How much is my $100 Canada Savings Bond worth now?

The federal government stopped selling Canada Savings Bonds and Canada Premium Bonds in 2017. If you still have some, here’s how to redeem CSBs and CPBs.

Advertisement

The federal government stopped selling Canada Savings Bonds and Canada Premium Bonds in 2017. If you still have some, here’s how to redeem CSBs and CPBs.

Do you still have Canada Savings Bonds (CSBs) in a safety deposit box or in a drawer at home? If so, you might be wondering how much they’re worth and how to redeem them.

First issued by the Government of Canada in 1946 to help finance the country’s growth after the Second World War, Canada Savings Bonds were once very popular investments. They offered a guaranteed return and attractive interest rates. Canada Savings Bonds reached their peak in 1981, with an interest rate of 19.5%.

While sale periods changed over the years, CSBs were only issued on November 1 until 1998. In later years, they were issued over a longer period to make them more accessible. For example, between 1998 and 2009, bonds were issued from November 1 through April 1.

Below, we answer commonly asked questions about these bonds, including questions about Canada Savings Bond redemption.

The Government of Canada discontinued the sale of Canada Savings Bonds and their newer, higher-yielding cousins, Canada Premium Bonds (CPBs), in November 2017. (Go to on CPBs.)

While the bonds were an important savings vehicle for Canadians for many decades, sales had declined, partly due to the increase in more flexible and competitive alternatives. (The bonds’ disappointing rates were even lampooned on the Rick Mercer Report in 2007.) Eventually, the bond program became unsustainable, and the government cancelled it.

So, can you still buy Canada Savings Bonds? No, you can’t; however, you have plenty of other options, which we cover below.

The #Budget2017 puts an end to #CanadaSavingsBonds But there are still $5b of them out there! Do you still have some? pic.twitter.com/lluVL4lFxE

— Kevin Frankish (@KevinFrankish) March 22, 2017

Canada Savings Bond interest rates were based on multiple factors, including prevailing market conditions. For the bonds to be attractive, the government had to price them competitively with similar fixed-income investments, including guaranteed investment certificates (GICs). Policy objectives also influenced rates. Because CSBs were used to finance government spending, the government might raise rates as a way to drive more investment.

Until 2012, CSBs were issued with a 10-year term to maturity, with a guaranteed fixed rate for the first year. Over the remaining nine years, bondholders received a variable interest rate. In its 2012 Economic Action Plan, the government announced changes to CSBs and CPBs to make them more appealing to investors. It reduced the term to maturity to three years and allowed bondholders to redeem their bonds at any time of year.

For illustrative purposes, the following table shows the yearly interest rates for CSBs and CPBs issued on Jan. 12, 2010. Both series of bonds matured 10 years later, in 2020. As you can see, rates were much lower than the high of 19.5% in 1981.

| Year | Series CSB-S127 | Series CPB-P77 |

|---|---|---|

| 2010 | 0.65% | 1.10% |

| 2011 | 0.50% | 1.40% |

| 2012 | 0.50% | 1.70% |

| 2013 | 0.50% | 1.00% |

| 2014 | 0.50% | 1.20% |

| 2015 | 0.50% | 1.40% |

| 2016 | 0.50% | 0.80% |

| 2017 | 0.50% | 0.90% |

| 2018 | 0.50% | 1.00% |

| 2019 | 0.50% | 1.30% |

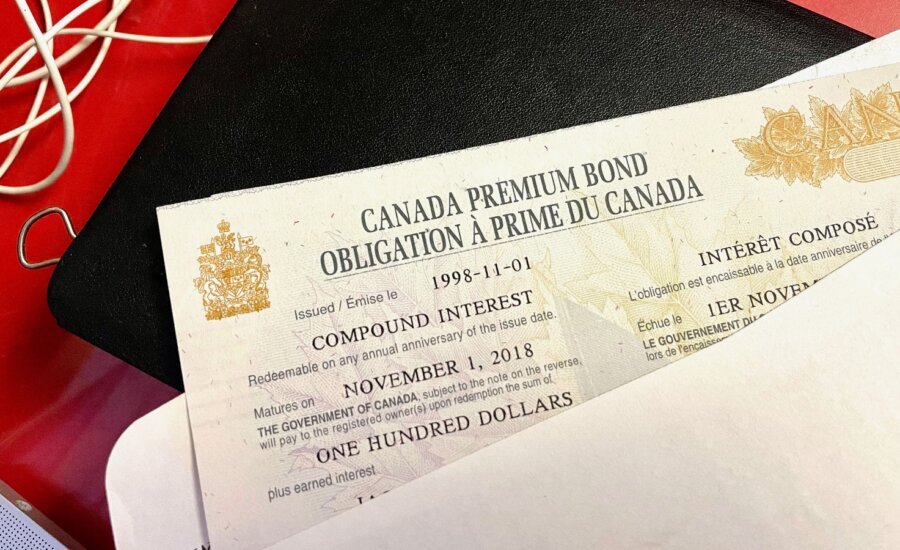

Canada Premium Bonds (CPBs) were introduced in 1998 as an enhanced savings bond, offering higher interest rates than regular CSBs.

CSBs and CPBs were redeemed differently, too. Canada Savings Bonds could be redeemed anytime, while CPBs could only be redeemed once yearly, on or within 30 days of their anniversary date. This changed in 2012—as of that year, all bonds could be cashed whenever bondholders wanted to redeem them.

The following table compares the key features of both bond types:

| Canada Savings Bond (CSB) | Canada Premium Bond (CPB) | |

|---|---|---|

| Inception | 1946 | 1998 |

| Purchase options | Payroll savings programs, financial institutions (pre-2012) | Financial institutions, investment brokers |

| Redemption options | Redeemable anytime | Once per year on or within 30 days of the anniversary date |

| Interest rates | Lower than CPBs | Higher than CSBs |

| Interest type | Regular or compounding | Regular or compounding |

In March 2017, the Government of Canada announced that sales of CSBs and CPBs would end in November of the same year. It did not create a replacement. However, Canadian investors looking for a safe investment with a predictable return can consider the following alternatives.

Many Canadian financial institutions, particularly online banks, offer high-interest savings accounts (HISAs) with low fees and attractive yields. Most of these accounts are CDIC-insured (meaning your deposits are covered, up to a limit, in the rare event that a financial institution becomes insolvent), and some don’t charge any monthly maintenance or transaction fees. Your funds are never locked in, so you can access your money when needed.

GICs are low-risk investments that require you to lock a set amount of money into a guaranteed investment for a predetermined period (unless it’s a cashable or redeemable GIC, which is more flexible but typically offers lower interest). The issuing institution guarantees your principal and interest rate. Because you agree to lock your money in the best GIC rates are often favourable compared to those of savings accounts. Like other deposit accounts, most GICs offered by Canadian institutions are CDIC-insured.

A money market fund is a mutual fund that invests in cash and cash equivalents, short-term debt instruments such as T-bills, and municipal and corporate bonds. Unlike CSBs, HISAs, and GICs, money market funds are not guaranteed. However, they are among the lowest-risk investments you can own. You can purchase money market funds through your financial institution, an online brokerage or an investment broker.

Get up to 4.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.55%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

Let’s say you have a mature $100 Canada Savings Bond. If it earned regular interest (not compound interest), you will realize its face value ($100) when you redeem it, as you would have received yearly interest payments during the bond’s term.

If your mature bond earned compound interest, you will receive the face value plus any accumulated interest when you redeem it. (Try our compound interest calculator.) The amount of interest will depend on which bond series you purchased.

If you have an outstanding bond, it’s best to redeem it as soon as possible. As of Dec. 1, 2021, all bonds stopped paying interest regardless of maturity date.

If you have the certificate, you can redeem a mature CSB or CPB through your financial institution. The bank teller can calculate the accrued interest (if applicable) and deposit the full amount into your bank account or pay you in cash. Note that all registered owners must sign the back of the bond certificate and provide identification.

If you’ve lost your certificate, follow the Bank of Canada’s process for reporting lost, stolen, or destroyed bonds. And if you hold CSBs inside a registered retirement savings plan (RRSP) or registered retirement income fund (RRIF), your financial institution can help you transfer them into another investment within a different registered retirement plan. You can also contact the government to withdraw cash from your RSP or RIF; however, there will be tax implications.

If you still have unredeemed Canada Savings Bonds tucked away somewhere, such as a desk drawer or safety deposit box, it’s not too late to cash them in. Mature bonds no longer earn interest, and inflation is eroding the value of your investment every year, so you’ll likely want to put that money to work elsewhere.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email