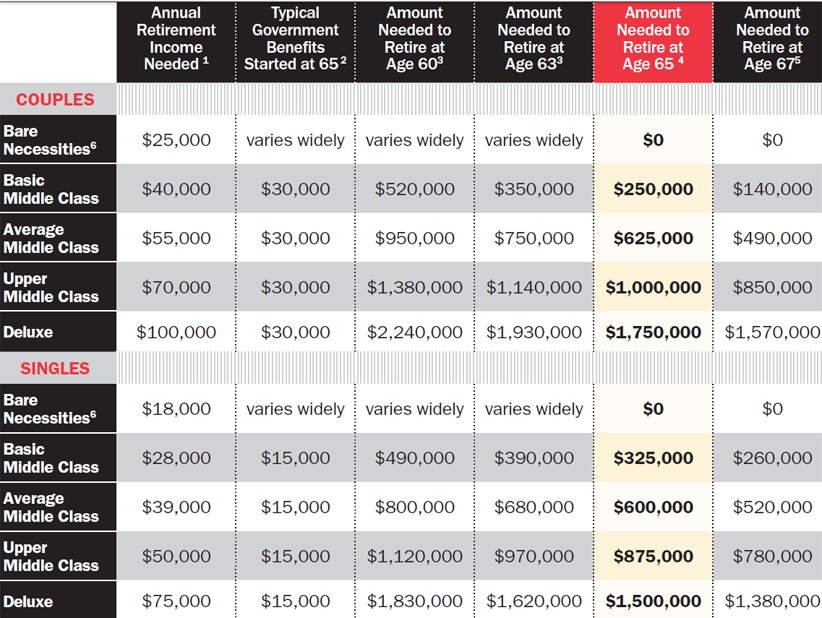

How much money will you need to retire?

We've calculated the nest egg you’ll need for different levels of income

Advertisement

We've calculated the nest egg you’ll need for different levels of income

Notes: (1) Retirement income is before tax. Assumes no debt in retirement and for all categories except Bare Necessities, a paid-for home. (2) Typical amount for OAS and CPP based on fairly long work career at average wages or better. Assumes OAS started at 65. People born after March 1958 will start OAS later and need to adjust calculations. Figures shown assume no employer pension (although employer pension income can be added to this column if applicable.) (3) Assumes initial withdrawal rate of 3.5% for retirement at 60 and 3.8% for retirement at 63, plus inflation. Adjustments also made for starting CPP at early retirement date and for bridging OAS equivalent until OAS start date. (4) Calculated by taking (annual retirement income minus government benefits) x 25. This assumes a withdrawal rate of 4% of initial portfolio plus inflation. (5) Withdrawal rate 4.2% of initial portfolio plus inflation adjustments. Adjusted for OAS and CPP start at 67. (6) Retirement income necessary for “Bare Necessities” derived from Basic Living Expenses for the Canadian Elderly by Bonnie-Jeanne MacDonald, Doug Andrews and Robert Brown, based on typical basic senior’s living expenses averaged for five Canadian cities. Amounts in study adjusted for inflation using Statistics Canada Consumer Price Index. Government benefits in this case comprised of CPP, OAS, and the Guaranteed Income Supplement and vary widely but ensure roughly that necessities at least are covered. People born after March 1958 have to wait longer than age 65 to collect OAS and GIS.

Read the full article, “What’s your magic number?”

Notes: (1) Retirement income is before tax. Assumes no debt in retirement and for all categories except Bare Necessities, a paid-for home. (2) Typical amount for OAS and CPP based on fairly long work career at average wages or better. Assumes OAS started at 65. People born after March 1958 will start OAS later and need to adjust calculations. Figures shown assume no employer pension (although employer pension income can be added to this column if applicable.) (3) Assumes initial withdrawal rate of 3.5% for retirement at 60 and 3.8% for retirement at 63, plus inflation. Adjustments also made for starting CPP at early retirement date and for bridging OAS equivalent until OAS start date. (4) Calculated by taking (annual retirement income minus government benefits) x 25. This assumes a withdrawal rate of 4% of initial portfolio plus inflation. (5) Withdrawal rate 4.2% of initial portfolio plus inflation adjustments. Adjusted for OAS and CPP start at 67. (6) Retirement income necessary for “Bare Necessities” derived from Basic Living Expenses for the Canadian Elderly by Bonnie-Jeanne MacDonald, Doug Andrews and Robert Brown, based on typical basic senior’s living expenses averaged for five Canadian cities. Amounts in study adjusted for inflation using Statistics Canada Consumer Price Index. Government benefits in this case comprised of CPP, OAS, and the Guaranteed Income Supplement and vary widely but ensure roughly that necessities at least are covered. People born after March 1958 have to wait longer than age 65 to collect OAS and GIS.

Read the full article, “What’s your magic number?”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email