A leaner portfolio for better results

Consider using low-cost index mutual funds

Advertisement

Consider using low-cost index mutual funds

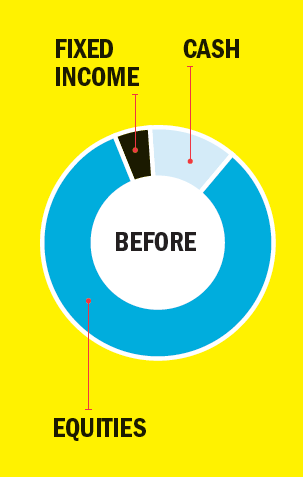

Mark Morin, 29, is a Montreal mining engineer who started building his five-figure portfolio with resource stocks back in 2010. When those didn’t perform well, he added several Canadian and U.S. blue-chip stocks as well as some equity mutual funds. His total holdings now include more than 30 investments—including stock in 25 different U.S. and Canadian companies. About 60% of his holdings are in RRSPs and the remainder in TFSAs and non-registered accounts. Just recently, Mark started building a new portfolio with TD’s e-Series funds. “I’m spread too thin,” he says. “I want something simpler and more cost-effective.”

Mark Morin, 29, is a Montreal mining engineer who started building his five-figure portfolio with resource stocks back in 2010. When those didn’t perform well, he added several Canadian and U.S. blue-chip stocks as well as some equity mutual funds. His total holdings now include more than 30 investments—including stock in 25 different U.S. and Canadian companies. About 60% of his holdings are in RRSPs and the remainder in TFSAs and non-registered accounts. Just recently, Mark started building a new portfolio with TD’s e-Series funds. “I’m spread too thin,” he says. “I want something simpler and more cost-effective.” Investment adviser Shannon Dalziel of PWL Capital agrees Mark needs a simpler and more broadly based portfolio for the long term. She advises he reduce his number of holdings and increase his exposure to global markets by investing in low-cost, broadly diversified exchange-traded funds (ETFs) or index mutual funds. Since Mark is already on the right track with the TD e-Series funds in his RRSP, Dalziel suggests he continue along this path and build a full portfolio with these funds in all of his registered and non-registered accounts. While the TD e-Series funds have a slightly higher management expense ratio (MER) than comparable ETFs, there are no trading fees. “Buying and selling is straightforward,” says Dalziel.

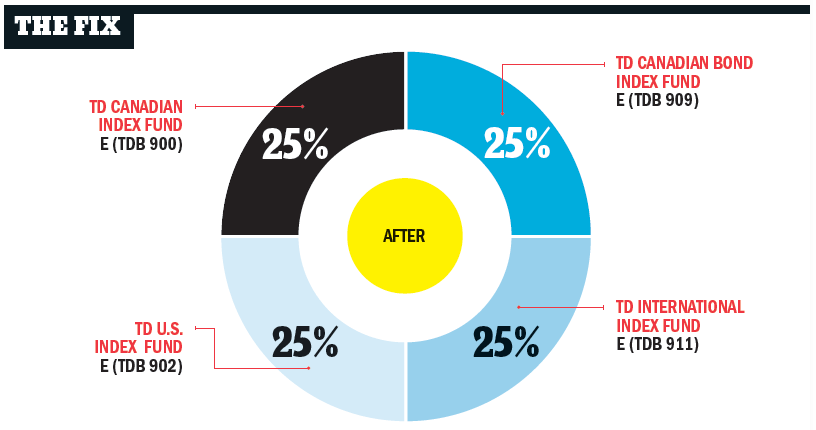

Because Mark has a long time horizon, she also recommends he consider an aggressive portfolio split as follows: 25% in fixed income, 25% in Canadian equities, 25% in U.S. equities and 25% in international equities. (Using TD e-Series funds, the average underlying MER of this portfolio is just 0.42%.)

Mark needs to be careful about asset location, too. The e-Series bond fund, which is fully taxable, should be held entirely in his RRSP. The Canadian index fund should go in his non-registered account to maximize the Canadian dividend tax credit. All remaining equity funds can go in his RRSP and TFSA.

Finally, Mark should meet with a tax accountant to understand the implications of selling his non-registered stocks. “It may be best just to bite the bullet and sell everything at once and start his portfolio over again from scratch,” says Dalziel.

Do you want a portfolio makeover from MoneySense? If so, send an email describing your situation to [email protected]

Investment adviser Shannon Dalziel of PWL Capital agrees Mark needs a simpler and more broadly based portfolio for the long term. She advises he reduce his number of holdings and increase his exposure to global markets by investing in low-cost, broadly diversified exchange-traded funds (ETFs) or index mutual funds. Since Mark is already on the right track with the TD e-Series funds in his RRSP, Dalziel suggests he continue along this path and build a full portfolio with these funds in all of his registered and non-registered accounts. While the TD e-Series funds have a slightly higher management expense ratio (MER) than comparable ETFs, there are no trading fees. “Buying and selling is straightforward,” says Dalziel.

Because Mark has a long time horizon, she also recommends he consider an aggressive portfolio split as follows: 25% in fixed income, 25% in Canadian equities, 25% in U.S. equities and 25% in international equities. (Using TD e-Series funds, the average underlying MER of this portfolio is just 0.42%.)

Mark needs to be careful about asset location, too. The e-Series bond fund, which is fully taxable, should be held entirely in his RRSP. The Canadian index fund should go in his non-registered account to maximize the Canadian dividend tax credit. All remaining equity funds can go in his RRSP and TFSA.

Finally, Mark should meet with a tax accountant to understand the implications of selling his non-registered stocks. “It may be best just to bite the bullet and sell everything at once and start his portfolio over again from scratch,” says Dalziel.

Do you want a portfolio makeover from MoneySense? If so, send an email describing your situation to [email protected]

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email