When you’re late to the savings game

In their early 30s, Lucas and Eva Simmons have a toddler, and a new baby on the way. Can they save for their kids’ education and an early retirement?

Advertisement

In their early 30s, Lucas and Eva Simmons have a toddler, and a new baby on the way. Can they save for their kids’ education and an early retirement?

The couple is contemplating big changes. Lucas, 38, works as a program co-ordinator at a local community centre, but is thinking about a career change. (We’ve changed names to protect privacy.) That means going back to school for up to four years. “I’d like a job in communications and I’m looking at several options before I make a final decision,” says Lucas.

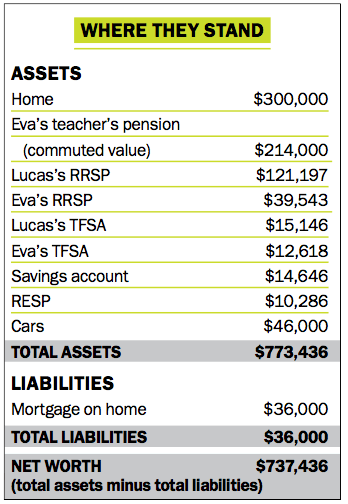

The Simmons have done two keys things right, by actively paying down their mortgage and building up savings. They bought their three-bedroom ranch-style home eight years ago and are on track to pay off the remaining $36,000 mortgage by the fall of 2017. “We hate debt and paying down the mortgage has been our No. 1 priority,” says Eva. The couple has also been able to save $213,436 in RRSPs, TFSAs, RESPs and a regular savings account. “Even though we know our glass is half full, there is always that worry,” says Eva. “Saving will get tougher when the baby comes.”

Right now, the couple’s largest expense, after the mortgage payment is their $650 a month daycare bill. This will double when the new baby turns one. But Lucas has a plan. “I’d like to leave my job and be a stay-at-home dad until both kids are in full-day school. Plus, I’d like to go back to school, but Eva worries.”

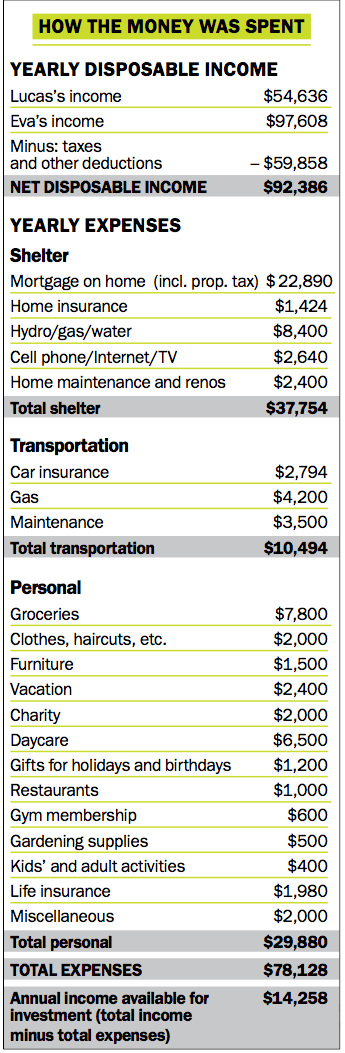

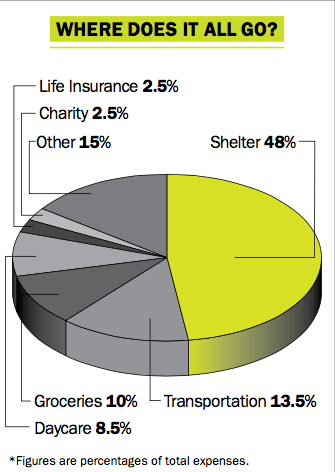

Between them the Simmons earn $152,244 a year. That will drop by almost half in the year Eva is on maternity leave and getting just employment insurance benefits (Lucas currently earns $54,636 per year). Then in the spring of 2017—once Eva returns to her full-time teaching job and Lucas stays home to study and watch the kids—their combined income will be about $97,000 annually. “Even now, we are finding it difficult to save,” says Lucas.

After all expenses the couple has about $14,260 left for investments. Up until now, they’ve been putting that towards RESPs and a spousal RRSP for Lucas. “As a one-income family will our savings have to stop?” asks Eva. “If so, what will that do to our dream of retiring at 58 and paying for our kids’ post-secondary education, as well as helping them with weddings and first-home purchases? We’ve waited a long time to have kids and want to spend as much time with them as possible. Can we do it all?”

Eva does most of the budgeting since she’s always felt comfortable with finances. “Mom worked at a bank and dad owned a clothing franchise in Edmonton when I was growing up,” says Eva. “Both were savers and I am too.” But things were a little different at Lucas’s house. “I remember my dad always moving money around in different accounts to cover bill payments while my mom always seemed to be putting money aside in savings,” says Lucas. “But it worked for them in the end and they retired at 60.”

In 2000, Eva received her teaching degree from the University of Alberta the same alma mater and year Lucas graduated from with a degree in history. The two met in 2004, when Lucas volunteered as a coach at the same school Eva taught at. “We made a bet over a basketball game and I won,” says Lucas. “She made me supper and I was smitten.”

The couple married in 2005 and, ever since, Eva has tried to keep the lines of communication about money open by getting Lucas’s input into budgeting and saving. “I’m a saver and Lucas used to be spender,” says Eva. “But I’ve tried to teach him as much as I can about saving and investing.” Lucas agrees, stressing that he was just getting over his spending ways when he met Eva. “We don’t fight about money but Eva stresses more than I do,” says Lucas. “She handles the day-to-day finances and I can’t thank her enough for doing that.”

One key thing the couple did five years ago is set the goal of having their mortgage paid off by age 40. “We bought the house for $170,000 in 2008 and every year we increased our payments by 5% to 10% and still managed to add about $1,500 a year to a spousal RRSP for Lucas,” says Eva.

But with a second child on the way, and their dream of having Lucas be a stay-at-home dad for a few years, they wonder if they’ll be able to save anything at all and, if so, should they prioritize RESPs for the kids, RRSPs or TFSAs? Eva has divided the family’s finances into several smaller accounts labelled fun money, vacation, maternity, Madison’s savings account and more. But saving for the kids’ education and retirement savings are their top priorities. “We’d like to retire early, volunteer more and possibly have a second career,” laughs Eva. “Plus, we’d really like to be there for the kids when they’re older.”

The couple is contemplating big changes. Lucas, 38, works as a program co-ordinator at a local community centre, but is thinking about a career change. (We’ve changed names to protect privacy.) That means going back to school for up to four years. “I’d like a job in communications and I’m looking at several options before I make a final decision,” says Lucas.

The Simmons have done two keys things right, by actively paying down their mortgage and building up savings. They bought their three-bedroom ranch-style home eight years ago and are on track to pay off the remaining $36,000 mortgage by the fall of 2017. “We hate debt and paying down the mortgage has been our No. 1 priority,” says Eva. The couple has also been able to save $213,436 in RRSPs, TFSAs, RESPs and a regular savings account. “Even though we know our glass is half full, there is always that worry,” says Eva. “Saving will get tougher when the baby comes.”

Right now, the couple’s largest expense, after the mortgage payment is their $650 a month daycare bill. This will double when the new baby turns one. But Lucas has a plan. “I’d like to leave my job and be a stay-at-home dad until both kids are in full-day school. Plus, I’d like to go back to school, but Eva worries.”

Between them the Simmons earn $152,244 a year. That will drop by almost half in the year Eva is on maternity leave and getting just employment insurance benefits (Lucas currently earns $54,636 per year). Then in the spring of 2017—once Eva returns to her full-time teaching job and Lucas stays home to study and watch the kids—their combined income will be about $97,000 annually. “Even now, we are finding it difficult to save,” says Lucas.

After all expenses the couple has about $14,260 left for investments. Up until now, they’ve been putting that towards RESPs and a spousal RRSP for Lucas. “As a one-income family will our savings have to stop?” asks Eva. “If so, what will that do to our dream of retiring at 58 and paying for our kids’ post-secondary education, as well as helping them with weddings and first-home purchases? We’ve waited a long time to have kids and want to spend as much time with them as possible. Can we do it all?”

Eva does most of the budgeting since she’s always felt comfortable with finances. “Mom worked at a bank and dad owned a clothing franchise in Edmonton when I was growing up,” says Eva. “Both were savers and I am too.” But things were a little different at Lucas’s house. “I remember my dad always moving money around in different accounts to cover bill payments while my mom always seemed to be putting money aside in savings,” says Lucas. “But it worked for them in the end and they retired at 60.”

In 2000, Eva received her teaching degree from the University of Alberta the same alma mater and year Lucas graduated from with a degree in history. The two met in 2004, when Lucas volunteered as a coach at the same school Eva taught at. “We made a bet over a basketball game and I won,” says Lucas. “She made me supper and I was smitten.”

The couple married in 2005 and, ever since, Eva has tried to keep the lines of communication about money open by getting Lucas’s input into budgeting and saving. “I’m a saver and Lucas used to be spender,” says Eva. “But I’ve tried to teach him as much as I can about saving and investing.” Lucas agrees, stressing that he was just getting over his spending ways when he met Eva. “We don’t fight about money but Eva stresses more than I do,” says Lucas. “She handles the day-to-day finances and I can’t thank her enough for doing that.”

One key thing the couple did five years ago is set the goal of having their mortgage paid off by age 40. “We bought the house for $170,000 in 2008 and every year we increased our payments by 5% to 10% and still managed to add about $1,500 a year to a spousal RRSP for Lucas,” says Eva.

But with a second child on the way, and their dream of having Lucas be a stay-at-home dad for a few years, they wonder if they’ll be able to save anything at all and, if so, should they prioritize RESPs for the kids, RRSPs or TFSAs? Eva has divided the family’s finances into several smaller accounts labelled fun money, vacation, maternity, Madison’s savings account and more. But saving for the kids’ education and retirement savings are their top priorities. “We’d like to retire early, volunteer more and possibly have a second career,” laughs Eva. “Plus, we’d really like to be there for the kids when they’re older.”

Right now, the Simmons pay about $20,000 a year for their mortgage and $6,500 a year for daycare expenses, which is a hefty chunk of their take-home pay. But even with these expenses gone in 2017, the couple isn’t sure their reduced income will allow them to save very much. Eva can’t see the light at the end of the tunnel and fears it may not come back until 2022, when Lucas goes back to work full-time to a new job earning about $60,000. During that time, Eva will remain in the teachers’ defined benefit pension plan but thinks they won’t be able to save much otherwise. “That’s scary for me,” says Eva.

The couple’s savings priorities are clear. They’d like to contribute $2,500 a year to their children’s RESPs (Eva’s mom kicks in $1,000 annually, too) and continue making contributions to a spousal RRSP for Lucas. “I have the higher income so it makes sense for me to contribute into an RRSP for him,” says Eva. The couple has a financial advisor but they consider themselves very conservative investors. On their planner’s advice, the couple purchased a variety of balanced segregated funds in 2007 that have achieved average annual compounded rates of return between 1.7% and 4%, depending on the fund. They aren’t sure what they’re paying in fees. The couple also has two $500,000 whole life insurance policies they are paying $1,980 for annually. “All of our other insurance—disability, dental, critical illness—is with my employer, so we’re very well covered,” says Eva.

Just as important to the couple is volunteering actively in their church, where they contribute $2,000 annually. They look forward to the day when they can take the odd trip to Las Vegas, travel to Scotland and perhaps go to a World Juniors Hockey Tournament in Europe. They’d also like to buy a small trailer and travel through B.C. and Alberta and Lucas would love to update his goalie equipment, so he is better prepared for his weekly adult hockey games.

Right now, the Simmons pay about $20,000 a year for their mortgage and $6,500 a year for daycare expenses, which is a hefty chunk of their take-home pay. But even with these expenses gone in 2017, the couple isn’t sure their reduced income will allow them to save very much. Eva can’t see the light at the end of the tunnel and fears it may not come back until 2022, when Lucas goes back to work full-time to a new job earning about $60,000. During that time, Eva will remain in the teachers’ defined benefit pension plan but thinks they won’t be able to save much otherwise. “That’s scary for me,” says Eva.

The couple’s savings priorities are clear. They’d like to contribute $2,500 a year to their children’s RESPs (Eva’s mom kicks in $1,000 annually, too) and continue making contributions to a spousal RRSP for Lucas. “I have the higher income so it makes sense for me to contribute into an RRSP for him,” says Eva. The couple has a financial advisor but they consider themselves very conservative investors. On their planner’s advice, the couple purchased a variety of balanced segregated funds in 2007 that have achieved average annual compounded rates of return between 1.7% and 4%, depending on the fund. They aren’t sure what they’re paying in fees. The couple also has two $500,000 whole life insurance policies they are paying $1,980 for annually. “All of our other insurance—disability, dental, critical illness—is with my employer, so we’re very well covered,” says Eva.

Just as important to the couple is volunteering actively in their church, where they contribute $2,000 annually. They look forward to the day when they can take the odd trip to Las Vegas, travel to Scotland and perhaps go to a World Juniors Hockey Tournament in Europe. They’d also like to buy a small trailer and travel through B.C. and Alberta and Lucas would love to update his goalie equipment, so he is better prepared for his weekly adult hockey games.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

I don’t feel this scenario represents a majority of Canadians when they are “late to the savings game”. It seems this couple was saving well before being married & having kids whereas I believe most couples who marry & have children later in life are not in an almost mortgage-free situation. Can You please re-write this article based on a family that was truly late to the savings game?