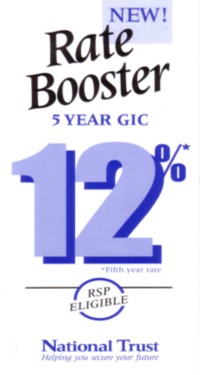

Clearly Toronto in 1993 was some kind of bizarre fantasy world. The Blue Jays won the World Series (again), the Leafs came within one goal of the Stanley Cup finals, and Bay Street was paying 12% on GICs during a year that saw 1.7% inflation.

Back here in the real world, most RRSP investors still like to keep at least a small part of their portfolio in cash. They may want to save their stock, bond or ETF distributions for several months before reinvesting them. Or they may want to “keep some powder dry” as they wait for opportunities to buy into an asset class that looks underpriced. Either way, it helps to have a safe place where you can stash some cash and earn a wee bit of interest, even if it isn’t 12%.

GICs and money market funds have long been the usual places to park cash in a registered account. The problem is that GICs are are not liquid: they’re not cashable without forfeiting the interest, and you can’t add to them each month. Money market funds are more flexible, but these days their yields can be neatly rounded off to 0% after fees. Fortunately, there are alternatives, though many investors don’t even know they exist.

An alternative to money market funds

Several Canadian financial institutions offer high-interest invest savings accounts that can be held inside a registered account at a discount brokerage. These products have a FundServ code, which means they can be bought and sold just like mutual funds. These little-known products combine the best features of GICs and money market funds.

First, investment savings accounts have no MER, and no fees or service charges. They pay a fixed rate of interest, usually calculated daily and paid monthly. You can add or withdraw money at any time, and transactions usually settle the next business day. Perhaps best of all, investment savings accounts are fully insured by CDIC for up to $100,000.

Here are some options to consider for the cash component of your portfolio:

Before using any of these products, call your discount brokerage to ask about them, quoting the FundServ numbers listed above. Your brokerage likely won’t offer all of them, and it may not allow you to trade them easily online. (When I made a deposit in the RBC fund through Scotia McLeod Direct Investing, I had to place the order by phone and it took two days to settle.) Brokerages may set their own minimum deposits, and may charge early redemption fees or other potential charges.

Some of these funds also disclose that they pay the dealer a commission of 0.25%. It’s not clear to me whether this is deducted from the posted interest rate, nor whether this fee applies to investors who purchase the funds through a discount brokerage as well as those who use an advisor. If any readers can help answer these questions, I welcome you to leave a comment below.