, global diversification is extremely important. But it does carry a price in the form of foreign withholding taxes. Almost all countries levy a tax on dividends paid to [...]

Investors and advisors are often unaware of how foreign withholding taxes affect returns, and the reason is simple: they’re damned complicated. The amount of tax you pay varies with the type of account (taxable, RRSP, TFSA) and the structure of the fund.

Investors and advisors are often unaware of how foreign withholding taxes affect returns, and the reason is simple: they’re damned complicated. The amount of tax you pay varies with the type of account (taxable, RRSP, TFSA) and the structure of the fund.

I’m discovering this post 7.5 years later, but I’m so grateful for it. I just heard about this issue of double FWT yesterday and I’ve spent the last two evenings identifying new funds to transfer my investments into. And here I thought Vanguard was the ultimate low-cost solution for a Canadian investor looking to diversify globally (I’ve been using VXC and VEE). I noticed BMO ETFs contain fractions of their holdings in US-listed ETFs (only ~5% for ZEA, for example) but the majority of international and US holdings are direct, and BMO’s fees are comparable to Vanguard’s. I’ve read quite a few posts about this topic now, but this one is particularly clear and helpful. Thank you!

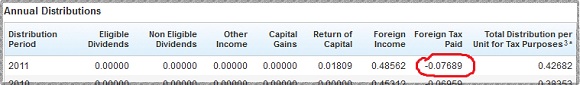

I own Vanguards emerging market ETF in my RRSP account. I recently read Justin Benders article that this ETF is subject to two layers of withholding taxes which showed in the table was 0.69%. However when i go to vanguards website under the heading prices and distributions of this fund I calculated the amount as 0.15%. By dividing the foreign tax paid 0.17 by the foreign income 1.11. I was considering selling this fund due to the added tax, but now not sure. Could you please explain, is the taxes hidden somewhere that the investor can’t see?

Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. We invite you to email your question to [email protected], where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor.

I am not certain from reading the article but as a resident of Uruguay, would I be able to open a brokerage account with a Canadian equities broker and would I be subject to a witholding tax on capital gains from the sale of Canadian equities…

Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. We invite you to email your question to [email protected], where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor.