Sharing the wealth

Francine wants to sell her business and be fair to her kids in the will

Advertisement

Francine wants to sell her business and be fair to her kids in the will

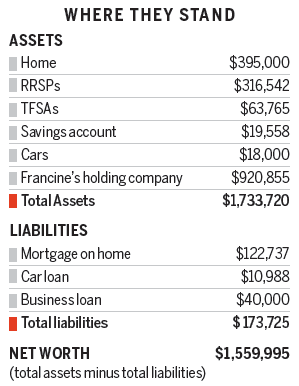

Francine Rousseau never thought she would one day own a business worth $1 million. But the 50-year-old self-employed software specialist from

Saskatoon has come a long way since those tough days as a struggling single mom to her then four-year-old son, Freddy. “It was 1999 and I had just quit my government job to start my own business when my husband Drew asked for a divorce,” says Francine, who’s now been happily married to her second husband, Gabriel, 58, for 14 years.

A small divorce settlement from that first marriage allowed Francine to put 10% down on a house with a little left over to help get her software business off the ground. Today, that same company pays her a healthy annual salary of $180,000. Yet, despite her success, she has always feared she could still end up penniless. “I have never forgotten how scary it was feeling like we didn’t have enough money to get by,” says the self-professed workaholic. “That fear is ruining my life.”

Francine worries. She worries she won’t have enough to retire on when she turns 55 and that her money isn’t invested in the right funds and she has no clue about what to do with her company when she does retire.

Probably her chief concern is her inability to make any type of retirement and estate planning decisions, particularly when her husband, a social worker, earns less than a third of what she earns. Almost all of the $1.3 million the couple has saved is a direct result of Francine’s saving and investing habits. While Francine is the first to say Gabriel is a great partner and pays for all household expenses, he isn’t a big saver or investor. “I’m at the point where I’m exhausted all the time and just want to pack up my small business and run away.”

Francine Rousseau never thought she would one day own a business worth $1 million. But the 50-year-old self-employed software specialist from

Saskatoon has come a long way since those tough days as a struggling single mom to her then four-year-old son, Freddy. “It was 1999 and I had just quit my government job to start my own business when my husband Drew asked for a divorce,” says Francine, who’s now been happily married to her second husband, Gabriel, 58, for 14 years.

A small divorce settlement from that first marriage allowed Francine to put 10% down on a house with a little left over to help get her software business off the ground. Today, that same company pays her a healthy annual salary of $180,000. Yet, despite her success, she has always feared she could still end up penniless. “I have never forgotten how scary it was feeling like we didn’t have enough money to get by,” says the self-professed workaholic. “That fear is ruining my life.”

Francine worries. She worries she won’t have enough to retire on when she turns 55 and that her money isn’t invested in the right funds and she has no clue about what to do with her company when she does retire.

Probably her chief concern is her inability to make any type of retirement and estate planning decisions, particularly when her husband, a social worker, earns less than a third of what she earns. Almost all of the $1.3 million the couple has saved is a direct result of Francine’s saving and investing habits. While Francine is the first to say Gabriel is a great partner and pays for all household expenses, he isn’t a big saver or investor. “I’m at the point where I’m exhausted all the time and just want to pack up my small business and run away.”

Complicating these decisions is the fact that Gabriel has two children from a previous marriage. “I want our wills to be fair but am having trouble convincing myself that leaving three equal shares is really the right thing to do. I’m paralyzed.”

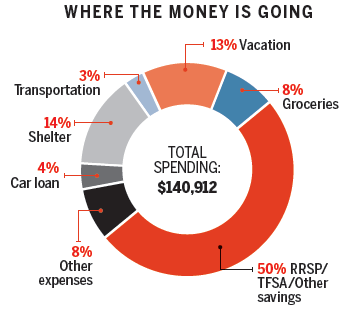

Finally, Francine doesn’t feel her investments are working hard enough. They’re invested in more than 12 mutual funds that have average fees of about 2% annually. While both she and Gabriel can look forward to full CPP and OAS at age 65, as well as a small $6,000 annual pension from Gabriel’s employer, Francine still struggles with the final details of their estate planning issues. “With our passion for travel, we’ll need about $70,000 net annually for about 15 years. I need to have all the pieces of my retirement plan aligned—without that, I won’t be able to enjoy the next phase of life.”

Complicating these decisions is the fact that Gabriel has two children from a previous marriage. “I want our wills to be fair but am having trouble convincing myself that leaving three equal shares is really the right thing to do. I’m paralyzed.”

Finally, Francine doesn’t feel her investments are working hard enough. They’re invested in more than 12 mutual funds that have average fees of about 2% annually. While both she and Gabriel can look forward to full CPP and OAS at age 65, as well as a small $6,000 annual pension from Gabriel’s employer, Francine still struggles with the final details of their estate planning issues. “With our passion for travel, we’ll need about $70,000 net annually for about 15 years. I need to have all the pieces of my retirement plan aligned—without that, I won’t be able to enjoy the next phase of life.”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email