25 timeless personal finance tips from MoneySense

For 25 years, MoneySense has helped Canadians make better financial decisions. Here’s a sampling of our work: a roundup of the best advice from our experts.

Advertisement

For 25 years, MoneySense has helped Canadians make better financial decisions. Here’s a sampling of our work: a roundup of the best advice from our experts.

To help celebrate MoneySense’s 25th anniversary, we are republishing (and updating) an article from our June 2014 issue. The editors collected timeless financial advice and money tips from the archives. Editor- and expert-approved, and fit for 2023 and beyond.

One of the most effective ways to build your savings is to set up pre-authorized biweekly or monthly contributions that automatically move money from your paycheque to an investment account. Get that money into registered retirement savings plan (RRSP) or tax-free savings account (TFSA) before you have a chance to spend it and you’ll barely miss it. You’ll also get the benefit of dollar-cost averaging, buying more shares when security prices are low and fewer when prices are high. This can help reduce timing risk and the impacts of volatility.

Tax-sheltering your money is an easy way to boost savings. RRSPs let you defer tax on a portion of your income until retirement, when your tax rate will likely be lower. The RRSP’s other big benefit is that the investments grow tax-deferred until you make withdrawals, meaning you don’t have to pay capital gains taxes when you sell your investments, nor do you have to pay tax on the annual dividends or interest.

TFSAs are another great way to grow your investments while minimizing taxes. Unlike with RRSPs, money put into a TFSA earns no upfront tax refund, but the government doesn’t get a single dime of your money when your investments earn a return or when you withdraw any money.

It’s futile to start investing if you’re also struggling to pay off credit cards or unsecured lines of credit with interest rates as high as 28%. By comparison, the long-term expected return on stocks is 6% to 8%. “Getting rid of high-rate debt earlier will get you ahead,” Certified Financial Planner Jason Heath has said. He remains a MoneySense columnist today, contributing to Ask A Planner.

Supercharge your savings by reinvesting RRSP tax refunds. If you contribute $5,000 to an RRSP each year and reinvest the $1,000 to $2,500 refund it generates (depending on your tax bracket), after a decade, your savings could be as much as 50% higher.

Get up to 3.50% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.65%.

Earn 4.25% for 4 months on eligible deposits up to $100k. Offer ends September 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

Few people become a millionaire overnight. Building wealth takes time, so have realistic expectations about what to expect from your investment returns. Expecting to earn 12% per year probably isn’t realistic no matter how much risk you’re willing and able to take. These days, you probably shouldn’t expect long-run returns of more than 3% on bonds and 7% on stocks, meaning you’re lucky to get a 5% return on a balanced portfolio.

Hidden costs can cause irrevocable damage to your investment portfolio. You may not see it on your quarterly statements, but investment management costs steadily erode returns all the same. Mutual fund investors often unknowingly pay management expense ratios (MERs) between 2% and 3% every year. “If your fees are 1% or lower, you’re doing OK,” said actuary Malcolm Hamilton in MoneySense’s June 2014 issue. “But anything over 2% is causing so many problems. At 2%, fees will eat up a third of your income over a lifetime. That’s considerable.”

MoneySense reader Helen said: “Fees matter. They can significantly erode investments. This spurred me to learn about ETFs and the couch potato [strategy], as well as the importance of asset allocation. No one—including advisors—consistently beats the market benchmarks.” Check out MoneySense’s annual report on the best exchange-traded funds (ETFs) in Canada.

You can’t put a portfolio together until you’ve identified your specific goals and developed a plan for reaching them. But realize your original plan will never come to fruition exactly as envisaged. “No one has any clue what the landscape will look like 30 years from now,” said Hamilton. Plans must be revisited yearly and adjusted due to changes in your personal life: job loss, birth of a child or divorce, for example. “What’s important is the process of looking ahead and adjusting your plan and changing it all the time,” he said. “That process is navigation.”

Get to know your financial advisor—that is, check out their credentials and employment history, verify licensing and check for any disciplinary action. Don’t be passive—lead the conversation and take the time to understand your portfolio.

If you are not getting the input you need, your fees are high, or you’re lacking confidence in your advisor, you shouldn’t stay with them just for the sake of it. It’s your money, and you need to do what’s in your best interest.

Avoid complex products that look too good to be true or can’t be explained easily, according to Dan Hallett, vice-president of High View Financial Group. He told MoneySense: “Products are sometimes structured to take advantage of people’s lack of understanding.” Instead, build your portfolio with individual stocks and bonds, guaranteed investment certificates (GICs) and low-cost funds that don’t use leverage or other exotic strategies that promise more than they can deliver.

Knowing your portfolio earned 10% doesn’t tell you much unless you know the context. For instance, if your benchmark returned 15% over the same time period, that might be cause for concern. If you have an advisor, ask for your personal rate of return on an annualized basis. But even a Canadian DIY investor should measure portfolio performance to determine whether a strategy is on target.

We all want our kids to be responsible and well-mannered. But how about being financially savvy? Teach your children the value of a dollar by showing them how to grow their money. For adult children, 18 and older, contributing to a TFSA is a good idea. But younger kids need short-term goals, like saving for a new bicycle. The best way to teach, of course, is by example.

Also, opening a registered education savings plan (RESP) for them is a good way to prep for their future. Check out MoneySense’s Student Money Guide for both parents and students.

Too many people don’t look at their portfolio as a whole and instead focus on the finer details because they seem more interesting, said Hallett. “It’s natural with the amount of information coming at you online and through the news to feel prompted to do something with your portfolio as a response. Most of the time that’s not a good idea.” Instead, all portfolios should be driven by the fundamentals of selecting an appropriate asset allocation and sticking with it.

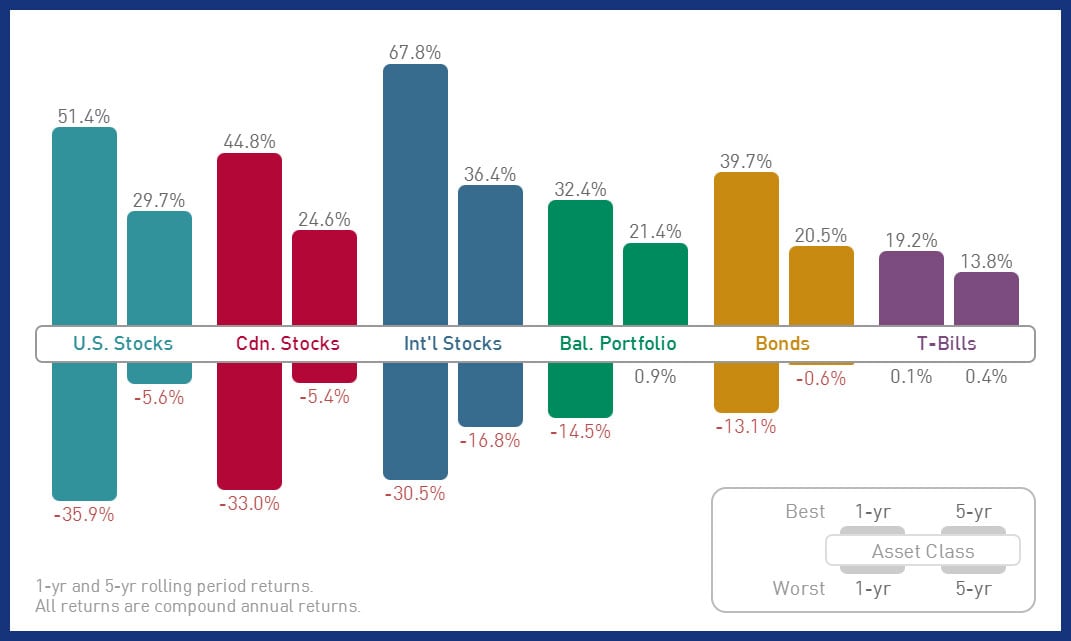

Many investors keep 100% of the equity portion of their portfolios in Canadian stocks, something academics call “home-country bias.” Sure, Canadian stocks may feel comfortable, but don’t forget that Canada represents just 3% of the global stock market. A well-diversified portfolio should tap into global stock markets to increase your investment opportunities and reduce the risks from a crash in one region.

Many advisors in Canada receive commissions from the financial products they sell. This can create two potential conflicts of interest:

A better alternative to consider may be a fee-based advisor who is paid directly and transparently by you, meaning you’re more likely to get unbiased advice.

Ill-chosen stock purchases are one of the most common and costly mistakes made by impulsive DIY investors. Even prudent investors can make overzealous tactical moves based on current market conditions, ditching stabilizing assets from their portfolio in favour of more stocks. Always remember: speculating isn’t investing—it’s gambling. So ask yourself if the money is worth losing when jumping on the bandwagon of meme stocks and other short-lived, risky trends.

The best way to save on insurance is to give the same company all of your business. That alone will save 5% to 10% annually on your premiums. Simply raising the deductible on your home and auto insurance can see premiums drop by another 20%. But don’t stop there. If you’re shopping for disability insurance, consider a policy that begins paying out after 90 days of a disability rather than 30, which could cut your premiums in half.

Also, one reader told us: “My favourite MoneySense tip is simply to ask for an increase in your deductible on your home insurance in exchange for a lower premium. It saved me a few hundred dollars with just one phone call,” said Isabelle. Just make sure you can afford to cover the same cost without going into debt. Another tip is to pay your insurance premiums annually instead of monthly. Your insurer may lower the cost of your premiums if you pay up front.

Forget about doing renovations just to boost the resale value of your home—in many cases, they won’t. Many of us will be staying put a lot longer than we think, so focus on doing renovations that actually improve your everyday existence, such as adding space-saving closets or building a deck.

The average home owner spends $3,840 a year on water, gas and electricity, up from $2,234 10 years ago. And those costs are likely to keep rising. However, here are some easy upgrades that will trim your bills: Installing a water-saving showerhead, purchasing an energy-efficient fridge, air-sealing windows and doors, or getting a programmable thermostat could all help your savings grow over time. Here are more tips on how Canadians can save on household bills.

Putting more down on your mortgage could save you thousands in interest charges. Consider simple strategies like opting for accelerated biweekly payments (so you make 26 payments per year instead of 24). Also, consider applying any bonuses from work or other windfalls to your mortgage up to your annual prepayment limit. Even a small amount can go a long way. For instance, an annual lump sum payment of just $1,000 on a $500,000 mortgage at 5% over 25 years will decrease your mortgage amortization by about one year and eight months.

People often underestimate the true cost of commuting, both in terms of stress and dollars. In 2014, MoneySense pointed to a calculation by the Canadian Automobile Association: A couple can spend more than $200,000 over five years making the one-hour commute from Barrie, Ont., to Toronto in separate Civic LXs. When adjusted for inflation, that number becomes $254,297.19.

If you work in a major Canadian city, those costs justify paying a little more for a condo or townhouse in the city and taking public transit or walking to work.

Many of us have basements or garages full of stuff we don’t need. Instead, build memories. Simple things like a family trip to the zoo, a cooking class with a sibling or even a saved-up-and-already-paid-for family vacation with kids or grandkids can build good memories that will last forever. Or consider giving your loved ones memberships to wine clubs, arts centres or aquariums. These cultural institutions rely on membership fees, so your support is invested back into your community.

Simply asking a polite question like “Can you come down a bit on the price?” is often enough to get yourself a deal. If you get a “no,” ask for free add-ons instead, like free delivery or a three-year warranty on an appliance. These things don’t cost the store a lot, but they could add up to big savings for you.

The longer you keep working, the better off you’ll be financially. Employer-sponsored defined benefit pensions pay out more the longer you stay. The Canada Pension Plan pays more if you start taking CPP at the latest possible age of 70, rather than the earliest possible age of 60.

Same goes for delaying the start of Old Age Security past the earliest possible age of 65. It can also be deferred to age 70 for a higher pension. If you’re counting on your investment portfolio, the longer you work, the more a portfolio has time to grow—and every extra year worked means one year less the portfolio has to last. If you enjoy work, think twice about early retirement. If not, you may need a career change instead.

The TFSA was introduced by the late federal finance minister Jim Flaherty, and it may well turn out to be the biggest favour Ottawa ever did for retirees. There’s nothing like tax-free income flowing to you in retirement, and that’s exactly what the TFSA was designed to provide. Unlike with RRSPs, you can keep contributing to TFSAs for your whole life.

Part-time work or a side hustle in retirement can provide structure, even for just a couple of mornings or afternoons a week. It also means you’ll continue to get out of the house and interact with other people. Plus, you may find the extra income welcome, which means you’ll have more money for retirement, or if already retired, you will have less of a need to draw down from your nest egg. Read How to make more money in Canada: 6 side hustle ideas.

Inflation can be a serious threat to long-term wealth. Even if you are extremely risk-averse, it’s prudent to keep at least 25% of your portfolio in stocks: preferably stable dividend payers that keep raising those dividends. (Check out MoneySense’s ranking of the best dividend stocks in Canada.) Other inflation hedges include real return bonds or ETFs that package them up, inflation-indexed annuities and gold/precious metals.

More food for thought on inflation…

| Food items | 1935 | 2014 | 2022 |

| Bacon (1 kg) | $0.68 | $11.10 | $17.10 |

| Sirloin steak (1 kg) | $0.51 | $19.54 | $26.39 |

| Flour (1 kg) | $0.07 | $2.04 | $4.65 |

| Sugar (2 kg) | $0.14 | $1.48 | $2.67 |

| Coffee (1 kg) | $0.83 | $18.43 | $18.70 |

| Onions (1 kg) | $0.09 | $1.93 | $2.37 |

| Potatoes (4.54 kg) | $0.14 | $5.99 | $10.33 |

| Eggs (2 dozen) | $0.31 | $3.25 | $7.74 |

| Butter (454 kg) | $0.28 | $4.52 | $5.67 |

| Grocery cart totals | $3.05 | $68.28 | $95.62 |

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Understand the difference between risk and volatility. The industry consciously conflates these 2 concepts.

Bring back the magazine in print!!!

Excellent advice!!

I agree. I miss the print version.

I think calculating your net worth on a quarterly basis would help in many of these areas.

I agree. I really miss the print edition.

Congratulations, MoneySense! You have been my go to since the days of your paper magazine, and have been an invaluable resource!

.68 cents in 1935 is $15.61 today

Congratulations, such a great influence and resouce for personal finance – we’ve enjoyed the great advice since day one, imho – Couch Potato investing should be higher in the list : )

Bring back the magazine!!!

I’ve always enjoyed reading Moneysense and will continue doing so for another 25yrs. I’ve encouraged my kids to do the same! Great practical information is invaluable. Thank you.

These tips are really helpful! It’s always good to refresh on personal finance strategies. I especially liked the part about budgeting for unexpected expenses. Thanks for sharing!