How much money do you need to retire in Canada? Is it really $1.7 million?

While $1.7 million is a big number, it’s possible to retire in Canada on that amount, if you start an RRSP early in life and contribute to it every year.

Advertisement

While $1.7 million is a big number, it’s possible to retire in Canada on that amount, if you start an RRSP early in life and contribute to it every year.

If you’re just starting out on the long road to saving for retirement, you may have heard about BMO’s recent poll, which found that Canadians say they will need $1.7 million to retire.

Because of inflation, according to the press release, that number is 20% higher than it was in 2020, when it was $1.4 million. I wrote my initial take on the poll on my own site, citing the Canadian Press article in the Financial Post as my main source. I wrote that you’d have to put away $42,400 every year in a registered retirement savings plan (RRSP) for 40 years (between the ages of 25 and 65) to reach $1.7 million. That’s more than double what even top earners are allowed to contribute. But, as you can see below, if you start saving in an RRSP early enough, you won’t need to save nearly that much each year.

Certainly, I sympathize with the Canadian millennials or gen Zers feeling discouraged by such a huge number. At a 4% rate of return (ROR) a year, $17,000 a year in RRSP contributions for over 40 years should get you to $1.7 million. And, as I wrote on my blog, my quick-and-dirty take assumed a 4% ROR, either from fixed income (such as guaranteed investment certificates, a.k.a. GICs) or Canadian dividend-paying stocks. Those assumptions may seem unduly conservative.

To follow up for MoneySense, I reached out to several experts to put more flesh on my guesstimates. Turns out, I was on the money, according to Erin Allen, vice president of online ETF distribution for BMO ETFs.

“I would agree with your conservative 4% ROR on the investment portfolio, and that would likely be how we would frame it as well,” says Allen.

Again, with an annual 4% ROR, $17,000 annual RRSP contributions should get you to $1.7 million over 40 years. But if you invest in your 20s, you won’t need to save anywhere close to that much because of compounded investment returns that are tax-deferred inside an RRSP. Because of the added value of time in the invested money, even the modest 4% compounded annual investment returns will, over the course of 40 years, get you to the retiree’s promised land.

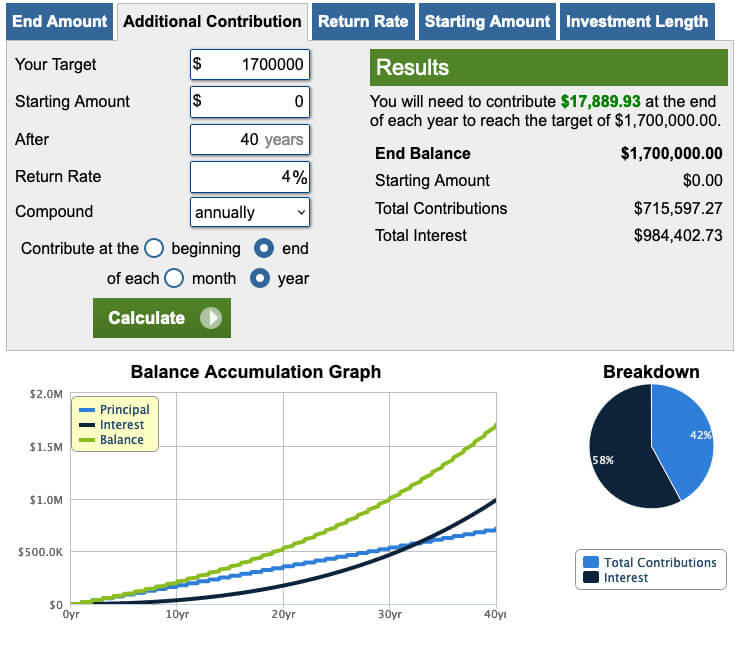

According to Allen’s estimates, using calculator.net, if you can annually earn a conservative 4%, you’d need to contribute $17,900 (rounded) at the end of each year to reach $1.7 million by end of year 40 of investing. That breaks down to $716,000 in total contributions, and another $984,400 in interest payments.

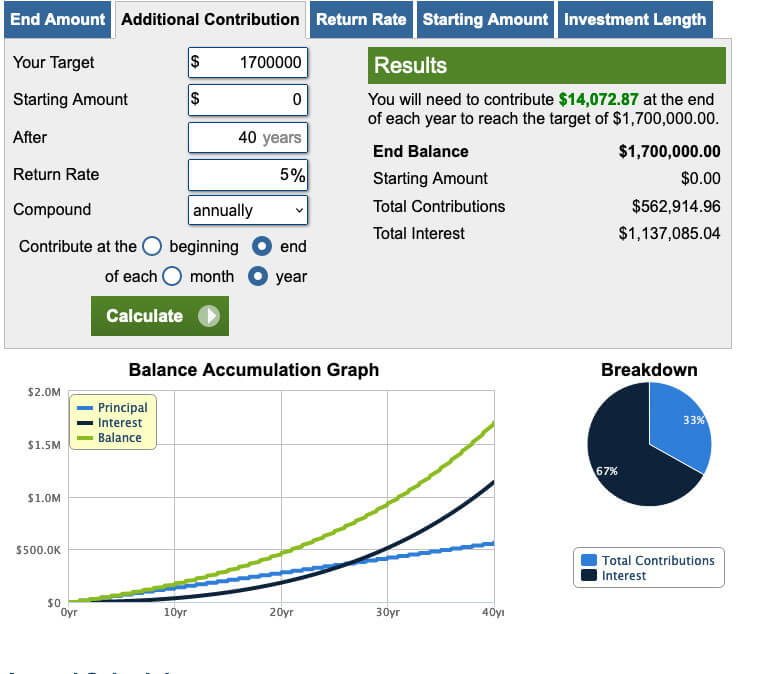

If you end up earning more than 4%, you could contribute even less money to your RRSP. At 5% a year, you’d need to annually contribute only $14,073 (rounded) for 40 years to reach $1.7 million. That breaks down to $562,915 in total contributions and $1,137,085 earned with interest.

Matthew Ardrey, a wealth advisor for TriDelta Financial in Toronto, says his client projections assume 5% return net of fees with 3% inflation. He uses a portfolio of stocks, bonds and alternatives. “I try to lean towards being conservative. When I get the Morningstar numbers from the financial planning program, [it] gives a balanced portfolio a return of 4.55% gross of fees,” he says.

Ardrey also considers how long his clients are planning to be in retirement, their life expectancy, marital status, the types of investment accounts, and how much they want to spend in retirement, as well as desired levels of Canada Pension Plan (CPP) and Old Age Security (OAS) payments. “Finally, when I do my projections, I also do a Monte Carlo stress test to see how things are if less than perfect,” he says.

What’s the “Monte Carlo stress test”? That is taking many costly events into account, including worst-case scenarios. Ardrey tests to see how much retirees with $1.7 million could spend assuming a paid-off home and full CPP and OAS for each spouse.

Using that $1.7-million example, he found that a Canadian couple could spend $8,500 per month under ideal conditions with a 4% rate of return. However, the stress test reveals that this scenario has only a 57% chance of success. By lowering spending to $7,000 per month, the probability of success rises to 97%.

A similar story is told when using a 5% return after fees. “Ideal conditions get them to $9,250 per month of spending under ideal conditions,” Ardrey says. “And to get to a likely probability of success, they need to reduce their spending to $8,000 per month.”

It’s not that straightforward. Of course, a lot of variables can come into play.

First, as expected, singles have a tougher time than long-term couples. If you’re one-half of a couple, each partner needs to save half the $1.7 million, which is $850,000 each.

Second, those with classic defined benefit (DB) pension plans in place may not need anywhere near $1.7 million saved to retire. If they’re inflation-indexed, many government workers and some private-sector employees (often those with unions) may find their DB pensions alone are worth $1 million, if they hang on to their job for 40 years.

Certified Financial Planner Steve Bridge of Money Coaches Canada commented on a Twitter thread about the BMO poll, saying, “a couple with two DB pensions may need $0.” On the other hand, Bridge (he’s @SteveMoneyCoach on Twitter) says: “Someone with no pension and wanting an expensive retirement lifestyle (say $200,000 a year) and retiring at age 50 would need many millions.” Especially if they plan to stop working by age 50.

Someone with no pension and wanting an expensive retirement lifestyle and retiring at age 50 would needs many millions.

— Steve Bridge, CFP® (@SteveMoneyCoach) February 10, 2023

It also depends on CPP, OAS, real estate situation, health of the individual, and other factors.

It’s tougher if you’re a private-sector worker with a group RRSP or a non-inflation-indexed pension than if you are a public-sector worker with an inflation-linked DB pension backstopped ultimately by taxpayers. In the former case, the $1.7-million estimate is more realistic. But the nest egg doesn’t have to only come from RRSPs. There are also tax-free savings accounts (TFSAs), non-registered savings and maybe an employer-sponsored defined contribution plan or group RRSP, if that’s accessible to you.

Thirdly, even if you lack an inflation-linked employer pension, all Canadians who have lived and worked in Canada for even a few decades can apply for CPP (as early as age 60) and OAS (as early as 65). Those two benefits are the equivalent of inflation-linked DB pensions. And the longer you delay receiving those benefits (say, ideally to age 70), the less you’ll need in your other retirement savings.

For example: When TriDelta’s Ardrey included an employer pension annually paying $40,000 indexed to inflation instead of an RRSP for one spouse (leaving the other with an $850,000 RRSP), he says, “the results are similar though slightly better in both cases. The probability of success rises about 10% to 15% in each case, while not moving to 100%.”

Nothing moves in a perfect straight line. Also, if these funds weren’t in RRSPs, but instead in TFSAs or taxable accounts, the numbers all change.

“That said, the RRSP does still have real value for those who have high earnings today and low in retirement,” says Ardrey.

Here’s what Canada’s pre-eminent retirement expert, retired actuary Malcolm Hamilton, says about the BMO poll: “My views on the amounts Canadians need to save for retirement have not changed. Couples who buy and pay for their homes and raise two children will find that, once the children leave home and their debts are paid off, can live comfortably on about 50% of their employment income—remembering that if you cut your income in half, your taxes reduce by much more than 50%. CPP and OAS will provide most of what the typical couple needs. If people can afford to save some additional money, they should do so, but no one should worry about saving less than financial planners or financial institutions want them to save.”

Throughout his working life, Hamilton says, he was told that baby boomers were not saving enough and would never be able to retire. “I disagreed,” he says now. “Most boomers have now retired voluntarily at or before age 65, much earlier for government employees, and they are enjoying an active retirement.”

Private wealth advisor Aaron Hector, Certified Financial Planner and Registered Financial Planner (RFP) with Calgary-based CWB Wealth, doesn’t put much credence in target figures like $1.7 million. So he declines to say if the number is a reasonable average. “That was a figure based on what 1,500 online respondents indicated they thought they would need; however, if I’ve learned anything as a financial planner, it is that no single individual or couple is representative of the average. Rather, each individual situation is specific to their facts.”

Hector says $1.7 million to one person will mean something very different for another. “Perhaps one person has $1.7 million inside an RRSP, and another has $1.7 million inside a combination of non-registered and TFSA accounts. On an after-tax basis, the money outside the RRSP is worth a lot more. These are not ‘apples to apples’ comparisons.”

Hector says he understands the natural desire to compare financial situations, but he stresses that “there is no ‘one size fits all’ [solution] when it comes to financial planning… The only way to determine if you are really on the right track for your retirement is to focus on your own unique circumstances. Then start planning for that.”

Of course how much money you need to retire is dependent upon where you live or end up living.

Kyle Prevost, the columnist behind MoneySense’s weekly “Making sense of the markets this week,” suggests $1.7 million is “probably more than most people need, especially if you own your home…. Most upper-middle-class Canadians—especially those with children who’ve moved out, [and own] their home—are significantly overestimating what they will spend, and how little tax they will pay in retirement.”

However, regional differences should be considered, says Prevost. If you live in Manitoba and have $1.7 million in savings, “you’d definitely be in the top 1% of retirees… Even in Calgary, Montreal, Edmonton, Halifax, maybe Ottawa and Victoria, that’s likely more than you’d need for a comfortable retirement as a couple, assuming decent CPP and maximum OAS.” However, those in Vancouver or Toronto who don’t own their own home may “need a fair amount more than $1.7 million.”

So, do you need $1.7 million to retire? That’s up to you and, if you have one, your planner.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

In 2014 I sold off after a FALSE accusation claiming that I said “something” about country to “someone” unnamed had my $100k/yr job go bye-bye.

I started with $275k, toured Europe, began wintering in Texas until the virus mandates. I’ll be out of money around December.

Live frugal. Buy a good used motorhome. Death to Schlumberger.

1) it’s 1.7m if you retired today, what will a realistic inflation eroded amount look like for a millenial or Gen Z? 2.5m? 3m?

Assuming that: young people don’t have DB pensions (they have pretty much gone the way of the do-do for this generation of workers), and that social security will have been somewhat depleted due to demographic shifts, not enough housing for new immigrants and a hot, expensive housing market, etc.

2) if a young person today is expected self-fund much of retirement (especially young professionals or small business owners, or members of the gig economy), how could an average Canadian who makes on the order of $50,000 per year be expected to save roughly 18,000 annually and still afford to own a home? With current interest rates, just the latter is nigh impossible for all but high income earners, and with lower rates home ownership is in reach, but retirement savings would have to be foregone.

It does feel like the 40 and under crowd presently will have to make some major, unanticipated sacrifices that the 2-3 generations above them did not.

The younger you are in that cohort, the more sacrifices you’ll have to make in order to achieve at least one of the goals that previous generations took for granted.

This is, needless to say, unsatisfactory, and it would be nice to see empowers and the government alike step up to tackle these challenges. Bringing back DB pensions would be a huge step (maybe make them the only option, so employees aren’t forced to tackle becoming an investment expert on top of their jobs, long commutes, and parenting).

That’s just my two cents, though.

A 4% rate of return is insanely low, and no one should settle for a set of investments that return so little. I started investing at age 32 in broad market equity index funds, paying 0.05 in fees, and putting away a healthy average of $1500 monthly. I now have over $650k and I’m 47. At current rates of return, taking into account bad years, I will have about $3M by age 65.

you are speaking unlogic, as who can save $17000/year or even less? which is about $1000 and up each month. An employee who makes $100.000 gross, will get monthly net$6000-7000 mostly, so according to inflation and prices increased and mortgage interest rate, they will pay monthly $3000 or up for mortgage house of $500000 plus property tax, hydero, in addition to grocery $800-$1000,car, or public transportation, internet, phone, insurance, car insurance, gas, clothing, entertainment, vacation, personal, charity, education for themselves or kids, savings, tv…… so if you make a calculation you find that money is not enough to save even$500/month since they start working at age20.This for the people who make $100.000/year which are not common, as average canadian income -$40000/year gross. people have 2 or more jobs to just survive not to have a comfortable life. The average income should be$60000_$70000 /year and government should help and control the increaseing of the prices and business owners, especially for basic needs as food and clothes. please be logic not talking nonsense.

I find what a lot of people don’t realize is that you don’t need as much money when you retire as you do beforehand. Reasons? Mortgage is paid off, kids have long moved out of home saving all kinds of extra expenses, less home maintenance required, receiving CPP & OAS payments, less activities such as shopping, travelling (much depending on age and health), less gas for driving (not having to drive to work daily). The list goes on.

BMO has been out gunned!

It is now $2,000,000.00 (and that may be US$)

It is all relative. How old are you in able to achieve this ridiculous (at present) amount? What life style do you envision? Are you minimum wage, middle class or a six figure salary. Do you want/have a family? How many members? Etc, etc, etc.

Sit down, budget and save what you can!

RICARDO

A critical question is whether the 4% rate of return assumption is nominal vs real rate of return.

If it’s nominal, and inflation is 4%, you’re not growing your wealth at all.

@Ricardo, we have had flat decades in the markets before, and the DCF (discounted cash flow model) suggests another weak decade for equities is ahead of us. The last 15 years have been an amazing time to be in the market (great timing for you!), but do not in the least predict the next 15.

I agree with Jimmy. I was actually on this track until I got a kid in 2010 and stopped trading for lack of time to watch the kitchen. I have not earned even 4% since then. Although I was trading investment funds, I would say that index investing was then and still is as profitable and needs less personal attention. I am 64 and have saved $2.4 million, earn $120 k/annum, and spend $185 k/annum on household expenses. Of course, as a single I did not live so – no wife, no kids, no house, no renos, no Costco, etc.

Don’t worry. The apocalypse is here!

I found it quite controversial as someone saved $1.7M upon retirement- say at 65 years old in RRSP then it will not be qualified for OAS as the compulsory annual drawdown upon conversion to RRIF plus the CPP plus any of the non-registered investment dividend income plus any capital gain from the non-registered investment will definitely bump its annual income over the OAS claw back threshold limit!! I can’t find anyway to save any taxes.

The simple parameter is one will live on what one’s cashflow provides. Unless, of course, one is super rich.

$1.7 million is ridiculous, nobody is going to save that while paying off houses and raising kids. It also assumes that you don’t touch the principle. If I saved that much I would def. spend the principle, over thirty years that is $56000/year without growth. Add on CPP and OAS and you are over $70000. What about a more realistic goal of $600000 for a couple, that would provide $20000 per year if spent down over thirty years (no growth) and add on OAS and CPP for both and you get over $20000 for a combined $40000 income, sell the house or reverse mortgage and you have another income source. An lets face it, as we age we spend less, no savings for retirement, less travel, no childcare expenses, and in retirement no CPP, EI, or other paycheck deductions. If you off yourself after 20 years of retirement, the initial spend on the savings jumps to $30000.

IMO its meaningless to throw a lump sum retirement figure out there. What ballpark $ monthly spend rate does that ballpark $1.7M assume? A 4.5% spend rate from the $1.7M computes to $6,375 per month. I consider that ballpark spend rate to be quite lofty for most debt-free Canadian retired couples.