Making sense of the markets this week: August 25, 2024

Canada’s railway-bound economy screeches to halt, inflation is down, Target shares rebound and TD to pay $4-billion penalty.

Advertisement

Canada’s railway-bound economy screeches to halt, inflation is down, Target shares rebound and TD to pay $4-billion penalty.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

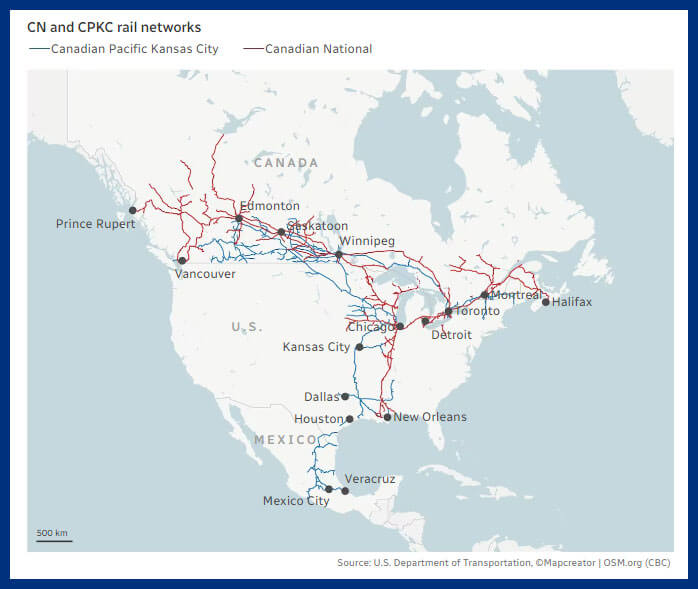

Many Canadians feel that “Canada is broken,” according to an Ipsos poll. And news this week seemed to support that sentiment, as Canada’s two major railways, Canadian National Railway (CNR) and Canadian Pacific Kansas City (CPKC), locked out employees on Thursday.

After deciding that they were fine with letting less than 10,000 railway employees hold the entire economy hostage this week, it took the Trudeau government about 17 hours to order everyone back to work.

The strike news was still developing as we went to press. Labour Minister Steve Mackinnon ordered the Canada Industrial Relations Board (CIRB) to find a solution under Section 107 of the Canada Labour Code. Mackinnon directed the board to impose binding arbitration, and that current collective agreements should be extended. The Minister said he expected trains to begin regular operation “within days.”

For every one day of disruption, it’s anticipated that three to five days are needed for a recovery. The impact has already been massive—and foreseeable.

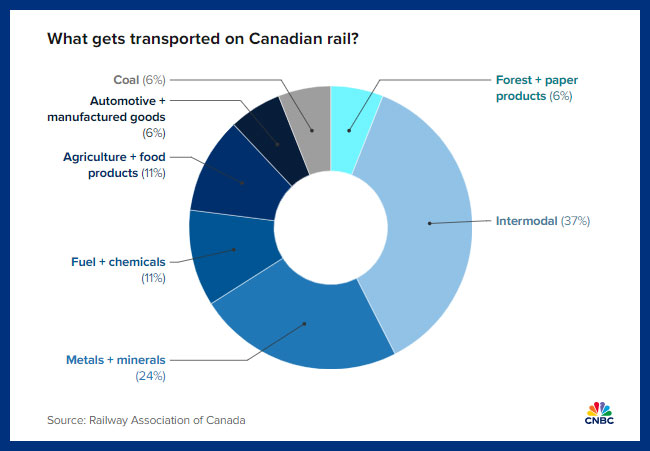

Throughout the week, headlines revealed the damage that would result from a rail shutdown. Ottawa stated on Monday, “The parties must do the hard work necessary to reach agreements at the bargaining table and prevent a full work stoppage.” Canadians watched it all unfold on Thursday, before the Justin Trudeau government finally intervened on what would impact millions of Canadians across the country, including:

Governments can get involved. Two years ago, similar labour demands in the U.S. drove railway workers to consider a strike before the Joe Biden administration forced the unions to accept a deal. Also, former Prime Minister Stephen Harper had twice ordered railway employees back to work.

CN has stated its engineers earn roughly $150,000 per year, while conductors earn about $120,000 per year, and that significant pay increases have been offered. CPKC says its compensation agreements are comparable to that of CN. According to CPKC spokesperson Patrick Waldon, the main issue now is around the pay employees receive for layover/waiting time. It’s not yet clear if the Minister’s referral of the matter to the CIRB will actually get trains moving.

If the current Canadian inflation trend holds, soon we won’t have to talk about it so much.

On Tuesday, Statistics Canada stated that the Consumer Price Index (CPI) measured inflation of 2.5% for July. That’s down from 2.7% in June, and is the lowest inflation rate recorded since 2021.

| CPI basket items | June 2024 | July 2024 |

|---|---|---|

| All-items Consumer Price Index | 2.7% | 2.5% |

| Food | 2.8% | 2.7% |

| Shelter | 6.2% | 5.7% |

| Household operations, furnishings and equipment | -0.9% | -0.1% |

| Clothing and footwear | -3.1% | -2.7% |

| Transportation | 2% | 2% |

| Health and personal care | 3.0% | 2.9% |

| Recreation, education and reading | 0.6% | -0.2% |

| Alcoholic beverages, tobacco products and recreational cannabis | 3.1% | 2.7% |

In fact, if you take shelter out of the equation, we’re getting close to zero inflation. And that’s significant for two reasons:

Notably, passenger vehicle prices were down 1.4% in July. Clothing and footwear was also down by 2.7%. Food and gas were up by 2.7% and 1.9% respectively. British Columbia and New Brunswick had the highest inflation rate growth, while Manitoba and Saksatchewan had the lowest.

It’s pretty clear there’s no longer an overall inflation crisis in Canada. It’s now simply a home affordability issue at this point. Economists were widely predicting that this continuing trend of a downward inflation rate would clear the way for continued interest-rate cuts in the coming months. Money markets are now predicting a 0.25% cut minimum on September 4, with a 4% probability that the cut will be 0.50%. Looking further down the road, those same markets are predicting there is a 76% chance we will see a 2% decrease by October of 2025.

I hope you locked in those guaranteed investment certificates (GICs) or bonds when you could still snag those high rates Check out MoneySense’s list of the best GIC rates in Canada, and my article on low-risk investments over at MillionDollarJourney.com.

Target Corporation posted a big earnings beat on Wednesday and shareholders saw its shares increase in value by 11.20%. The Minneapolis-based discount retailer is the seventh-largest in the U.S.

All numbers are in U.S. dollars.

Same-store sales for Target grew 3% last quarter, after five straight quarters of declining sales. More purchases of discretionary items like clothing were responsible for the positive reversal to the declining sales trend.

Target’s COO Michael Fiddelke had a very cautious tone, though. “While we’ve been pleased with our performance so far this year, our view of the consumer remains largely the same. The range of possibilities and the macroeconomic backdrop in consumer data and in our business remains unusually high.” And Target CEO Brian Cornell cited price reductions and a value-seeking consumer as reasons for increased foot traffic in the quarter.

It was very much a mediocre earnings report for Lowes, though, as it beat earnings expectations decisively but cut its full-year forecast. Shares were down by about 1% on Tuesday after the earnings announcement.

Lowe’s CEO Marvin Ellison said consumers were waiting for cuts in interest rates before taking on large home improvement projects. Because 90% of Lowes’ customers are homeowners (as opposed to contractors), they are particularly sensitive to movements in interest rates, he shared. Same-store sales were down 5.1% year over year.

Target’s and Lowes’ earnings trends mirror those of Walmart and Home Depot, which we covered last week. Overall, we certainly see a more price-conscious consumer, but there’s little evidence that a recession is imminent.

TD’s mixed earnings day on Thursday was overshadowed by the news of a historically massive fine that it is anticipating paying before the end of 2024.

TD was the first of the Canadian banks to report earnings for the quarter.

It appeared to be a case of the bad news already being baked into the share price, as despite the negative headlines, TD’s stock was down only about 2% on Thursday.

The surprise revenue beat was primarily driven by TD’s Canadian operations. Personal and commercial banking recorded a 13% increase in income. And U.S. operations saw a 5.6% decrease in revenues. In a preview of what we will likely see more of in bank earnings next week, TD also raised its provisions for credit losses to $1.07 billion (from $766 million a year before).

But by far the biggest news for TD this week had nothing to do with quarterly earnings or profit numbers: TD’s alleged laundering of Chinese drug-dealing money finally broke into a much-anticipated downpour on Wednesday. We previously wrote that TD had set aside USD$450 million to pay probable fines, so the markets knew a shock was coming.

That said, the headline that TD is now setting aside an additional USD2.6 billion in order to pay anticipated fines before the end of the year was big news of the week. A penalty of about $4 billion in Canadian dollars is massive for the bank. I mean, that’s nearly 3% of the bank’s total market capitalization or 37% of its profit in 2023. The penalty was so large that TD sold a bunch of its prized shares of Charles Schwab Corp so it could pay the penalty without using up all of its “Tier 1 capital” (basically the cash on hand it needs to operate as a bank). TD owned 12.3% of Schwab as part of its deal to sell the TD Ameritrade brokerage in 2020. After selling its shares, TD’s share of Schwab will now be reduced to 10.1%.

It’s also worth noting this isn’t business as usual, even for a banking sector that often traffics in legal grey areas. The anticipated $4 billion fine would be the largest for any Canadian bank by a large margin, and the second-largest banking penalty ever levied in North America. Only Wells Fargo’s 2022 US$8 billion penalty tops it.

The fallout from these penalties could actually be substantially larger than the initial penalty, as TD had hitched its proverbial wagon to U.S. expansion opportunities. American regulators are unlikely to be in a forgiving mood going forward when TD acquisition proposals for mid-size U.S. banks hit their desk. Given that TD has over 10 million American customers and has nearly 1,200 branches in the U.S., it would be difficult to suddenly reverse course on its U.S. strategy.

All said and done, TD’s Canadian revenue growth for the quarter proves it still has a fairly high floor, as far as the long-term future goes. Its privileged position in the Canadian banking scene likely isn’t going to disappear, and the average Canadian is unlikely to make banking decisions based upon abstract negative news headlines from the U.S. Given how profitable Canadian banking continues to be, there is no reason to doubt the viability of Canada’s second-biggest company. No one likes to lose $4 billion, but it appears that for now, shareholders have decided that the worst news is in the rearview mirror.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

The TD and CEO should be charged and return all perks. Retail share holders shouldn’t pay for the fine.