The cost of retirement happiness

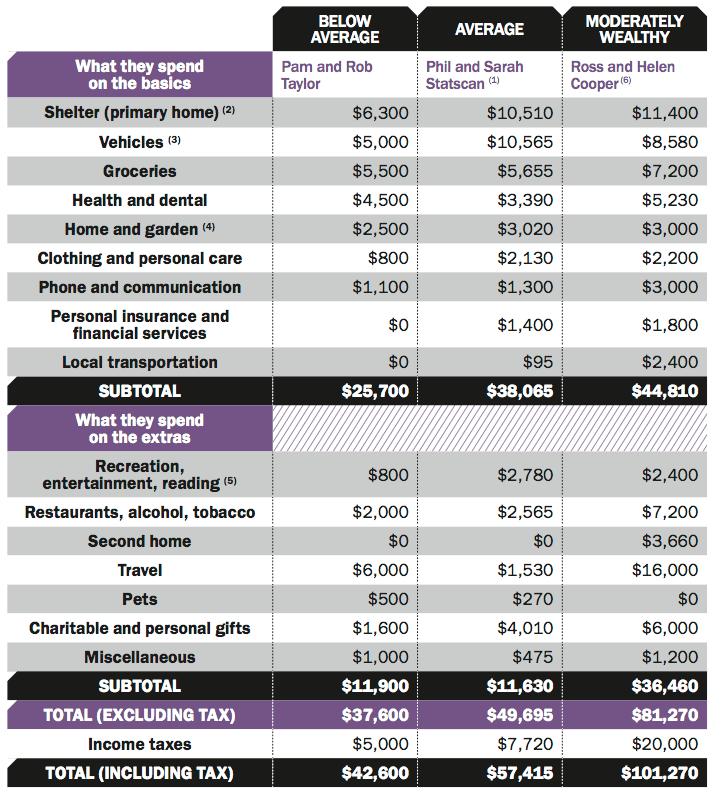

A look at three different budgets to help you plan your spending more thoughtfully

Advertisement

A look at three different budgets to help you plan your spending more thoughtfully

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

This is an incredibly useful study and very difficult to find. We are encouraged to build a budget for retirement but it is incredibly difficult to envision what that budget will be in 10+ years (and for younger people this may be 20+).

How about updating this – it is now 6 years old

Why is this so difficult to find?