When I update the performance of my model portfolios, the returns I use are based on the annual change in each fund’s net asset value (NAV). That’s the most appropriate way to measure an ETF’s performance against its benchmark index, but it may not be the return investors actually obtain in their own accounts. If you calculate your portfolio performance using your brokerage statements, you’re more likely to get the fund’s market price return, which may be quite different.

Let’s back up and make sure the terminology is clear. An investment fund’s net asset value (NAV) is the total value of all its underlying holdings. To use a simple example, if an equity fund’s portfolio is valued at $1 billion and there are 50 million units outstanding, its NAV is $20 per unit. In North America, a fund’s NAV is calculated once per day at 4 pm EST, when the New York and Toronto exchanges cease trading.

A mutual fund always transacts at its NAV, because orders are filled only once per day after the markets close. In other words, its NAV is also its de facto market price. But that’s not true for ETFs: their net asset value is still calculated at 4 pm, but they trade throughout the day, so their market price can change from minute to minute—just like an individual stock.

Of course, an ETF’s market price reflects its net asset value (NAV), so in theory these should always be very close. The ETF’s market makers estimate the NAV throughout the trading day and post bid and ask prices accordingly: if the NAV is $20, you might expect a bid of $19.99 and an ask of $20.01. But in practice things are rarely that tidy, and sometimes an ETF’s market price can differ substantially from its net asset value—at least temporarily.

These discrepancies can cause differences in the way an ETF’s returns are reported, so most providers include both market price and NAV performance on their websites. Here, for example, are the numbers for the BMO Mid Corporate Bond (ZCM):

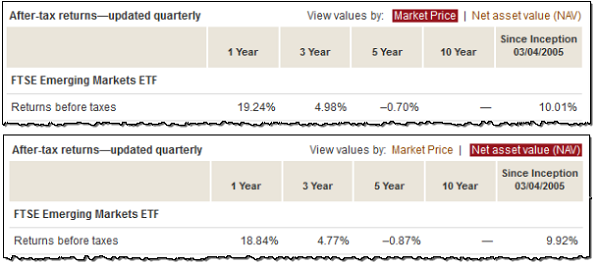

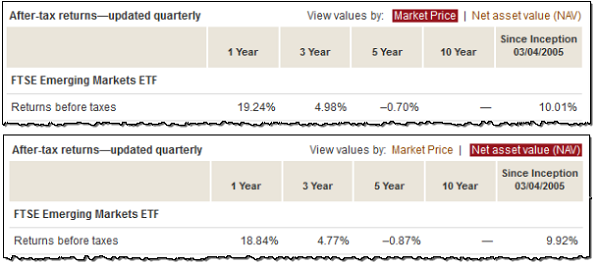

And here’s how Vanguard reports them on its US website, using the Vanguard FTSE Emerging Markets (VWO) as an example:

As you can see, even over two or three years, the discrepancy can be 20 to 40 basis points. For index investors who often choose one fund over another because of small differences in fees, that’s a big deal. And in some cases the gap is much larger: in 2011, the iShares BRIC Index Fund (CBQ) lost 22.35% on a market price basis, but its NAV declined 23.51%, for a difference of 116 basis points. (Current market price returns are temporarily unavailable on the iShares website.)

Should I be worried?

This difference between market price and NAV returns no doubt raises a lot of questions. What causes the discrepancy? Which one is a more reliable measure of an ETF’s performance? And should I be worried about all of this?

To get some insight I spoke to Pat Chiefalo, director of ETF research and strategy for National Bank Financial. In general, the answer to the last question is no, you don’t need to be overly concerned, especially if you’re a long-term investor who holds your ETFs for many years. “Point-to-point is not a good indication of which ETF actually performed the best. Because nobody buys their ETF on December 31 and then sells it on December 31 following year.”

Chiefalo explained that large discrepancies occasionally indicate a genuine problem with the way the ETF is managed, but more often they reflect a pricing anomaly that is short-lived. “When you see a big difference it’s very important to know why,” he says. “We correct for a lot of the stuff in the performance numbers to make more apples-to-apples comparisons, and to see whether the problem was real.”

Unfortunately, retail investors simply don’t have the tools to investigate these discrepancies themselves. If they try, they’re likely to make bad decisions based on incomplete or misleading information. “I’m not going to say all ETFs are perfect, but there are a lot of reasons why someone could jump to conclusions when actually everything is fine,” Chiefalo says. So next week I’ll look more deeply into the reasons why market price and NAV can vary, with the help of Chiefalo and other specialists.