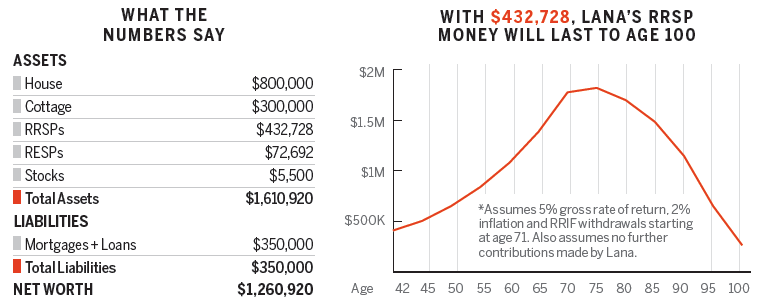

Am I on track to quit my job now?

This RRSP strategy will let this mother of two step away from the corporate ladder for good

Advertisement

This RRSP strategy will let this mother of two step away from the corporate ladder for good

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email