How to establish a scholarship fund

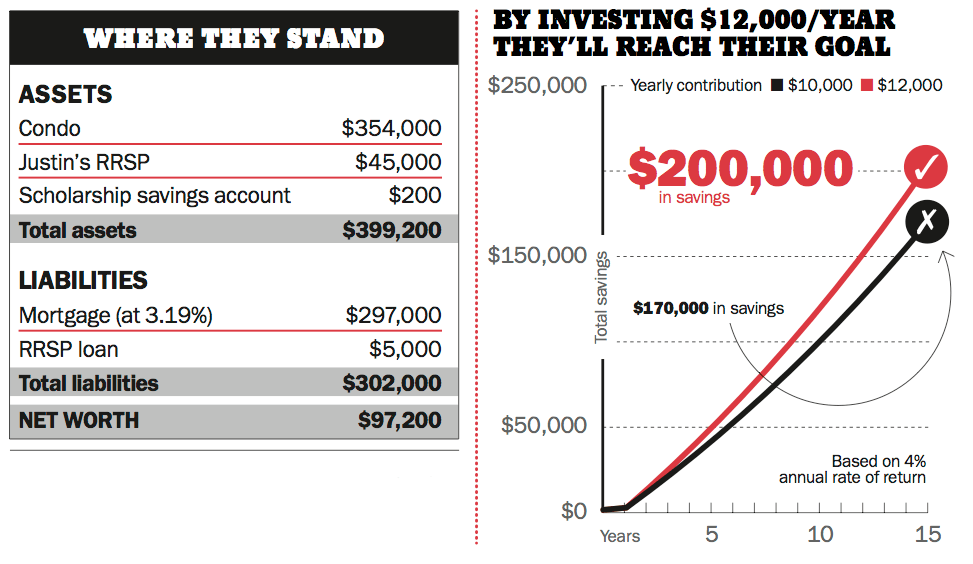

Can this couple make their dream of creating a $200,000 endowment fund a reality?

Advertisement

Can this couple make their dream of creating a $200,000 endowment fund a reality?

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email