The hybrid approach: Passive + active investing

Couch Potato portfolio not for you? Try the "Hot Potato"

Advertisement

Couch Potato portfolio not for you? Try the "Hot Potato"

There’s nothing like indulging in a few potato chips on a hot summer day with a cold beverage close at hand. You might prefer the salty kick of regular potato chips or maybe you like to spice things up with a little barbecue flavour, or perhaps, a touch of jalapeño.

When it comes to investing, the MoneySense Couch Potato represents the regular option for portfolios. It’s not fancy, but it is effective and has been very satisfying over the long term.

Investors looking for a little more spice might consider an aggressive style of indexing that has provided fiery returns without much downside. Call it the “Hot Potato,” if you will.

Before getting to the hot stuff, it’s useful to remember what the regular Couch Potato has to offer. In an effort to highlight its merits, I’m going to focus on a portfolio that’s composed of equal amounts of four basic asset classes. It starts with the stability of Canadian bonds, which are represented by the DEX Universe bond index. Canadian stocks and U.S. stocks provide upside potential and are tracked by the S&P/TSX Composite and S&P 500 respectively. Finally, international stocks round out the portfolio’s holdings via the MSCI EAFE index.

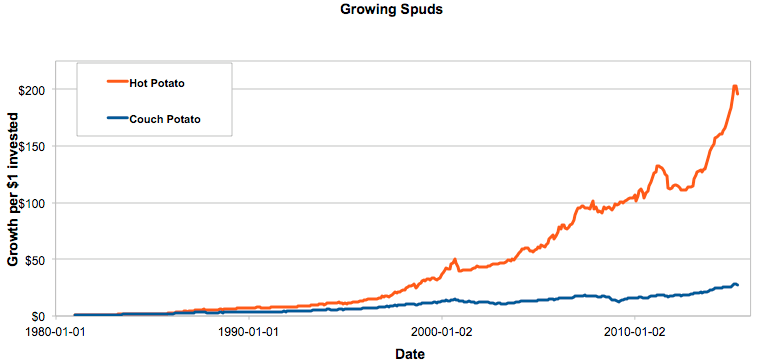

A Couch Potato portfolio composed of an equal mix of the four indexes, rebalanced annually, performed quite well over the years. It gained an average of 10.1% per year from the start of 1981 through to the end of April 2015. The very respectable showing was helped along by a general decline in interest rates and the expansion of stock market valuations.

Investors looking for a little spice might consider following an admittedly unconventional path with the Hot Potato. It tries to hitch a ride on the hottest asset of the day. That is, instead of investing in an equal mix of the four asset classes, the Hot Potato plunges into the single asset class that fared the best over the prior year.

Hot Potato investors who rebalanced each month into the top performing asset class of the prior 12 months gained an average of 16.6% annually from the start of 1981 to the end of April 2015. They beat the regular Couch Potato by a whopping 6.5 percentage points annually. You can examine the return history of both in the accompanying graph.

While the Hot Potato was more volatile than the regular couch potato, it came mostly from the sort of upside volatility that few investors complain about. It was also nimble enough to sidestep several market crashes along the way.

The Hot Potato’s largest drawdown came when the Internet bubble popped and it declined 21.4%. But the portfolio bounced back almost 2 years faster than the Couch Potato which fell 29.2%.

The Couch Potato’s biggest loss was 31.1% and it occurred during the 2008 collapse. Its portfolio didn’t recover until 2011. The Hot Potato fared better because it was in bonds for a good part of the time. It fell 10.0% from its 2007 highs to its 2008 lows and fully recovered by the summer of 2009.

It is important to point out that good past performance does not guarantee that either portfolio will fare as well in the future. Indeed, we’re in a period of low interest rates and relatively high stock market valuations, which suggests that returns might be muted in the future.

In addition, the Hot Potato is more active than the regular couch potato. It made an average of 1.7 large trades per year from 1981 to 2015. As a result, trading costs (commissions and bid-ask spreads) will reduce its returns and are not factored into the numbers above. (The method also frequently triggers capital gains taxes in taxable accounts.) Hot Potato investors should try to minimize trading costs by favouring liquid low-cost index funds or similar exchange-traded funds.

Before leaving you to nibble on the portfolio of your choice, I have to confess that I’m not a big trader myself. Nonetheless, I savour the idea of being able to outperform the Couch Potato using its own ingredients.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Is it work?