Making sense of the markets this week: December 1, 2024

Back into the tariff hurricane, Couche-Tard pumps profits, Macy’s loses $130 million, and is there too much optimism about markets right now?

Advertisement

Back into the tariff hurricane, Couche-Tard pumps profits, Macy’s loses $130 million, and is there too much optimism about markets right now?

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

The Canadian economy found itself in the midst of the Trump economic tornado again this week—again. The first time was from 2017 to 2021 when he was U.S. president, and now as he heads into the role again on January 20, 2025.

With one post on his social platform Truth, the president-elect threw our export-based economy into scramble mode, as our currency dropped 1.2% overnight.

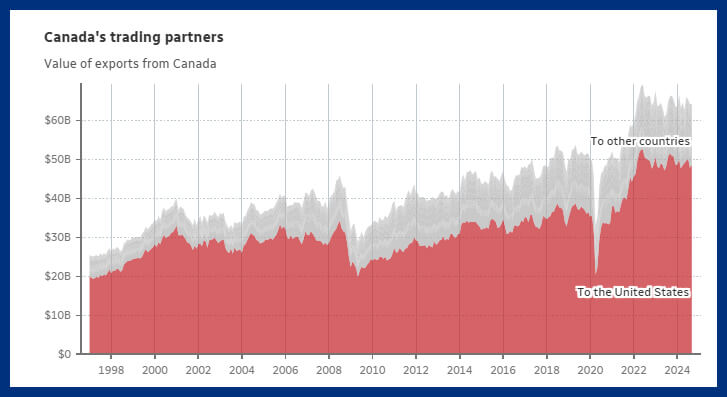

Make no mistake, a 25% tariff on all of Canada’s exports to the U.S.A. would be catastrophic. Many small businesses would go bankrupt, profit margins would be slashed for Canadian companies of all sizes, and our currency would lose a lot of value (thereby increasing inflationary pressures). Overnight—and two months before Trump becomes president—his musings have once again plunged Canadians into despair.

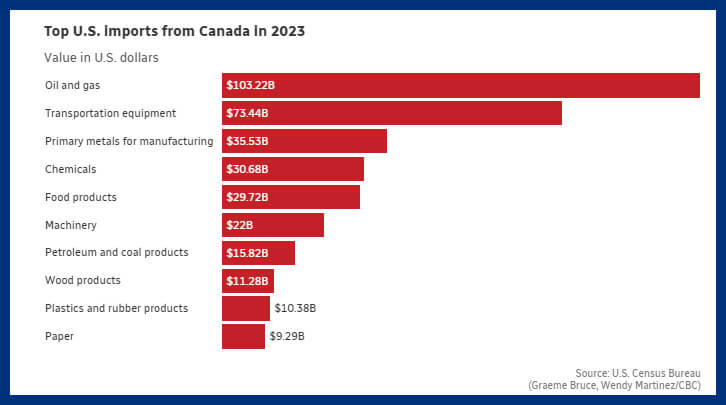

A few points on trade between Canada and the U.S.:

Interestingly, investors, in general, appear to believe that the 25% tariff threat is merely yet another of Trump’s negotiating ploys.

Isn’t it fun when your partner-in-democracy of 150-plus years decides to threaten economic devastation if you don’t give in to whatever they demand?

Given the Canadian stock market has actually done slightly better than the S&P 500 over the last couple of days, most serious people seem to be betting the tariff talk is mostly bluster.

Investment bank Goldman Sachs stated, “Given the focus from Trump to lower energy costs, we think Canada tariffs are somewhat unlikely.”

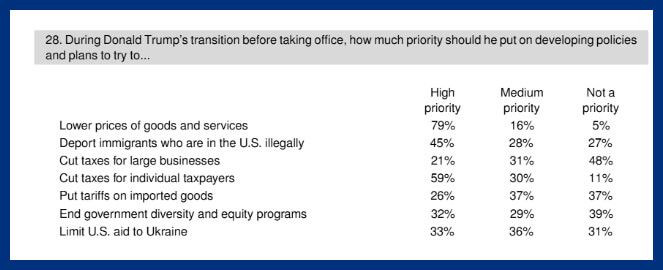

We can tell from the last round of Trump’s economic shenanigans that tariffs most definitely have an inflationary impact on the price of goods. Low prices are also of the highest priority to the American electorate.

Despite evidence that tariffs would be bad for all countries involved, predicting the course the incoming president will take remains incredibly difficult. We wish we could remain as optimistic as the markets appear to be, but the potential risk to the Canadian economy is so massive, that it’s hard to just shrug off the tariff threats.

Get up to 3.50% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.60%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

Canada’s largest gas-station retailer released its earnings this week.

Due to much of its operations being south of the border, Alimentation Couche-Tard reports earnings in U.S. dollars.

While ATD share prices were down slightly earlier in the week when earnings were announced, they were up over 6% over the past few trading days. While it continues to be a key company in Canada, earnings were down 13.5% year over year, primarily due to lower gasoline profit margins, declining tobacco sales and lower traffic numbers.

CEO Alex Miller explained that the convenience store business was feeling the pinch as inflation-conscious customers were spending less at convenience stores.

The share price of ATD has been on a bit of a rollercoaster over the last few months, as the company pursued a big acquisition of Japan’s Seven & i (better known to us Canadians as 7-Eleven). Miller recently said, “We continue to see a strong opportunity to grow together […] We also remain confident in our ability to finance and complete this combination.”

While that may be true, it looks as if a Japanese “White Knight Investor” in the form of the 7-Eleven-founding Ito family is much likelier to win the bidding war.

There will always be other acquisition targets for ATD’s growth-oriented management team to pursue.

It was an eventful week for U.S. retail.

All numbers below are in U.S. dollars.

Another solid quarter for U.S. consumer spending on clothing was overshadowed by the fact Macy’s had to delay its earnings announcement due to uncovering a massive fraud issue. A single employee is reported to have stolen more than $130 million from the company over the last few years. For context, that amount is almost equivalent to the store’s total profit for the entire last quarter.

Macy’s is hoping the nostalgia of its Thanksgiving Day Parade quickly changes the channel from the embarrassing lack of managerial oversight, as well as the fact the stock took a 4% price hit on the news.

Earnings beats generated a muted reaction from the market for the other three clothing retailers. Much of the good news appears to be baked into prices in the form of high expectations. Abercrombie & Fitch continues to “rise from the dead” (in this case “the dead” is clothing brands from my teenage years) and is up more than 90% over the last twelve months.

All three companies commented on the strength of the U.S. consumer, and increased freight prices that resulted from the port strikes early in the financial quarter.

Back in the bad ol’ days (not the good ol’ days) of June 2022, soon after I started doing this column, I wrote about how I was pretty bullish on the stock market’s direction. That was based on how over-the-top market commentators seemed to be. I tend to think, if everyone already thinks the sky is falling, then how much worse can it get?

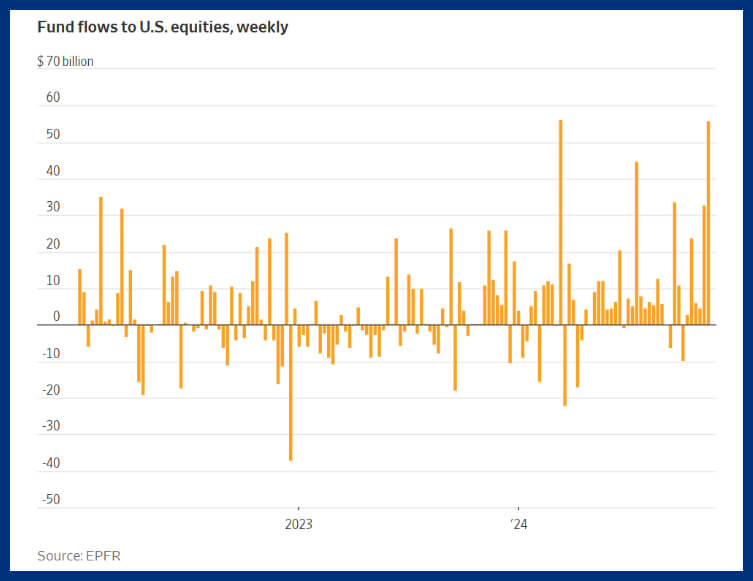

The opposite appears to be true today. “It feels like the election was a spark that seems to have awoken the animal spirits,” Ben Carlson recently wrote. “There’s excitement in the air again for investors.” It certainly seems like many believe the sky will never fall again.

Animal spirits is a term used by economist John Maynard Keynes to explain irrational behaviour by investors. Traditional economics views people as rational beings who act logically based on facts. In real life, however, investors often act on emotions, rumours or gut instinct. Keynes attributes this behaviour to people having “animal spirits.”

Read the full definition of animal spirits in the MoneySense Glossary of finance and investing terms.

Carlson should be an expert on this type of investor sentiment, since he has a 400-episode podcast actually called Animal Spirits. And as evidence to prove his point, Carlson cites the recent post-2008 record for amount of money flowing into the stock market:

Many of the world’s biggest investment banks weighed in. They’re predicting moderately positive returns next year (the S&P 500 is currently at about 6,000).

There’s no question the probable Republican changes—including tax cuts, promised regulatory changes, AI speculation and simple momentum-based investor psychology—have changed the “vibecession” into a vibe-rally or vibe-boom. (We’re still workshopping what to call it when sentiment of the economy rides over its data).

While the hard numbers tell a story of a still-strong economy that’s struggling to keep momentum, business survey data (soft data) tells us that optimism is on an upswing.

And the survey says….

— Matthew Miskin, CFA (@matthew_miskin) November 19, 2024

A difficult element in tracking this economic cycle is that "soft" data (surveys) has been weaker than the "hard" data.

Love this chart from @NFIB showing the convergence starting. Business/consumer surveys likely to be more indicative of real growth. pic.twitter.com/CDCbsJO495

We’d argue that individual investor optimism far outstrips the sentiment of the folks who answer business surveys. Perhaps it can be measured by the success of the blockchain company MicroStrategy. Shares of the company are up 515% this year, and its whole business plan is to borrow as much money as it can to buy more Bitcoin.

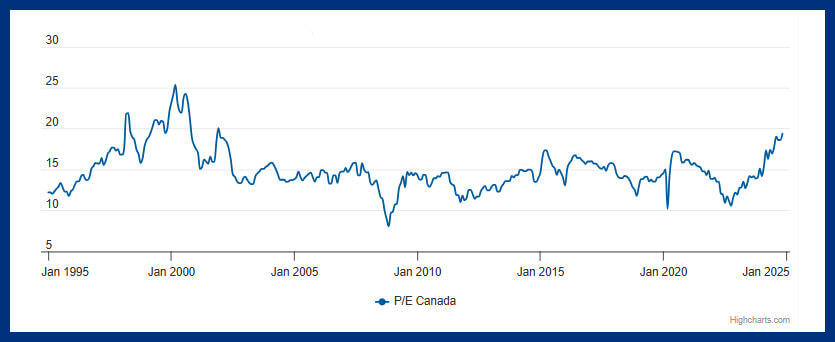

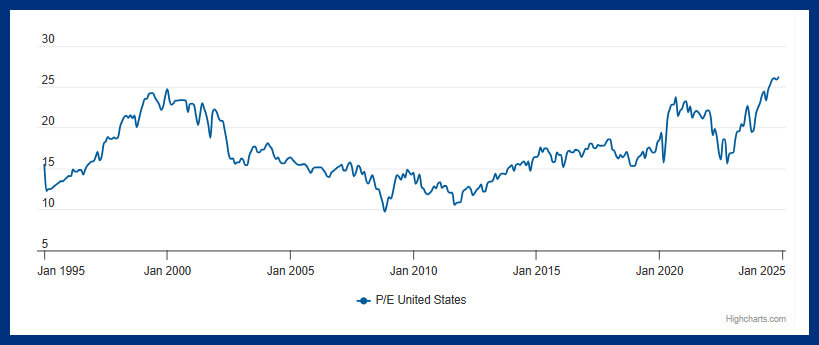

In what we used to call the “real world,” companies’ worth would be (and still be) mostly measured by what we expect their future profits to be. Canada’s 12-month forward price-to-earnings ratio is 16.7x and the S&P 500 is 24x. That’s not unbelievably high from a historical standpoint. But that forward-looking metric is assuming some pretty rosy jumps in earnings next year. Here’s where we’re at with a backward-looking current price-to-earnings ratio:

So, is the market overvalued and due for a correction?

Well, we’re probably closer to the top than the bottom.

Corporate earnings, in both Canada and the United States, would have to continue to increase massively for these valuations to make sense. It’s certainly possible that AI will make the average worker much more productive. It’s more likely that the vibe-rally (powered by the Trump-make-market-number-go-up crowd) will continue to pay more for companies regardless of their ability to raise profits. If investors buy into the market at any price, it will lead to higher prices and price-to-earnings multiples that go higher and higher.

Until they don’t.

Then, that multiple might go lower—fast.

We’re not in the business of betting money on market tops and bottoms. You can read why I’m a big advocate of index investing at MillionDollarJourney.com. Long story short: the market could get much more overvalued from here. If the stock market goes up 25%, before it goes down 30%, you could look pretty foolish for a long time before you look smart again. Furthermore, you’d have to time getting back in at the perfect moment—when the market was down 30%—to take advantage of that scenario. The news headlines when a market crashes 30% read as terrifying. Headlines in big bold font that talk about companies going bankrupt, another depression being imminent, etc. In order to successfully time the market, you would have to have confidence that you could invest a lot of money back into the market despite those negative headlines. Not many can do that. And at the end of the day, it’s far easier to stay broadly invested than it is to time any market ups and downs.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email