Two ways to lower risk in your investment portfolio with ETFs

The U.S. election made the market go up—for now. Is volatility keeping you up at night? Here are some ETFs that could help you sleep better.

Advertisement

The U.S. election made the market go up—for now. Is volatility keeping you up at night? Here are some ETFs that could help you sleep better.

With U.S. equity indices like the S&P 500 hitting all-time highs repeatedly this year, the investment atmosphere is charged, especially post the recent U.S. presidential election. The victory by Donald Trump has injected volatility into the markets, given the uncertainty of what his administration is planning to do. Some investors are looking to exchange-traded funds (ETFs) to help with the uncertainty in the markets.

While the immediate market response has seen a significant “Trump pump,” analysts, including those at Goldman Sachs, project modest U.S. equity returns of about 3% annually over the next decade, adjusting for inflation and dividends. Why? Primarily due to high valuations.

The price-to-earnings, or P/E ratio, is used for valuing a company. It measures the company’s current share price relative to its earnings per share (EPS). The P/E ratio formula is: Earnings per share divided by market value per share.

Read the full definition in the MoneySense Glossary: What is price-to-earnings ratio?

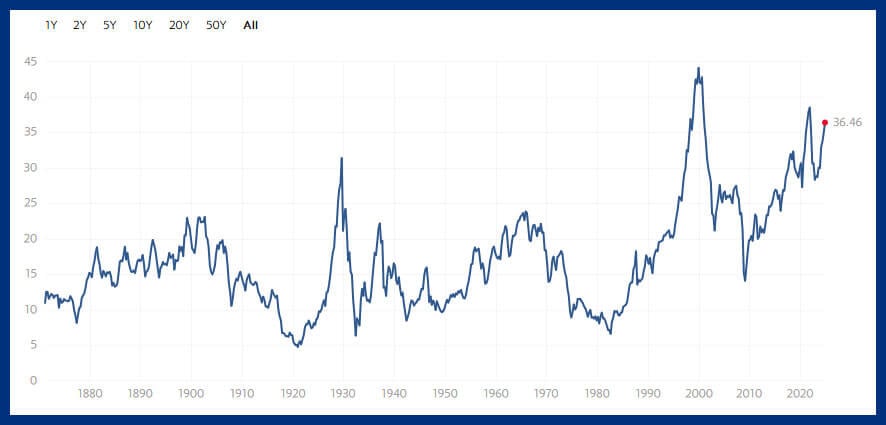

Consider the Shiller price to earnings (P/E) ratio, or CAPE (Cyclically Adjusted Price Earnings) ratio, which is one of many barometers analysts use to gauge return expectations from equities. This ratio averages inflation-adjusted earnings from the past decade to smooth out anomalies from any single year’s earnings, offering a more comprehensive view of the economic environment.

At press time, the Shiller price-to-earnings (P/E) ratio for the S&P 500 index stands at 36.46, notably higher than its historical mean of 17.17 and median of 16.00. This elevated level suggests that stocks are relatively overpriced, which typically signals modest future returns compared to historical averages.

While my approach as a retail investor remains focused on purchasing low-cost index funds to stay the course, it’s clear that many other investors may have overestimated their risk appetites during the recent bull market.

If the market’s rollercoaster ride has you on edge, know that there are strategic ways to mitigate risk through ETFs. By “de-risk,” I mean methods to potentially reduce your portfolio’s volatility—the rate at which its value fluctuates—and minimize drawdowns, the measure from peak to trough decline during a specific period.

One of the simplest ways to decrease risk in a portfolio is to hold a portion of assets in cash equivalents rather than maintaining a 100% equity position. It’s called diversification. Options such as Treasury Bill ETFs, high-interest savings account (HISA) ETFs, or money market ETFs, can serve this purpose well.

To illustrate, consider three backtests from Portfolio Visualizer: The first portfolio is entirely invested in the iShares MSCI World Index ETF (XWD). Portfolio two introduces a 10% allocation to iShares Premium Money Market ETF (CMR). And portfolio three increases the CMR allocation to 20%.

| Metric | Portfolio one (100% XWD) | Portfolio two (90% XWD 10% CMR) | Portfolio three (80% XWD 20% CMR) |

|---|---|---|---|

| Start balance | $10,000 | $10,000 | $10,000 |

| End balance | $29,581 | $27,127 | $24,840 |

| Annualized return (CAGR) | 11.66% | 10.68% | 9.69% |

| Standard deviation | 12.13% | 10.92% | 9.71% |

| Best year | 22.38% | 20.44% | 18.53% |

| Worst year | -11.59% | -10.22% | -8.87% |

| Maximum drawdown | -18.18% | -16.46% | -14.71% |

| Sharpe ratio | 0.82 | 0.81 | 0.81 |

| Sortino ratio | 1.30 | 1.29 | 1.29 |

Incorporating cash equivalents into your investment portfolio can significantly reduce fluctuations and lessen the depth and duration of market losses, as evidenced by lower standard deviations and maximum drawdowns in the second and third portfolios.

Practically, this means your investment journey will not only be smoother due to fewer dramatic rises and falls, but also less stressful during market downturns. Potential losses won’t be as deep or last as long. It’s a good way to sleep better at night if you have a lower tolerance for risk.

However, it’s important to note that reducing risk in this way does not improve your risk-adjusted return. That’s the Sharpe Ratio, and that means for every unit of risk you reduce by adding cash, you also give up a proportionate amount of potential return. Ideally, you’d want to reduce risk without sacrificing as much return—and cash won’t help with that.

Another effective method for reducing risk in a portfolio is to focus on stocks that have historically been less volatile, meaning they fluctuate less on a day-to-day basis.

This approach is known as “low-volatility investing,” which generally involves selecting securities with a lower beta. Beta is a measure of a stock’s volatility relative to the overall market: if the market (beta of 1.0) is like the sea, your portfolio is like a boat and you ride the sea. Beta will tell you how volatile a stock is.

A beta higher than 1 means your portfolio amplifies market movements. A beta less than 1 means it’s less responsive to those movements. A beta of 0 indicates there’s no correlation with the market. And a negative beta suggests movement opposite to the market. You can find the five-year beta of most stocks and ETFs listed on news and investing websites that list quotes for individual stocks, such as Yahoo Finance.

Mathematically, low-volatility investing is beneficial because it mitigates the asymmetry of losses and gains. For example, a 10% loss requires an 11% gain to break even, a 25% loss requires a 33% gain, and a 50% loss requires a 100% gain.

Therefore, by minimizing downside exposure, low-volatility strategies can improve the portfolio’s performance consistency over time. It’s the investing equivalent of the tortoise versus the hare. And this strategy has proven effective in some respects, as demonstrated by the following backtest of the BMO Low Volatility Canadian Equity ETF (ZLB) from Portfolio Visualizer. Historically, it’s shown a far lower standard deviation compared to the iShares S&P/TSX 60 ETF (XIU), while actually achieving a higher CAGR.

| Metric | XIU | ZLB |

|---|---|---|

| Start balance | $10,000 | $10,000 |

| End balance | $22,749 | $24,276 |

| Annualized return (CAGR) | 8.72% | 9.44% |

| Standard deviation | 12.47% | 10.47% |

| Best year | 28.05% | 22.93% |

| Worst year | -7.82% | -2.77% |

| Maximum drawdown | -20.23% | -19.08% |

| Sharpe ratio | 0.58 | 0.73 |

| Sortino ratio | 0.86 | 1.15 |

However, remember that low-volatility strategies do not eliminate risk entirely, especially during severe market crashes. In such scenarios, all correlations tend to converge toward a beta of 1.0, making diversified holdings behave similarly.

During big market downturns, different types of investments can often start to move in similar directions—typically downward—regardless of their expected behaviour. Practically speaking, this means that low-volatility ETFs, while generally effective, might not always protect a portfolio from losses when the entire market drops sharply.

Remember the COVID-19 market crash in February and March 2020? The max drawdown—meaning the largest drop from peak to trough during a specific period—of ZLB was nearly as significant as that of XIU. So even ETFs that are normally considered less volatile can still experience large declines in value during widespread market downturns.

The concept of a “free lunch” in risk management refers to the ability to reduce risk without significantly impacting returns. It was American economist Harry Markowitz who said: “Diversification is known as the only free lunch in investing.” So, ideally, if you could decrease risk by one unit, you would want your returns to be reduced by less than half a unit or not at all.

However, achieving this balance depends heavily on maintaining low correlations between assets—where one asset zigs while another zags. Unfortunately, this balance is fleeting because during severe market downturns, correlations between different types of investments often converge toward a beta of 1.0, meaning they can all lose value simultaneously.

Additionally, the few assets that do pay off reliably when markets tank, like put options and long volatility derivatives, aren’t suitable for long-term holders as the maintenance costs can exceed the payoffs in most scenarios.

Many fancy hedge-fund-like alternative ETFs promise to offer this balance, but they often come with high fees and survivorship bias. Survivorship bias is the tendency to consider only successful examples in an analysis while ignoring those that failed—a key thing to watch out for when screening funds.

For most Canadian ETF investors, a pragmatic investing approach involves “diversifying your diversifiers.” That means incorporating a variety of asset types that each respond differently under various market conditions, with each offsetting the weakness of another. Your team of assets together create the ultimate Fantasy sports team.

For example, if your portfolio contains global equities, adding high-quality bonds can provide a buffer during economic recessions, as bonds typically perform better when stocks falter. To further safeguard against inflation and rising interest rates when bonds might underperform (like in 2022), some might add commodities to their mix. Finally, holding some cash equivalents provides liquidity and stability if all else fails.

This layered approach builds a comprehensive defense-in-depth around your investments, addressing different types of investment risks effectively. Each asset type has its own strengths and weaknesses, but when strategically combined, they can effectively balance each other out and create a more resilient investment portfolio.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email