Why GICs beat bond ETFs in taxable accounts

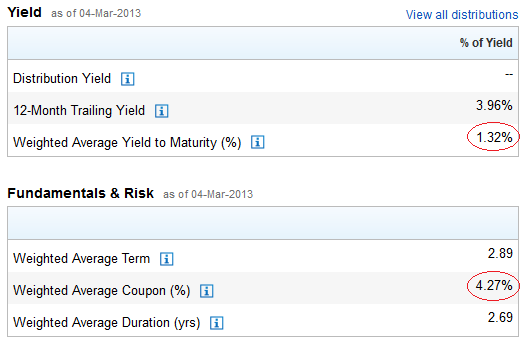

Last October, Justin Bender wrote a blog post explaining why GICs are more tax-efficient than bonds. The blog caught the attention of The Globe. Many investors are still surprised and confused by this idea, however, so I thought it was time to take another look.