The smart way to pay for “experiences” and other money tips

Doretta Thompson loves travel and is not a fan of debt. Here’s how she finds balance between treating herself, saving, investing and more.

Advertisement

Doretta Thompson loves travel and is not a fan of debt. Here’s how she finds balance between treating herself, saving, investing and more.

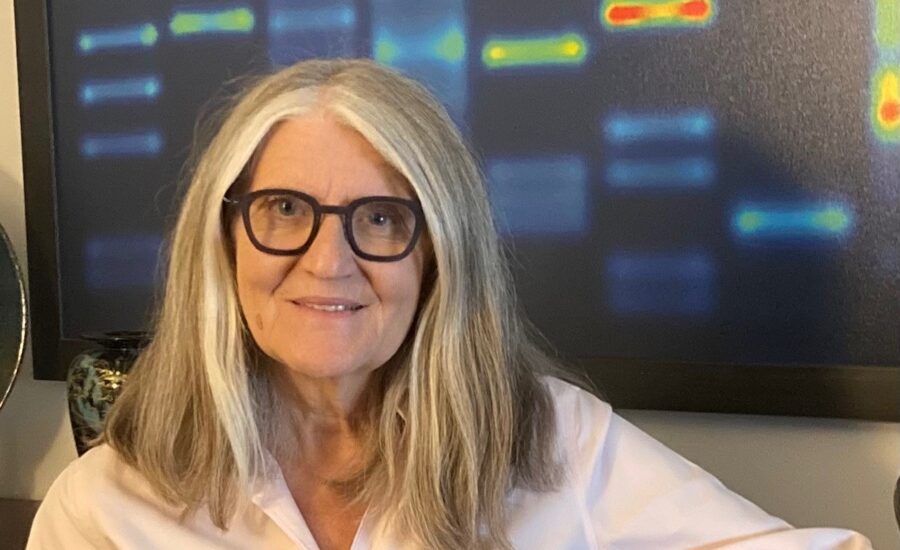

Who is Doretta Thompson? She is the director of corporate citizenship at CPA Canada, where she leads its impressive and award-winning financial literacy initiatives. She also sits on the board of AFOA Canada (formerly the Aboriginal Finance Officers Association of Canada) and on the advisory committee of Excellence Canada’s financial literacy standards. In fact, she was awarded the Queen Elizabeth II Diamond Jubilee Medal. She actually has a list of accomplishments that is too long to list here, so you’ll have to trust us when we say she’s a force for financial literacy in Canada. Let’s get into her “My MoneySense” answers:

I don’t really have any, but if I were to think about someone whose approach resonates, it’s the straightforward, common-sense approach of Dave Chilton [author of The Wealthy Barber]. And I learned a lot about how not to approach my money decisions from my mother.

With my family, especially my three grandchildren. Walking around cities—I suppose I’m a flâneuse. There’s really no English word for it, but [it means] meandering, especially in urban spaces with history. I love old churches, museums and galleries. And I write a lot of stories and poems I never show anyone.

Pretty much what I’m doing now, but with a little more balance of personal time to travel. I love the idea of living in a different city for a few months at a time, long enough to develop habits and a sense of what it means to be a local.

My parents fighting about it. It’s not a good memory, but I learned a lot about the importance of transparency and goal-sharing around money as a foundation of a healthy marriage.

A book, specifically: Leonard Cohen: Selected Poems. I still have it.

A checkout girl—that’s what we were called back then—at Loblaws. I quite liked it; I was fascinated by what people bought. And, yes, I did judge. I saved all that money I earned. I wanted to leave home to go to university very badly.

When I got my first job, I took a course called “Nancy Thompson’s Investing for Women.” The first lesson was that investing wasn’t any different for women than it was for men. But when there were men in the room, women stopped asking questions. I had a lot of fear about money because it was such a matter of friction growing up and I was terrified of debt. The course helped me set priorities and understand that there are different kinds of debt, and it gave me permission to invest in myself and my future.

Don’t invest in anything you don’t understand. This kept me out of the tech bubble—and out of crypto!

I took the advice of my broker at the time to sell my Apple shares when Steve Jobs died.

Assuming tax neutrality, a large sum at once, so I could invest and gift it.

The importance of developing the habit of saving regularly, even if it’s just a few dollars a week to start.

That you need to have a significant amount of money to start investing.

Not taking more chances. I’m a very cautious person and have always prioritized safety over risk-taking. I kept all my savings in laddered GICs for an embarrassingly long time.

“Experiences” over “things.” I love to travel and learn.

A painting. I had just started my first job, and it cost me three months’ rent, which I had saved up for. But it was a huge amount for me. Still have it, still love it, no regrets.

It depends on the debt. Debt that enables you to invest in your future, in things that increase in value, is reasonable. Incurring debt for consumer goods or discretionary spending makes no sense to me. I’ve always felt that if you can’t pay off your credit card every month, you’re living beyond your means.

A trip to Italy and Spain.

A proof copy of the next book in CPA Canada’s financial literacy series. It’s called The Last Act, by Larry and Kimberly Short, and it’s a thoughtful, straightforward guide to estate planning. It will be out in January.

Cash. I carry and spend cash. I support small local businesses, and they appreciate it. And my Presto card for public transit.

Maybe my Movado Museum watch. It was a gift from my husband many years ago, and it reflects my general approach to time. It has no numbers, just a single dot at the 12 point.

The next trip abroad. We haven’t decided on a destination yet. Maybe Ireland.

Own.

Public transit. I live in downtown Toronto and no longer own a car. I used to own cars, and kept them for a long time. And, generally I bought good second-hand cars. If you can write it off for tax purposes, leasing may make more sense. Run the numbers.

Both. I have accessible savings for emergencies and actively save for planned expenditures, like a trip or a major purchase. Everything beyond that is invested with a conservative investment strategy.

Yes and no. We don’t have a spreadsheet or a formal budget for regular expenses anymore, as we know where everything goes and how much our lifestyle costs. We review expenses regularly and save for trips so that all costs are pretty much covered before we leave. I do use my banking app to keep track of expenditures by category. When I was a stay-at-home mom, though, I was very strict about cash-flow management.

I think in general having a plan is important, and it should be as formal as you need it to be to keep yourself honest and on track.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Fabulous comments from Doretta for Canadian consumers! Reviewing expenses regularly and saving for travel or other big ticket items is essential.